Hydropower Bill Overwhelmingly Clears Senate, Heads to President’s Desk

The U.S. Senate has cleared a major water infrastructure bill that contains several provisions promoting hydropower development, sending it to the president’s desk.

The Senate passed S. 3021, “America’s Water Infrastructure Act of 2018,” on October 10 through a bipartisan vote of 99–1. Because the House of Representatives unanimously passed the bill in a voice vote on September 13, the bill now heads to President Trump and is likely to be signed, though it is unclear how soon.

Among its sprawling provisions is that the bill seeks to amend the Federal Power Act to streamline authorizations for necessary hydropower approvals. Specifically, it will require the Federal Energy Regulatory Commission (FERC) to establish an expedited process for issuing licenses for hydropower facilities at existing, non-powered dams. FERC will now likely move to convene an interagency task force, working with federal, state, and tribal entities, and coordinating with the Departments of Army, Interior, and Agriculture to jointly develop a list of existing non-powered federal dams that have the greatest potential for non-federal hydropower development.

Good News for Closed-Loop Pumped Storage, Conduit Projects

The bill also requires FERC to establish an expedited process to issue licenses for closed-loop pumped storage projects. The regulatory body will also convene an interagency task force to achieve this measure, and it will likely hold a workshop to explore potential opportunities for development of closed-loop pumped storage projects at abandoned mines, according to the National Hydropower Association (NHA).

Conduit projects—hydropower in existing tunnels, canals, pipelines, aqueducts, and other manmade structures that carry water—of up to 40 MW may now also qualify for the expedited licensing process under the bill. That provision extends the size of qualifying projects from a 5-MW cap established by Congress in August 2013. The provision is significant for small hydro conduit installments, which Oak Ridge National Laboratory in 2013 estimated could provide a potential 12 GW if developed nationwide.

Under the bill, FERC must also consider project-related investments made over the term of the existing license when determining the term of a new license. “It requires FERC to give the same weight to these investments, which include re-development activities, new construction, new capacity, efficiency improvements, modernization efforts, rehabilitations, safety improvements, and recreation and environmental measures,” the NHA explained.

Finally, the bill gives FERC the authority to extend the deadline for a newly licensed project to begin construction. Construction was previously required to begin within two years of licensing, and FERC could only grant a single two-year extension. “Due to the number of post-licensing construction approvals, refinements in final project design, continuing negotiations on power purchase agreements, and securing financing, most projects need more time,” the NHA said. “Previously, a licensee would need to seek approval by Congress through individual project legislation to extend the construction deadline.”

Hydropower’s Stagnancy in a Changing Market

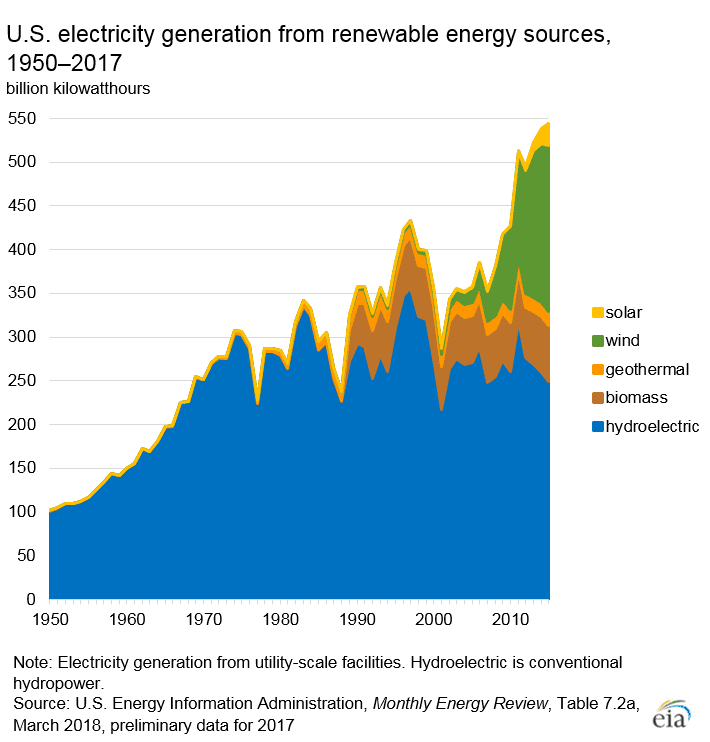

According to the NHA, these provisions are significant for an industry that has, of late, suffered a stagnant share of total U.S. electricity generation. In 2017, hydropower accounted for about 7.5% of total utility-scale power generation, a moderate rise from 6.2% in 2008. But according to the U.S. Energy Information Administration (EIA), while hydro represented the largest share of electricity generation among renewable sources in 28 states in 2007, it retained that status in only 19 states in 2017, as wind and solar became more common. By 2019, wind generation is expected to surpass hydro, based on the latest forecasts in EIA’s Short-Term Energy Outlook.

In an April 2018 report, the Department of Energy (DOE) said the U.S. hydro fleet is the third-largest in the world, and that hydro capacity has increased by 2 GW from 2006 to 2016, bringing total installed capacity to 80 GW across 2,241 separate plants. But of this net increase, 70% (1,435 MW) resulted from refurbishments and upgrades to the existing fleet. Most of the 118 new hydropower plants that started operation since 2006 involved additions of hydropower generation equipment to non-powered dams (40) or conduits (73), but five new stream-reach development projects also started operation from 2006 to 2016—all of them in the Northwest. At the end of 2017, there were 214 projects with combined proposed capacity of 1,712 MW in the U.S. hydropower project development pipeline.

Substantial pumped storage capacity increases—of 2 GW—have also been achieved since 2006, as operators upgraded turbine generator units in the existing fleet. However, only one new pumped storage facility, the 40-MW Lake Hodges plant, completed by the San Diego County Water Authority in 2012, began operation over the last decade. The pumped storage development pipeline included 48 projects at the end of 2017, more than 90% of which were in western states or in the Northeast.

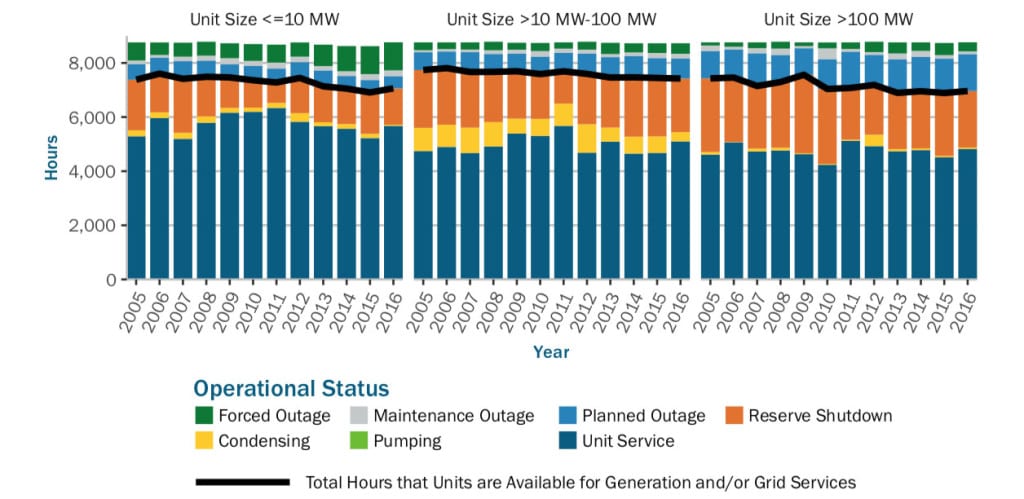

Despite a recorded capacity increase, U.S. hydropower availability factor—the number of hours that a hydropower unit is connected to the grid or stands ready to connect as needed—has declined over the last decade. From 2005 to 2008, the availability ratio was 84% for large units, 85% for small units, and 88% for pumped storage units. The 2009–2016 average availability ratio has been 81%, 83%, and 83% for those unit types respectively.

Over the last decade, the DOE noted, average forced outage hours have also fluctuated for small hydro, and increased in both planned and forced outages for units larger than 100 MW. “Accelerated wear and tear associated to the transition toward operational modes involving more frequent or pronounced ramping and unit starts or stops could also explain some of the outages for medium and large units,” it said.

Average hydropower operational status (hourly breakdown by unit size classes of units reporting to NERC GADS). Source: North American Electric Reliability Corp. Generating Availability Data System (NERC GADS) / DOE

In tandem, except for the largest hydropower plants, operations and maintenance (O&M) costs have also risen at rates higher than inflation over the last decade. “Since 2007, O&M costs for hydropower projects have risen by as much as 40% compared to inflation of 16% over the same time period. These cost increases are particularly challenging for the smallest plants, which are spending much more to remain operational on a relative ($ per kilowatt) basis than larger counterparts,” it said.

The DOE urged more research on a number of issues affecting the hydropower sector, including how flexibility plays into grid demand, especially in parts of the country with a high penetration of variable renewables. In the short-run, providing grid services could offer an “opportunity cost” for hydropower owners, it noted. “In the long-run, provision of load following flexibility or frequency regulation, which require frequent ramping and starts/stops, accelerates the wear and tear of turbine-generator units and translates in increased O&M costs. Thus, the revenue offered for grid services should compensate those costs for hydropower operators to be willing to provide the optimal, from a grid or social perspective, level of grid services,” it recommended.

The agency also called for more insight in relicensing trends, noting that based on the expiration dates of existing licenses, FERC predicts that hundreds of hydropower plants will submit relicense applications during the next decade. “Obtaining a relicense is a major milestone for existing facilities; it has implications for the timing of R&U [rehabilitations and upgrades] investment decisions and it can result in new constraints that influence future mode of operation for the hydropower fleet,” it said.

While the NHA said that passage of S. 3021 would be crucial to support investments in hydro and in the existing system, the group also noted that growth has been stifled by “outdated licensing and regulatory policies.”

“While significant work remains to further modernize the hydropower licensing process, the measures included in [S. 3021] are meaningful steps forward,” said Linda Church Ciocci, NHA president and CEO. “With these legislative improvements, we now have an opportunity to more efficiently develop new projects that add generation to non-powered dams, closed-loop pumped storage, and conduit power projects.”

—Sonal Patel is a POWER associate editor (@sonalcpatel, @POWERmagazine)

The post Hydropower Bill Overwhelmingly Clears Senate, Heads to President’s Desk appeared first on POWER Magazine.