The Rise of Natural Gas Generation in Europe

Spurred by the shale gas revolution, natural gas’s stunning rise to dominate the U.S. power profile has been echoed by a number of countries, particularly in the Middle East. In Europe, where domestic natural gas production is actually in decline—and consensus is that shale gas won’t likely play a major role on the continent—natural gas use in the electricity sector has faced significant pressure in recent years, struggling to compete with coal and increased shares of renewables. Recent studies suggest that might be about to change.

According to the Oxford Institute for Energy Studies (OIES), the modern history of natural gas in Europe began in 1959, with the discovery of the Groningen field in the Netherlands. That was followed by substantial discoveries of gas resources in the UK’s North Sea region as well as in Norway. In the 1970s and 1980s, after massive gas fields were discovered in Russia’s Siberian region, multiple strings of large-diameter pipelines were built from Siberia to Ukraine and eventually extended into Europe, and by the 1990s, Western Europe had become a sizable consumer of natural gas, driven by demand from its growing natural gas generation sector. During that period, as more countries embarked on market liberalization, and the price of gas fell compared to coal, the share of natural gas in total electricity production on the continent surged from 8.6% in 1990 to 23.6% in 2010—at an average growth rate of 6.5% per year, according to the European Environment Agency.

But the global financial and economic crisis that began in 2008 starkly dampened electricity consumption in Europe, and the natural gas sector was hard hit. Between 2012 and 2014, European utilities announced decisions to mothball or shut down more than 50 natural gas–fired power plants—a cumulative capacity of almost 9 GW. The utilities cited poor profitability prospects of gas-fired generation assets, a situation exacerbated by the rapid development of renewables, which were bolstered by subsidization.

As Ahmed Ousman Abani, an energy economist within the Economic Advisory team of Deloitte France noted in a recent brief, gas generation profitability also suffered as the merit-order between gas-fired and coal-fired power plants switched to the advantage of coal, driven in some cases (like the UK) by plummeting coal prices and low carbon prices in the European Union’s (EU’s) Emissions Trading Scheme (ETS). A telling factor is the evolution of gas plant capacity factors, Abani noted, specifically in three countries: Italy, the UK, and Portugal. “In these three countries, the average capacity factor for gas dropped from about 70% in 2008 to less than 40% in 2014 in the UK, and less than 20% in Italy and Portugal,” he said.

Between 2015 and 2017, however, gas generation on the continent seems to have regained some ground, owing largely to Europe’s transition toward a more-aggressive carbon pricing strategy and a significant increase in coal prices—which doubled around July 2016. “As a result, electricity generation in Europe from gas increased by almost 30% between 2015 and 2017,” Abani said.

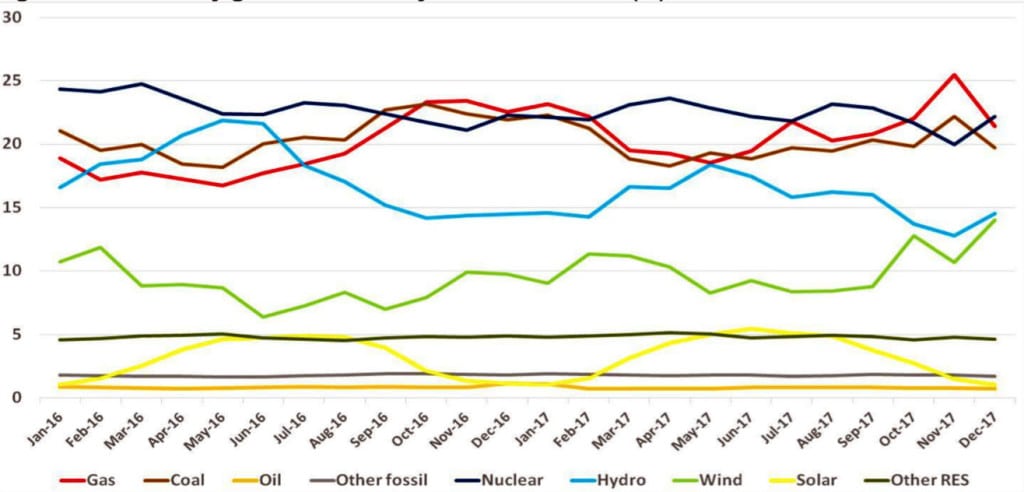

According to the International Energy Agency (IEA), gas generation in the EU alone surged 12.3% (78 TWh) in 2017, citing low gas prices, the carbon price, as well as a “moderate growth in renewables generation.” The IEA also pointed to improving flexibility and increasing full-load efficiency. The OIES in April 2018 noted that the share of natural gas in Europe’s generation mix rose to 21.2% in 2017, up from 19.5% in 2016—and that it peaked at above 25% in November 2017 (Figure 1). By comparison, the share of coal declined from 20.7% in 2016 to 20.1% in 2017.

1. Power generation mix in Europe by fuel in 2016–2017 (%).Calculations by Dr. Anouk Honoré, based on data from the European Network of Transmission System Operators for Electricity, sourced on April 2, 2018, show that despite the continued increase in renewables, gas generation in Europe was higher in 2017 for 10 months out of 12 compared to 2016. Courtesy: Oxford Institute for Energy Studies

OIES also said that natural gas deliveries to the power generation sector have risen variably three years in a row (since 2015), but in 2017, all major markets saw additional gas demand in the power sector. For example, compared to a year earlier, Spain saw a 26.8% surge in power sector demand; Turkey, 26.3%; France, 19.2%; the Netherlands, 12.6%; Poland, 11.4%; Italy, 8.4%; the UK, 4.4%; Belgium, 3.9%; and Germany, 0.4%.

According to OIES’s Dr. Anouk Honoré, the rise in gas for power in Europe was driven by the improved economic condition of gas-fired plants compared to coal plants but also by coal plant closures, and specific circumstances that dampened nuclear and hydro availability in 2016 and 2017. “When the situation normalises, these will displace natural gas in the mix,” she said.

Generally, however, Europe’s gas power outlook appears bright. Germany’s remaining nuclear capacity (9.5 GW) will be phased out by 2022, and several countries are mulling nuclear plant closures. France, for example, plans to lower the share of nuclear power in its mix from 75% to 50%. Though timing for that decision is uncertain, it could influence neighboring markets, in Italy, for example. Turkey, meanwhile, has embarked on building a new nuclear plant by 2023, and others by 2026, which could impact gas demand from the country where gas is the predominant fuel for its power mix (but reliance on gas is discouraged owing to supply security and high prices).

Coal generation is also undergoing a shakeup. Emissions limits set by the Industrial Emissions Directive could require 50 GW of mostly coal (and some old gas) plants to close by 2023, such as in Spain and Poland. “Best Available Technique” for large combustion plants could require another swathe of coal plants to install costly upgrades, reduce operations, or shut down by mid-2021. The EU’s ETS market stability reserve, the European Commission’s long-term solution to address the current surplus of emission allowances, will also begin operating in January 2019, backloading 900 million allowances to the reserve rather than auctioning them. The impact on carbon prices is unknown, but higher prices are largely expected. Finally, prompted by pledges to combat climate change, a number of European countries have moved to phase out coal over the next decade. France, for example, will be coal-free in 2022; the UK and Italy in 2025; and Finland, Portugal, and the Netherlands, in 2030. Several utilities have also declared coal phaseouts as part of decarbonization initiatives.

Honoré suggested these measures could prompt a sharp decline in coal in the coming years. “All will not be replaced, and certainly not all by natural gas, but if the closure of a vast amount of coal plants happens soon, then there may be no time for alternative plants or grid extensions to be built. Gas-fired plants may be called back into the mix at both peak and baseload times, at least until further low carbon capacities are developed,” she said.

As Abani noted, meanwhile, gas-fired generation—which has been widely lauded as an important component of the ongoing energy transition—may have a market bolster. “[M]any stakeholders have questioned the ability of energy-only markets [where generation capacity is compensated solely based on produced and sold energy] to properly remunerate generation capacity (especially gas plants) and provide efficient long-term incentives for investments.” he said. “This concern has led some countries to adapt their market designs consequently by implementing so called ‘capacity mechanisms’, which are an additional source of income for generation assets.”

For some industry observers, however, optimism about a natural gas renaissance—a “golden Age for gas” as predicted by the IEA in 2011—in the EU’s electricity sector may be mislaid. In an August report published by Columbia University’s Center on Global Energy Policy, an assortment of researchers and analysts evaluated various scenarios that made increasingly bold assumptions about the future costs of renewables, generally assumed a robust average carbon price through 2030, and included all planned coal and nuclear phaseouts. The authors found that only modest room for fuel switching and growth of natural gas demand in the EU’s power sector is likely—about 40 billion cubic meters (bcm), which compares to Europe’s total natural gas demand of 483 bcm in 2017—concluding that fuel prices, carbon prices, and interest rates will be critical factors to determine gas’s future trajectory. The authors also weren’t convinced that a large-scale phaseout of coal was likely, owing mostly to political reasons. An increase in natural gas generation has the most promise in southern Europe, where power demand is still growing, the report says.

The IEA, for its part, in June also tempered optimism surrounding the “golden age of gas,” noting that global demand for natural gas has slowed considerably from an average of 2.8% per year between 2000 and 2010, to 1.4% per year from 2011 to 2016. But while the agency’s outlook for natural gas through 2040 suggests that power generation will be replaced by industry as the dominant driver for gas demand growth, it points to Asia as a potential bright spot. In 2017, it pointed out, gas generation in China grew 17.2% in 2017 compared to 2016; in India, it surged 13.3%; and in Southeast Asia, it grew 6.3%. “Generation growth was driven by healthy electricity demand growth and measures to reduce local air pollution,” it said.

The post The Rise of Natural Gas Generation in Europe appeared first on POWER Magazine.