How Does the Western Energy Imbalance Market Work?

The California Independent System Operator’s Energy Imbalance Market (EIM) is a real-time energy market, the first of its kind in the western U.S. EIM’s advanced market systems automatically find low-cost energy to serve real-time consumer demand across a wide geographic area. But how does it work and what are the benefits?

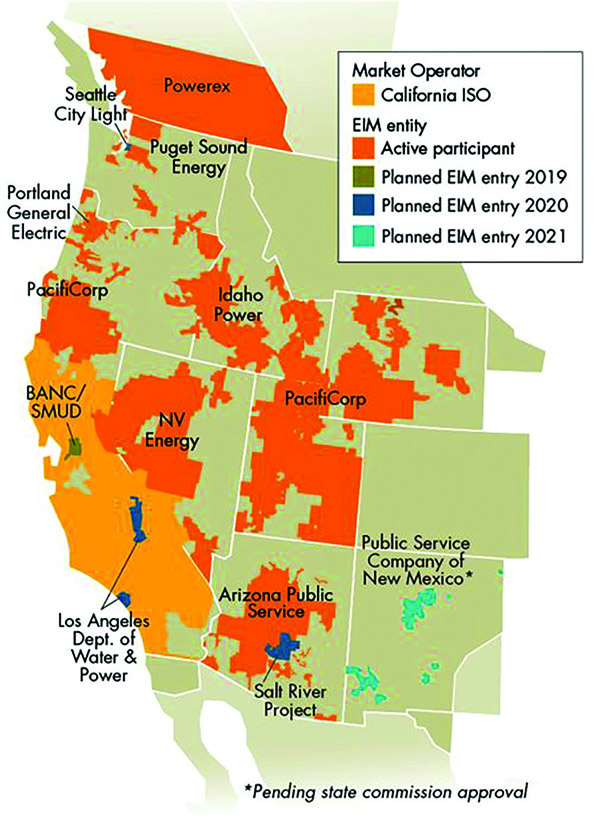

The California Independent System Operator (CAISO) began financially binding operation of the western Energy Imbalance Market (EIM) on November 1, 2014. In the beginning, resources were only being optimized across the CAISO and PacifiCorp balancing authority areas. But since that time, NV Energy, Arizona Public Service, Puget Sound Energy, Portland General Electric, Idaho Power, and Powerex have become participants in the EIM. The footprint now includes portions of Arizona, California, Idaho, Nevada, Oregon, Utah, Washington, and Wyoming, even extending to the Canadian border.

Furthermore, the Balancing Authority of Northern California—a joint powers authority whose founding members are the Sacramento Municipal Utility District, Modesto Irrigation District, Roseville Electric, Redding Electric Utility, Trinity Public Utility District, and the City of Shasta Lake—will join the EIM next year. The Los Angeles Department of Water and Power, Salt River Project, and Seattle City Light will enter the EIM in 2020, and Public Service Co. of New Mexico recently announced that it will join by 2021, pending state commission approval (Figure 1).

|

| 1. An actual Bigfoot sighting. The western Energy Imbalance Market (EIM) has a large—and growing—footprint. Courtesy: California Independent System Operator (CAISO) |

Expanding the Market to Outside Entities

The concept behind the EIM is nothing new; all ISOs and Regional Transmission Organizations (RTOs) run integrated day-ahead markets and real-time markets, which include 15-minute and five-minute markets. But what is different about EIM is that CAISO has made its markets available to entities outside of its ISO territory. The result has been enhanced grid reliability and cost savings for participants in the hundreds of millions of dollars. Besides its economic advantages, the EIM improves the integration of renewable energy, which leads to a cleaner, greener grid.

“It was a little unique from the standpoint that, what we call the EIM entities—the other utilities in the region that have decided to join—they’re not a part of the ISO, and so their participation in this market is voluntary,” Don Fuller, director of strategic alliances with CAISO, told POWER. “So, it’s basically the real-time market that we’ve operated, and extending that and making it available to a broader region.”

The EIM facilitates renewable resource integration and increases reliability by sharing information on electricity delivery conditions between balancing authorities across the EIM region. It allows participants to buy and sell power close to the time electricity is consumed, and gives system operators real-time visibility across neighboring grids. The market platform balances supply and demand fluctuations by automatically identifying lower-cost resources from across a larger region to meet real-time power needs.

A Renewable Energy Enabler

“One of the things we have found with the energy imbalance market is it’s helping us and it’s helping our neighbors better accommodate large penetrations of new renewable resources, whether it’s solar or wind,” Fuller said.

For California, that’s huge; the state has abundant renewable energy resources and now a new mandate that will encourage further growth. On September 10, Gov. Jerry Brown signed legislation requiring California to produce all its electricity from renewable sources by 2045. The new law also established a 60% renewable energy target by 2030 and accelerated the previous 50% target from 2030 to 2026. Renewables currently comprise about 32% of generation in the state, according to the California Energy Commission.

“As we continue to ramp up with increased renewables, we’ll be looking at all kinds of tools to help us manage that, and the energy imbalance market will be an important part of that,” added Fuller.

EIM also manages congestion on transmission lines to maintain grid reliability, and it makes excess renewable energy available at a low cost to participating utilities rather than forcing generating assets offline.

Reducing Solar Energy Curtailments and CO2 Emissions

“EIM is helping to reduce curtailments of renewable energy, and that in turn helps to reduce carbon emissions,” Fuller said. “There are times of the day when we may have an oversupply of electricity, and historically, we would have been faced with having to curtail that renewable energy. But EIM has allowed us to find a home and sell it to our neighbors, and by doing so, not having to curtail the production of that equipment. So, that’s been another added benefit.”

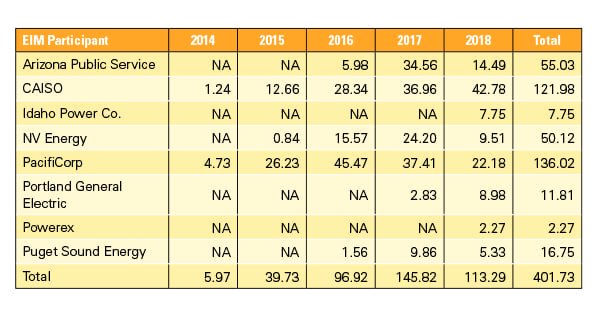

CAISO’s Western EIM Benefits Report Second Quarter 2018, released on July 31, shows benefits to the eight market participants of $71.21 million during the period. That brought the total gross benefits attributable to the real-time western energy market to $401.73 million since it began operation in 2014 (Table 1).

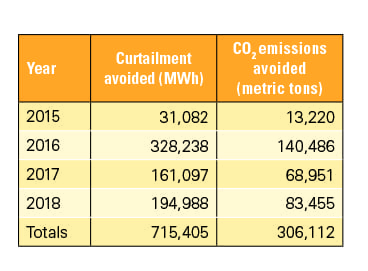

Meanwhile, significant environmental benefits have also accrued. The report says CO2 emissions were reduced in the second quarter of 2018 by 55,267 metric tons through avoided clean-energy curtailments. To calculate the emissions reduction, CAISO assumes avoided renewable curtailments displace production from other resources at a default emissions rate of 0.428 metric tons CO2/MWh. The report notes the “current market process and counterfactual methodology cannot differentiate the [greenhouse gas] emissions resulting from serving ISO load via the EIM versus dispatch that would have occurred external to the ISO without the EIM,” so benefits are only calculated based on avoided curtailments. In total, CAISO estimates that CO2 emissions have been reduced by 306,112 metric tons since the EIM was launched (Table 2).

The report says avoided renewable curtailments may have also contributed to an increased volume of renewable credits that would otherwise have been unavailable. However, CAISO does not quantify an additional dollar value associated with that benefit.

Wheeling Power

As the EIM footprint evolves, wheel-through transfers—that is, the process of transmitting power through a balancing authority’s system from generation sources, and to loads, outside of its boundaries—are likely to become more common for participants. At present, the power source and sink are the only direct beneficiaries; an EIM entity facilitating a wheel-through receives no direct financial allowance for enabling the wheel. However, as part of the EIM Consolidated Initiatives stakeholder process, CAISO committed to monitoring wheel-through volumes so it could assess whether there is a need to pursue a market solution for equitable sharing of wheeling benefits.

CAISO first began publishing wheel-through data in the third quarter of 2017. During the 12-month period from July 1, 2017, through June 30, 2018, more than 5 million MWh associated with EIM transfers were wheeled through the combined footprint. However, the energy wheeled varied greatly during the period. In the third quarter of 2017, for example, about 378 MW on average were being wheeled at any given time. By the second quarter of 2018, after Idaho Power Co., Portland General Electric, and Powerex had all been added to the EIM mix, more than 1,082 MW on average were being wheeled. Of course, many factors affect how much power is wheeled, including seasonal and diurnal supply and demand variations, but as more entities are added to the EIM in the future, wheeled power is likely to increase.

Some California lawmakers have been working on legislation to create a regionalized power grid, which would expand the ISO to include as many as 14 western states. California Assembly Bill 813 would have eliminated much of the state’s authority over the transmission network by doing away with the governor’s ability to appoint the CAISO board, instead giving the authority to a panel of energy-industry experts, regulated by the U.S. Federal Energy Regulatory Commission. However, the bill was denied a vote on the state Senate floor before the 2018 legislative session ended on August 31. The failure of the bill makes the EIM all the more important.

The EIM Governing Structure

One very important aspect of the EIM for many participants is the fact that utilities get to maintain local control of their assets. Obviously, power companies must operate within state guidelines and directives, but in general, they have full control over their generation and transmission resources. And that is often very important to them.

“As we go forward, there may be entities that don’t want to join an RTO and just want to participate in a market while they’re still able to maintain local control over their system,” said Fuller. The EIM allows that.

Of course, a market such as the EIM requires a well-defined governance structure. To that end, a transitional committee was established in May 2014 before the EIM launched to develop a long-term independent governance structure.

“We got a stakeholder group from across the West that put together the structure, and there’s a five-member independent body—the EIM Governing Body—with representation across the region,” Fuller said. “They have been delegated the authority for decision-making on EIM.” The stakeholders formalized the governance framework in a charter, which was approved on December 18, 2015. The charter also established a body of regulators and a regional issues forum. “It’s been very successful and very well-received by all the entities across the west,” Fuller added. ■

—Aaron Larson is POWER’s executive editor.

The post How Does the Western Energy Imbalance Market Work? appeared first on POWER Magazine.