IAEA: Global Nuclear Power Industry Is ‘Struggling’

Nuclear power’s share of the world’s power generating mix could shrink dramatically from 10% in 2017 to just 5.6% in 2050 as the industry struggles with “reduced competitiveness,” the International Atomic Energy Agency (IAEA) suggested in a new report.

The international organization based in Vienna, Austria, that works to promote the peaceful use of nuclear energy, bases that projection on a “low” estimate in its newest edition of “Energy, Electricity and Nuclear Power Estimates for the Period up to 2050,” which was published on September 10. The annual report provides detailed global trends in nuclear power by region.

However, the IAEA’s “high” estimate foresees a much brighter future for nuclear power. It predicts nuclear’s share of total electricity production will increase to 12% in 2030 and 11.7% in 2050—which would mean more than a two-fold increase above present levels of nuclear generation. The IAEA noted, however, that even high-case growth projections through 2050 are smaller by 45 GW when compared to the group’s estimates last year.

The report’s dismal projections are troubling for larger collaborative efforts to combat climate change, the IAEA noted. “The declining trend in our low projection for installed capacity up to 2050 suggests that, without significant progress on using the full potential of nuclear power, it will be difficult for the world to secure sufficient energy to achieve sustainable development and to mitigate climate change,” said IAEA Director General Yukiya Amano.

The projections are based on a critical review of global and regional energy trends; electricity and nuclear power projections made by other international organizations; national projections supplied by countries to an Organization for the Economic Cooperation and Development (OECD) Nuclear Energy Agency study; and estimates of an expert group that provides consultancy to the IAEA on its yearly nuclear capacity projections. The estimates also take into account possible license renewals, planned shutdowns, and plausible construction projects.

The low, “conservative” estimate assumes current market, technology, and resource trends will continue and assumes few changes will occur to current laws, policies, and rules affecting nuclear power. The high-case estimate assumes that current rates of economic and electricity consumption growth will continue—particularly in Eastern Asia—and takes into account country policies toward climate change.

Cheap Gas, Renewables Could Destabilize Global Nuclear Standing

According to the IAEA, over the short term, in both cases, cheap natural gas and subsidies for renewables will continue to affect nuclear growth in some regions of the world. In the near-term, it projects “ongoing financial uncertainty and declining electricity consumption in some regions will continue to present challenges for capital intensive projects such as nuclear power.”

Nuclear power growth could also be stymied by “[h]eightened safety requirements, challenges in deploying advanced technologies and other factors,” which have “increased construction times and costs, contributing to delays,” it said. The Fukushima Daiichi nuclear accident in March 2011 also continues to dampen nuclear development prospects, the agency noted.

On the positive side, nuclear’s prospects could be improved by “underlying fundamentals of population growth and electricity consumption in the developing world, as well as climate change and air quality concerns, security of energy supply and price volatility of other fuels,” it said.

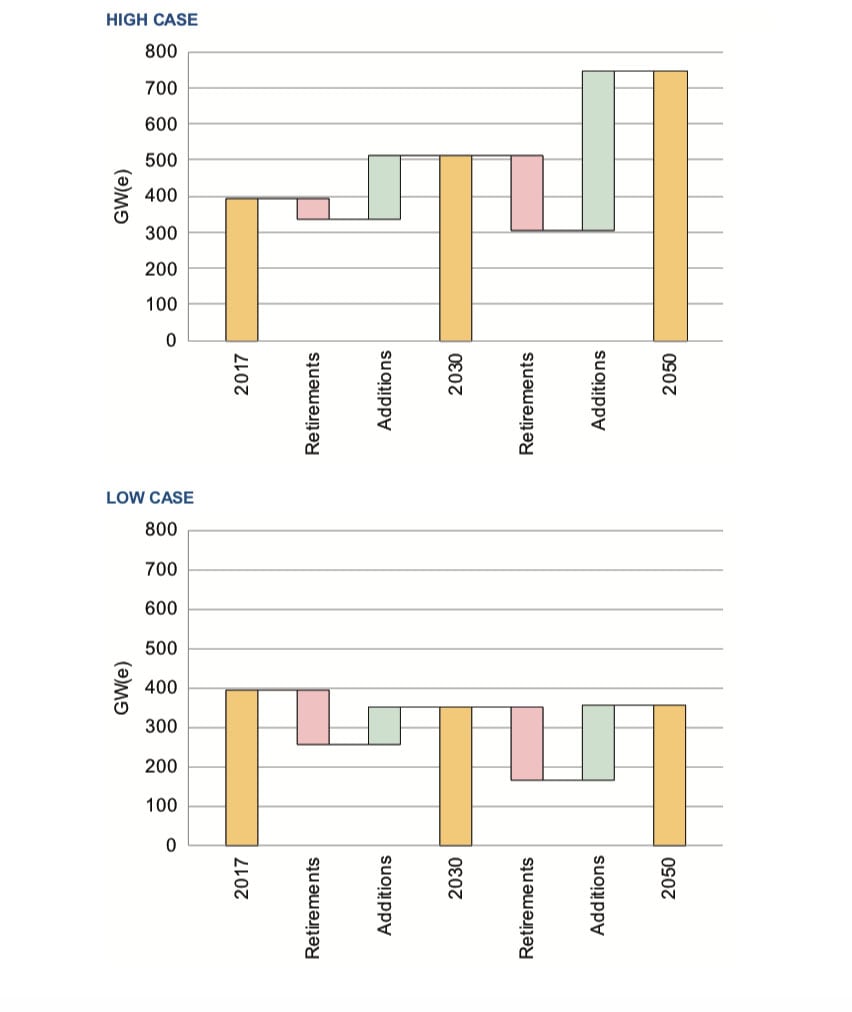

Significantly, the IAEA cautioned that uncertainty surrounds both projections owing to the considerable number of reactors scheduled to be retired in some regions around 2030 and beyond. More than half the world’s existing nuclear power reactor fleet is more than 30 years old, it noted. “Significant new nuclear capacity would be necessary to offset any retirements resulting from factors such as aging fleets and economic difficulties.”

In the low case, about 139 GW(e) would be retired by 2030, but only 99 GW(e) of new reactors would be built to replace them. In the high case, several reactors would receive life extensions, so that only 55 GW(e) would be retired by 2030, with an additional 207 GW(e) retired by 2050. New reactors in that case would add 175 GW(e) by 2030 and 443 GW(e) of capacity by 2050.

World nuclear capacity: actual retirements and additions. Source: IAEA, Energy, Electricity and Nuclear Power Estimates for the Period up to 2050, Sept. 10, 2018

Nuclear Power Production Slated for Dramatic Decline in North America

The projections also vary widely by region. North America, for example, will see dramatic changes over the next two years. “Almost all of the existing nuclear power reactors in the Northern America region are scheduled to be retired by the middle of the century,” the report notes. In the low case, nuclear’s share in the generation mix will fall from 19% in 2017 to 11.9% in 2030—and only about 5% in 2050. However, in the high case, too, it will decrease, falling to 16.3% in 2030 and 14.7% in 2050.

In Latin America and the Caribbean, both cases suggest that nuclear’s role will increase but remain small. In Northern, Western, and Southern Europe, where several countries have announced a phaseout of nuclear power, nuclear generation will fall from its current share of 24% to 16.1% by 2030 and 7.2% by 2050. In the high case, it would increase by about 5% by 2030, but fall again dramatically—by 23%—by 2050.

In Eastern Europe, nuclear generation will continue to grow in both the low and high case, albeit at different rates. In Africa, which currently has only one nuclear plant (the 2-GW Koeberg plant in South Africa), the report projects capacity increases in the low case to 3 GW by 2030 and 8 GW by 2050.

Southern Asia will see a dramatic increase in nuclear capacity in both the low and high cases, with the majority of existing reactors remaining in operation until 2050. In the low case, nuclear electricity production is projected to increase 3.5-fold in the next 13 years. In the high case, an almost six-fold increase could occur through 2030.

In Central and Eastern Asia, several nuclear reactors in Japan, specifically, will not be put back into operation, the report predicts in the low case. Still, the share of nuclear generation will increase from 5.2% in 2017 to 6.8% in 2030. In the high case, there will be a three-fold increase in nuclear generation through 2030.

—Sonal Patel is a POWER associate editor (@sonalcpatel, @POWERmagazine).

The post IAEA: Global Nuclear Power Industry Is ‘Struggling’ appeared first on POWER Magazine.