Australia Braces for Power System Transformation, Disruptions

The inaugural integrated system plan (ISP) released by Australia’s Energy Market Operator (AEMO) in mid-July warns that the country is in the midst of a “transformative and unprecedented” rate of change. Disruptions are affecting almost every element in the value chain associated with the National Electricity Market (NEM), and “care must be taken now more than ever to manage this transformation in order to minimise costs and risks to maximise value to consumers,” said AEMO Managing Director and CEO Audrey Zibelman.

The AEMO’s ISP projects reliability and security system needs for the next 20 years using probabilistic scenario-based analyses that incorporate projected federal emissions policy and state renewable policies. Foremost among major fundamental changes occurring in the country is that demand is flattening, owing mainly to the growth of rooftop photovoltaic (PV) solar systems and increasing use of local energy storage, as well as from a surge in energy efficiency measures. Demand will likely remain flat even if demand for electric vehicles grows over the next two decades, it said.

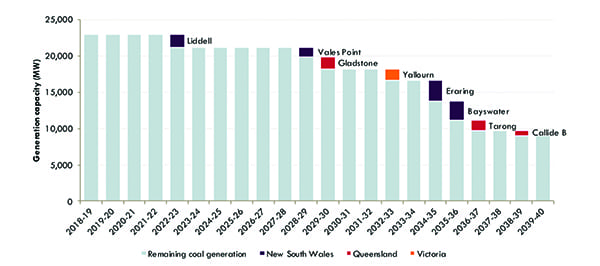

Meanwhile, the NEM—which covers eastern and southeastern Australia—is facing the mass retirement of a substantial portion of its conventional generation fleet. By 2040, 14 GW of coal-fired generation (Figure 6) and about 1 GW of gas-fired generation will reach the end of its technical life and retire. This represents about 70 TWh—a third of NEM’s total current consumption. This “highlights the importance of m itigating premature retirements as these resources currently provide essential low-cost energy and system support services required for the safe and secure operation of the power system,” the AEMO said.

Compounding this is that the investment profile and capabilities of various supply resources have changed, and will continue to change “radically,” it said. Specifically, costs of new renewable plants are expected to fall. As storage technologies—like battery storage and pumped hydro—advance and become more available, the country’s power profile will be transformed by the proliferation of flexible gas-fired generation and distributed energy resources (DERs).

Considering these changes, regional collaboration will become “more critical due to both the footprint required to support renewables, and the value of diversity to support resiliency,” Zibelman said. On the supply side, the NEM will need to both retain existing resources and integrate growing utility-scale renewables, energy storage, DERs, flexible thermal capacity, and transmission reinforcement and expansions.

In the short-term, Australia will need to maximize existing low-cost generation, which includes its coal fleet. Investments to spur development of renewable resources to replace retiring resources will also be needed to provide system security. Though the ISP projects flat operational consumption under “neutral economic conditions,” its portfolio approach calls for between about 14 GW and 48 GW of grid-connected variable renewables to be developed by 2040. Under the ISP’s neutral scenario, the analysis projects that the lowest-cost replacements (based on forecasted costs) include 28 GW of solar and 10.5 GW of wind. The country will also need flexible, dispatchable resources at utility-scale of between 4 GW and 23 GW by 2040, the AEMO said. This will likely comprise 17 GW (90 TWh) of utility-scale storage, although new flexible gas generators could play a larger role “if gas prices materially reduce.”

Investment is also urgently needed to ramp up transfer capacities between New South Wales, Queensland, and Victoria by 170–460 MW, to reduce congestion from renewables in western and northwestern Victoria, and make South Australia’s system stronger. To that end, the ISP calls for establishment of an “interconnected energy highway” by 2020 that would allow for easy access to lower-cost resources. Between 2030 and 2040—when all the NEM’s coal fleet is expected to retire—the grid should effectively be able to transfer capacity between New South Wales and Victoria by about 1,800 MW.

Investment costs associated with replacing old and retiring infrastructure could range between A$8 billion and A$27 billion, depending on assumptions made around economic growth and rate of industry transformation. “This level of capital investment is going to be needed, irrespective of this plan,” the ISP says.

The AEMO now plans to consult with industry stakeholders on the ISP, promising that “Further information will become available on key projects, especially related to storage.”

—Sonal Patel is a POWER associate editor.

The post Australia Braces for Power System Transformation, Disruptions appeared first on POWER Magazine.