10 Near-Term Global Power Sector Trends

Credit to Author: Sonal Patel| Date: Tue, 03 Jan 2023 05:17:14 +0000

While 2021 provided its own share of extraordinary energy debacles, Russia’s invasion of Ukraine in early 2022 cascaded into full-blown energy turmoil. This year will begin with the world “in the midst of its first global energy crisis,” noted the International Energy Agency (IEA) in its World Energy Outlook 2022 (WEO2022) report.

The crisis has so far left Europe scrambling for gas supplies to offset Russian gas shortfalls, but it has also stoked inflationary pressures and created a looming risk of recession. Several governments across the world have so far committed billions of dollars to shield energy consumers from immediate impacts. Some, like Germany and Japan, have taken extraordinary measures to temporarily ramp up oil- and coal-fired power, and extend the lifetimes of some nuclear plants.

The IEA somberly acknowledged that the world’s energy markets remain “extremely vulnerable.” But while “the fragility and unsustainability of our current energy system” has posed somewhat of a setback for clean energy transitions, momentum continues for clean energy investment. Following are some key trends the Paris-based intergovernmental organization highlights in its latest annual global outlook.

Diversification Becoming Crucial

The WEO2022 explores three primary scenarios: a stated policies scenario (STEPS), which assumes today’s policy settings will endure; the announced pledges scenario (APS), which assumes all governmental aspirational targets will be achieved; and the net-zero by 2050 (NZE) scenario, which maps a pathway to achieve a 1.5-degree-Celsius stabilization in global temperatures while nurturing universal access to energy by 2030.

Under STEPS, the IEA projects a sustained ramp-up for renewables and nuclear power—if markets rebalance. However, the energy crisis will likely push up utilization rates for coal-fired assets, though the agency does not expect investment in new coal-fired plants to endure. Much of the world—including in Europe, Asia, Africa, and the Middle East—are beginning to bank heavily on natural gas. Expansions to gas infrastructure are beginning to take shape, including to accommodate major new additions to liquefied natural gas (LNG) supplies from North America, Qatar, and Africa, which could dominate the market by the mid-2020s. “Competition for available cargoes is fierce in the meantime as Chinese import demand picks up again,” the agency noted.

Fossil Fuel Could Peak This Decade

The IEA, for the first time, under its STEPS projects a “peak or a plateau” for coal, natural gas, and oil demand. That could have big implications for fuels used for power generation. The report notes the electricity sector accounted for 59% of all the coal used globally in 2021, along with 34% of natural gas, 4% of oil, 52% of all renewables, and nearly 100% of nuclear power. “The share of fossil fuels in the global energy mix has been stubbornly high, at around 80%, for decades. By 2030 in the STEPS, this share falls below 75%, and to just above 60% by 2050,” the report says.

However, if no substantial carbon abatement is made, the current trajectory would be associated with a rise of around 2.5 degrees Celsius in global average temperatures by 2100. So far, however, policy momentum around the world appears to have made gains. Since 2015, it has shaved about 1 degree C off the long-term temperature rise, according to the IEA. The WEO2022, however, also suggests that the world will continue to invest in and consume fossil fuels if the transition doesn’t pick up. The current crisis warrants bringing oil and gas to market quickly, the IEA noted, but “lasting solutions” to today’s crisis will lie in reducing fossil fuel demand, the agency said.

A Coming Surge in Global Electricity Demand

Current trends, however, pose substantial hurdles. Adding substantial complexity is that global power demand is slated to rise by 5,900 TWh under STEPS (from 24,700 TWh in 2021) and more than 7,000 TWh under APS by 2030—“equivalent to adding the current level of demand in the United States and the European Union,” notes the report. In advanced economies, the largest driver for demand growth is from transport. In developing economies, drivers include population growth and rising demand for cooling. Electrification’s massive boost for demand growth occurs substantially in all three scenarios. “Global electricity demand in 2050 is over 75% higher in the STEPS than it is today, 120% higher in the APS and 150% higher in the Net Zero Emissions by 2050 (NZE) Scenario,” the report notes.

A Temporary Uptick for Coal

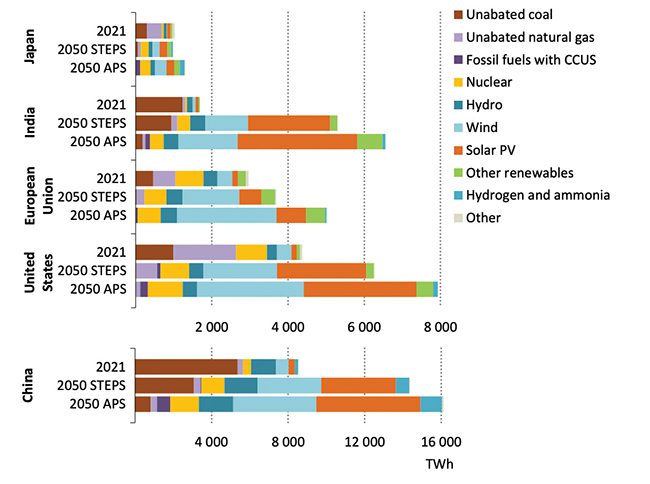

Strong power demand, high natural gas prices, and energy security concerns have in recent months prompted an uptick in coal use for electricity. However, under STEPS, unabated coal is slated to fall steeply from 36% of global generation in 2021 to 26% in 2030 and 12% in 2050, reflecting renewables growth, led by solar photovoltaic (PV) and wind (Figure 1).

|

1. Electricity generation by source, key region, and scenario, 2021 and 2050. STEPS = Stated Policies Scenario; APS = Announced Pledges Scenario; CCUS = carbon capture, utilization, and storage. Courtesy: International Energy Agency / World Energy Outlook 2022 |

Low-Emission Fossil Fuel Prospects Trudging Along

However, the share of unabated natural gas could also fall from 23% in 2021 to 20% in 2030 and 13% in 2050. Prospects for abated fossil fuels remain slim, the IEA noted. Fossil fuel generation equipped carbon capture, utilization, and storage (CCUS), and projects co-firing ammonia in coal plants and hydrogen in gas plants, are still at the pre-commercial stage of development. “Significant efforts would be required for them to start being deployed at scale before 2030,” it said. Under STEPS, CCUS technologies could gain a “limited amount” of traction, driven by carbon reduction commitments. In the APS, however, the first CCUS retrofits—mostly in China, Indonesia, Japan, and the U.S.—could be completed before 2030, and more than 200 GW of coal-fired capacity and greater than 80 GW of gas-fired plants equipped with CCUS could be in operation by 2050. These would still account for just 2% of total global electricity generation. Co-firing of ammonia or hydrogen, meanwhile, “remains very limited” in the STEPS, and accounts for less than 0.1% of total electricity generation in 2050.

Nuclear Buoyant on New Optimism

Nuclear power generation, which currently provides a 10% share of global generation, is set to maintain its share under STEPS—but that will still require the completion of 120 GW of new nuclear capacity from 2022 to 2030, and another 300 GW between 2030 and 2050. “Recent events, market conditions and policies are shifting views on natural gas and limiting its role, while underlining the potential for nuclear power to cut emissions and strengthen electricity security,” the IEA noted. However, “the continued role of nuclear power in the electricity sector relies on decisions to extend the lifetime of existing reactors and the success of programmes to build new ones,” it said.

Clean Energy Investment a Concern

“Clean” electricity and electrification along with expanded and modernized grids offer the clearest, cost-effective opportunities to cut emissions, the IEA concluded. “Today’s growth rates for deployment of solar PV, wind, EVs [electric vehicles], and batteries, if maintained, would lead to a much faster transformation than projected in the STEPS,” the WEO2022 notes. The IEA’s outlook suggests renewables’ share in global generation will rise from 28% in 2021 to about 50% by 2030 and 80% by 2050. However, this rapid transition will ultimately depend on investment. The STEPS projects clean energy investment would need to increase to $2 trillion from the current $1.3 trillion today by 2030 (and soar to $4 trillion in the NZE). Investment is specifically lagging in emerging economies. “Today’s rising borrowing costs could exacerbate the financing challenges facing such projects, despite their favourable underlying costs,” the WEO2022 says.

Supply Chain Hurdles Are Looming

Meanwhile, “Supply chains are fragile, and infrastructure and skilled labour are not always available. Permitting provisions and deadlines are often complex and time-consuming. Clear procedures for project approval, supported by adequate administrative capacity, are vital to accelerate the flow of viable, investable projects—both for clean energy supply as well as for efficiency and electrification,” it said. Optimistic efforts to bring new infrastructure online also may not take into consideration long timeframes for development. “Our analysis finds that permitting and construction of a single overhead electricity transmission line can take up to 13 years, with some of the longest lead times in advanced economies,” the IEA said. Development of adequate critical minerals also poses a key hurdle. Development of new deposits have historically taken “16 years on average, with 12 spent lining up all aspects of permitting and financing and 4–5 years for construction.”

Flexibility, Resiliency, and Energy Security Growing Critical

The WEO2022 attempts to guide policymakers to look beyond the current crisis and ensure future systems will be reliable. That will entail keeping fossil fuels in the mix to some extent. “Even as transitions reduce fossil fuel use, there are parts of the fossil fuel system that remain critical to energy security, such as gas-fired power for peak electricity needs, or refineries to supply residual users of transport fuels. Unplanned or premature retirement of this infrastructure could have negative consequences for energy security,” the WEO2022 notes. “During energy transitions, both [fossil fuel and clean energy systems] are required to function well in order to deliver the energy services needed by consumers, even as their respective contributions change over time. Maintaining electricity security in tomorrow’s power systems calls for new tools, more flexible approaches and mechanisms to ensure adequate capacities,” it says. The onus will fall heavily on power generators, which “will need to be more responsive.” However, consumers, too, “will need to be more connected and adaptable, and grid infrastructure will need to be strengthened and digitalized.”

Electricity Affordability Re-Emerging as a Key Priority

Along with energy security, the report focuses heavily on future power affordability. The IEA estimated that market conditions and the energy crisis are raising the global average cost of electricity supply by almost 30% in 2022. Impacts on power prices are disproportionate, however. The European Union is facing particular pressures following a tripling of wholesale power prices in the first half of 2022, owing largely to high natural gas prices, as well as higher coal, oil, and carbon dioxide prices, and reduced availability of nuclear and hydropower.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).

The post 10 Near-Term Global Power Sector Trends appeared first on POWER Magazine.