U.S. Spent Nuclear Fuel Reprocessing May Be Making a Comeback—Here’s Why

Credit to Author: Sonal Patel| Date: Thu, 27 Oct 2022 14:47:24 +0000

The Department of Energy (DOE) has ramped up efforts to explore recycling spent nuclear fuel (SNF), or used nuclear fuel (UNF), from the nation’s fleet of light water reactors (LWRs), doling out $38 million in federal awards to a dozen projects on Oct. 21.

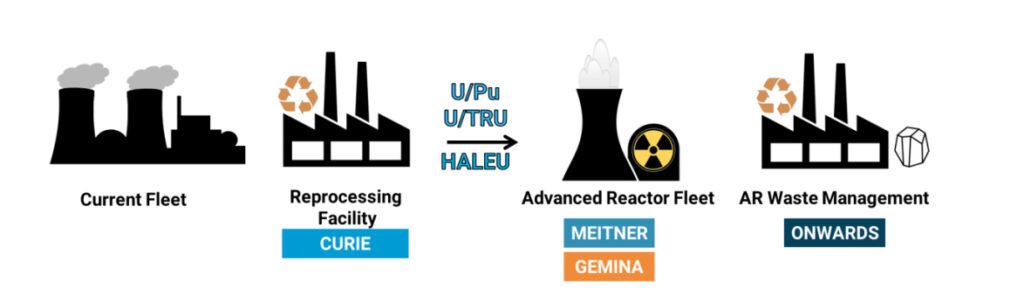

Teams will receive funding under the DOE’s March 2022–launched “Converting UNF Radioisotopes Into Energy” (CURIE) program to work on projects that will advance recycling of SNF. The projects will seek to reduce the volume of high-level waste (HLW) that will require permanent disposal, but they will also potentially provide feedstock that could be used in domestic advanced reactors, the DOE said.

The awards represent a pivotal advancement for the nation’s emerging strategy to deal with SNF from its fleet of LWRs, most of which is in temporary storage, awaiting final disposition. So far, the nuclear industry has safely stored 88,500 metric tons of commercial SNF and HLW in spent fuel pools and dry casks at 76 operating and decommissioned reactor sites in 35 states, but many experts believe that approach is highly inefficient and unsustainable. Driven by disposition uncertainties and concerns about future advanced nuclear reactor fuel supplies, the federal funding institutes new momentum for commercial SNF reprocessing, which the agency hopes will be economically viable and proliferation-resistant.

A Renewed Effort to Explore a Closed Nuclear Cycle

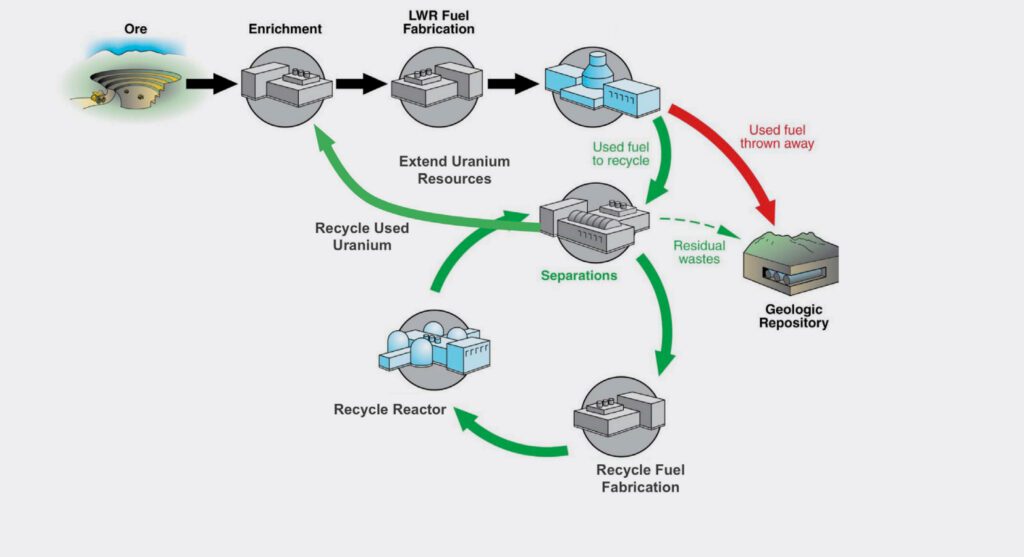

The efforts diverge from the U.S’s long-held ambitions to deal with SNF disposition through direct disposal in a geologic repository designed to contain residual hazards for 100,000 years or more. Owing in part to a political deadlock in Congress, and the DOE’s decades-long default on a “standard contract” to begin disposing of SNF as required by the 1982 Nuclear Waste Policy Act (NWPA), geologic disposal at Yucca Mountain, Nevada, has ground to a halt. The DOE recently began implementing a consent-based siting process for an interim storage facility. These approaches, however, cater to a once-through fuel cycle.

While not yet part of a formal nuclear waste strategy, the DOE Advanced Research Projects Agency-Energy’s (ARPA-E’s) CURIE program has set out to explore a closed nuclear cycle by enabling commercially viable reprocessing of SNF from the current LWR fleet. CURIE envisions that if key gaps or barriers are resolved in reprocessing technologies, process monitoring, and facility design, commercial reprocessing could thrive. The program posits that SNF reprocessing to recover reusable actinides and recycling them into new fuel has the potential “to improve fuel utilization—especially when coupled with advanced fast reactors—and drastically reduce the volume of HLW requiring disposal.”

The measure is notable because while the U.S. has explored reprocessing for decades—starting with World War II-era Manhattan Project’s recovery of plutonium from irradiated metallic uranium fuel discharged from the Hanford production reactors—commercial reprocessing attempts have encountered technical, economic, and regulatory issues. And though the U.S. has for decades mulled the reprocessing option as a potential pathway forward, nuclear waste research priorities in recent years have fluctuated under different administrations (see sidebar, “Reprocessing’s Re-Emergence as a Nuclear Waste Pathway”).

Reprocessing’s Re-Emergence as a Nuclear Waste PathwayThe U.S. government originally developed reprocessing technology as part of the World War II effort to develop the atomic bomb, but spent nuclear fuel (SNF) reprocessing grew into an essential pathway to address future nuclear fuel supply shortfalls during the early stages of commercial nuclear power—from the 1950s to the late 1970s. Owing in part to uncertain uranium supplies in the 1970s, breeder reactor research programs sprung up in several countries to explore fast neutron reactors’ breeding capabilities. Breeders promised to convert abundant uranium-238 (U-238) into a usable fuel (plutonium-239), produce more usable fuel than they consumed, and use 60% or more of the energy content of the uranium fuel. After the Atomic Energy Commission (AEC, the Nuclear Regulatory Commission’s [NRC’s] predecessor) expressed an intent to withdraw from providing nuclear reprocessing services for SNF in 1957, private industry development gained steam through 1976. While development and construction of four large commercial reprocessing plants were initiated, only one commercial reprocessing facility was built and operated in the U.S., Nuclear Fuel Service’s West Valley plant near Buffalo, New York. The facility ran from 1966 until 1972, but it never processed commercial SNF, and it was ultimately shuttered owing to stricter regulatory requirements. In 1976, the Ford administration declared that the U.S. should no longer regard reprocessing of used nuclear fuel to produce plutonium as a “necessary and inevitable step in the nuclear fuel cycle.” In 1977, the Carter administration announced an “indefinite” deferment of commercial reprocessing and recycling of plutonium produced in U.S. nuclear power programs. While the Reagan administration in 1981 lifted the indefinite bans on commercial reprocessing, President George H. W. Bush’s administration halted weapons reprocessing in a policy statement on nuclear nonproliferation in 1992. That same year, the administration permanently closed the federal Plutonium Uranium Extraction Plant (PUREX) reprocessing facility in Hanford, Washington. In 1993, the Clinton administration declared that the U.S. “does not encourage the civil use of plutonium and, accordingly, does not itself engage in plutonium reprocessing for either nuclear power or nuclear explosive purposes.” However, in its 2001 National Energy Policy, the George W. Bush administration urged consideration (in collaboration with international partners with highly developed fuel cycles) of reprocessing and fuel treatment technologies that are “cleaner, more efficient, less waste-intensive, and more proliferation-resistant.” Under the Bush administration, the Department of Energy (DOE) also initiated work toward an engineering-scale demonstration of the UREX+ separation process. The Obama administration, however, deemed reprocessing with existing technology “uneconomic,” although it underscored that reprocessing did significantly reduce the waste burden. It also suggested that used nuclear fuel reprocessing had resulted “in large and growing stocks of separated plutonium” as a byproduct, representing “one of our greatest nonproliferation problems.” The administration instead championed regional or international interim storage. Under the Trump administration, the DOE again emphasized the benefits of fuel cycle research and development (R&D). In 2018, the DOE’s Advanced Research Projects Agency-Energy (ARPA-E) established the MEITNER (Modeling-Enhanced Innovations Trailblazing Nuclear Energy Reinvigoration) program, encouraging “a rethinking of how pieces of the nuclear reactor system fit together.” And in 2019, ARPA-E launched the Generating Electricity Managed by Intelligent Nuclear Assets (GEMINA) program, aiming to develop digital twin technology for advanced nuclear reactors, and transform operations and maintenance systems in the next generation of nuclear power plants. ARPA-E has continued that drumbeat under the Biden administration. Charged with providing “transformative solutions to improve the management, clean-up, and disposal of radioactive waste and spent nuclear fuel” by the 2019 ARPA-E Reauthorization Act, the agency in May 2021, launched the Optimizing Nuclear Waste and Advanced Reactor Disposal Systems (ONWARDS) program. Through ONWARDS, ARPA-E expects to develop and demonstrate “breakthrough technologies that will facilitate a 10x reduction in [advanced reactor] waste volume generation or repository footprint.” In March 2022, ARPA-E rolled out the Converting UNF Radioisotopes Into Energy (CURIE) program. CURIE—which honors physicist and chemist Marie Curie—seeks to develop innovative and proliferation-resistant separations of long-lived elements, such as plutonium, that could be made into new fuel and “transmuted” into shorter-lived commercial radioactive isotopes and critical minerals. But CURIE also supports online monitoring and materials accountancy technologies. “CURIE will fuel advanced reactors and provide important clean energy elements, all while drastically reducing waste,” Dr. Jennifer Gerbi, acting director of ARPA-E, said in March. “With this new program, we’re emphasizing safeguards and lowered costs as we provide clean energy technology options for the future.”

|

What Is Spent Nuclear Fuel Reprocessing and Recycling?

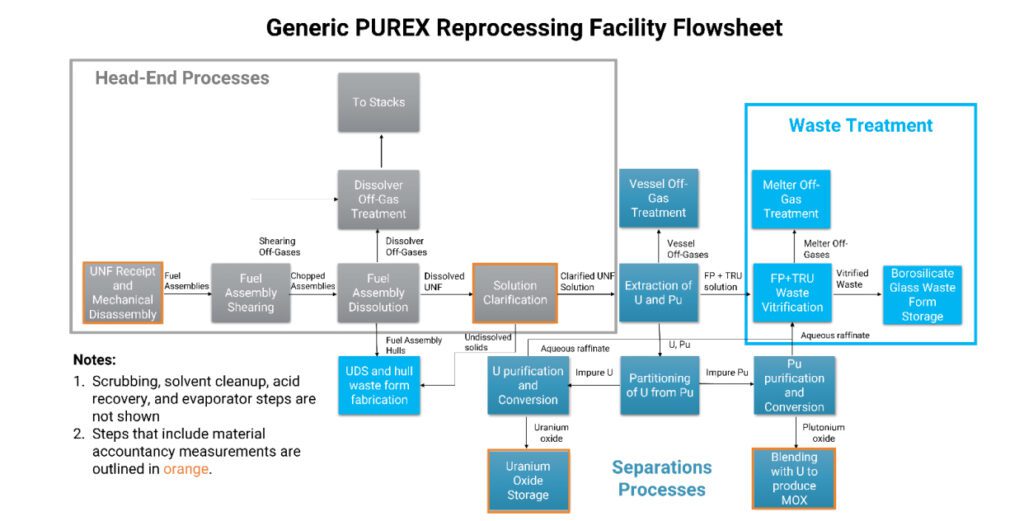

CURIE’s proposed closed nuclear fuel cycle envisions reprocessing UNF, essentially by separating UNF to recover reusable actinides—uranium and plutonium, among them—and then recycling them into new fuel. Historically, commercial reprocessing facilities—like La Hague in France—have used a 1950-developed solvent extraction-based process, the Plutonium Uranium Reduction-Extraction process (PUREX), to recover uranium and plutonium products (as uranium trioxide and plutonium dioxide). “The plutonium dioxide product serves a feedstock that is blended with uranium oxide to fabricate mixed oxide (MOX) fuel, which is used by LWRs,” the DOE explains. The PUREX process remains the standard method of UNF separation, and the only method presently practiced on a commercial and industrial scale.

While the U.S. marked several early milestones in reprocessing, other countries, including France, the UK, Japan, Russia, and China, have spearheaded advancements. Some already have established commercial recycling applications.

Russia, notably, on Sept. 9 announced it fully loaded its 820-MWe BN-800 fast rector’s core with uranium-plutonium MOX fuel. Russia’s MOX fuel comprises “oxide of plutonium bred in commercial reactors, and oxide of depleted uranium which comes from de-fluorination of depleted uranium hexafluoride (UF6), the so-called secondary tailings of uranium enrichment facilities.” China has also announced several reprocessing milestones. Following completion of tests at a pilot PUREX plant in 2015, China has explored plans to begin reprocessing UNF at a larger commercial facility. It is in tandem reportedly building two MOX facilities.

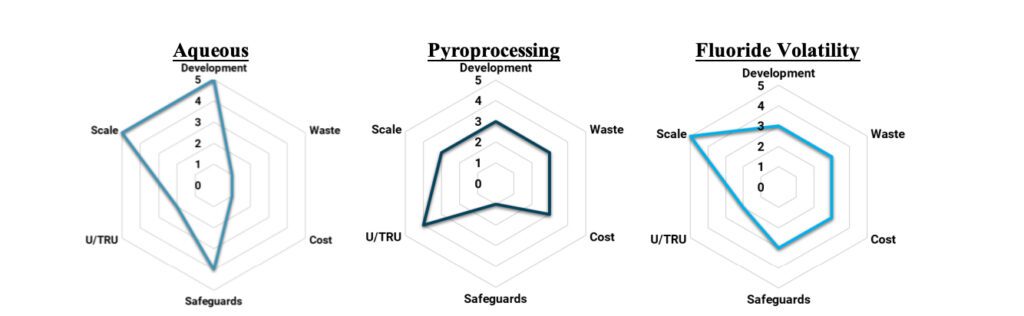

Under its CURIE program, ARPA-E sets out a pathway to develop “innovative” separation technologies, process monitoring techniques for special nuclear material, as well as equipment designs that will “significantly improve the economics and process monitoring of reprocessing technologies while dramatically reducing the volume of HLW from LWR UNF requiring disposal.” A more focused program than ONWARDS, which also seeks to minimize HLW quantities, CURIE will explore multiple reprocessing technologies, including aqueous, pyroprocessing, and fluoride volatility.

CURIE Sets Out Notable Cost Metrics

Compared to ONWARDS, CURIE also sets out notable cost-related metrics. Among these are to maintain disposal costs in the range of 0.1¢/kWh but to provide a 1¢/kWh fuel cost for “a 200 metric tons heavy metal [MTHM]/year nth-of-a-kind (NOAK) facility.” That’s important considering that cost estimates for a large-scale PUREX-based reprocessing facility currently hover at $20 billion.

In addition, CURIE is targeting in situ special nuclear material process monitoring approaches that can predict (within a 1% uncertainty) the post-process material accountancy. It will also work to enable UNF separations “that do not produce pure plutonium streams.”

These metrics will support “a commercially viable reprocessing technology that would provide valuable [advanced reactor] fuel feedstock and the ability to recover fission products of interest (e.g., precious metals and medical radioisotopes) while minimizing the nation’s HLW waste impact,” the agency says.

“Given the advances in separations technologies, material accountancy and online monitoring technologies, and equipment design, opportunities exist to dramatically improve reprocessing facility economics by reducing the facility footprint, modularizing unit operations and construction, reducing waste streams, facilitating regulatory compliance, and enabling timely and accurate nuclear material accounting for unit operations,” it adds.

The Urgency to Develop Sustainable Advanced Reactor Fuel Feedstocks

CURIE’s focus on developing advanced reactor feedstocks derived from reprocessed LWR UNF is especially notable given concerns emerging from the burgeoning field of advanced reactor developers about how they will procure adequate supplies of high-assay low-enriched uranium (HALEU), a form of uranium-235 fuel enriched to 20%. Many advanced nuclear reactor designs, including nine of the 10 designs awarded under the DOE’s Advanced Reactor Demonstration Program (ARDP), require HALEU.

However, HALEU is currently available from only two sources: limited amounts from the DOE via down-blending of existing stockpiles of material, and from commercial supplies via Tenex, a nuclear fuel company owned by Russian state-owned company Rosatom.

While the U.S. has, for now, stopped short of imposing sanctions on Russian uranium after Russia’s aggression in Ukraine, the U.S. recognizes that reliance on Russian fuel for advanced nuclear poses several inherent risks. These include supply disruptions and general risks to export competitiveness, as well as an “unintentional” spread of Russian or Chinese influence. But barring any dramatic near-term actions by the U.S., “there is essentially no choice for advanced reactor developers but to initially rely upon Russian-supplied HALEU, particularly given the expedited timeframes for their first demonstrations and units,” warns think tank Third Way.

So far, at least two U.S. facilities could be licensed to enrich HALEU by the time advanced reactors are deployed. Centrus Energy, which has received a $115 million award from the DOE to demonstrate production of HALEU at its Piketon, Ohio, facility, and the nation’s only Nuclear Regulatory Commission (NRC) license for HALEU production, in August told POWER it has completed centrifuge construction and met all other program milestones as required by June 2022. Operations, however, were delayed owing to supply chain constraints in obtaining HALEU storage cylinders.

In April 2022, the DOE modified its HALEU contract to extend the period of performance to Nov. 30, 2022. Centrus said it also planned to submit a bid to the DOE’s June 2022 request for proposals for a 50/50 cost-share contract to complete the cascade and produce 20 kilograms of HALEU. “Once 20 Kg of HALEU has been produced, the base contract will transition to a cost-plus-incentive-fee contract for production of 900 kg over the subsequent 1-year period,” but the DOE includes options to extend performance up to nine years, the company said. The DOE “has estimated that it will take a little less than a year to get the HALEU cascade online from the time the operations contract is awarded,” the company said. Meanwhile, in 2019, Urenco USA, Inc., a U.S. subsidiary of a European company, said it is capable of producing HALEU and meeting industry needs and that a new enrichment module for such purposes could be operational within 24 months of NRC licensing.

Recognizing the urgency to develop a more robust domestic source for HALEU, Congress in its August-enacted Inflation Reduction Act (IRA) provided $700 million to make HALEU available for advanced reactors. Sustaining that funding, however, is posing new concerns. The DOE’s Sept. 1–issued supplemental appropriation request for an additional $1.5 billion for HALEU activities to address shortfalls in access to Russian uranium and fuel services has faced hurdles in Congress. Still, the agency continues to pursue new avenues to procure enough HALEU. On Oct. 6, the agency released a “sources sought” notice to gauge industry interest and feasibility of “large and small businesses” to produce HALEU. Original responses are due on Oct. 28.

Reprocessing: A Glimmer for Advanced Reactors

The DOE’s rollout of CURIE and the program’s recent awards champion reprocessing of LWR UNF—which is typically zirconium alloy-clad uranium oxide UNF—as another potential pathway to address the nation’s nuclear fuel woes. According to the DOE, CURIE’s wide scope of reprocessing technologies can “all provide feedstocks compatible with fuel needs of advanced reactor designs nearing deployment,” including gas-cooled, molten salt, and liquid metal-cooled reactors. “Any other separations technologies that meet program metrics are also within [CURIE’s] scope,” it says.

CURIE envisions that feedstock products arising from a reprocessing facility could “ultimately be sold to a fuel fabricator” to produce advanced reactor fuel. As significantly, it suggests that a facility scaled to CURIE’s metric of 200 MTHM/year could provide sufficient uranium and plutonium (U/Pu) or uranium/transuranic (U/TRU) feedstock to meet advanced reactor fuel needs “in the 2030 timeframe.” That assessment is based on the Nuclear Energy Institute’s 2020 estimate that industry will need approximately 220 MT per year of HALEU by 2032. “U/TRU or U/Pu fuel would provide the feedstock equivalent to the same amount of HALEU, and reprocessed material could serve as a HALEU feedstock,” the DOE suggests.

The necessary technology development, however, must overcome significant barriers, the agency acknowledges. Today, for example, “there is no demonstrated pathway for a U/TRU fuel from a solvent extraction technology, and safeguards are largely established but are associated with significant cost,” it notes.

Still, the DOE appears optimistic. “Many opportunities exist for the development of alternative solvent extraction technologies that would disrupt the processing landscape,” it says. Development of alternative aqueous (solvent extraction) technologies, for example, could enable the co-recovery of actinides (uranium through americium) that are relevant to the advanced nuclear fuel cycle in a single separation step that improve both the economics and potentially boost proliferation resistance, it says.

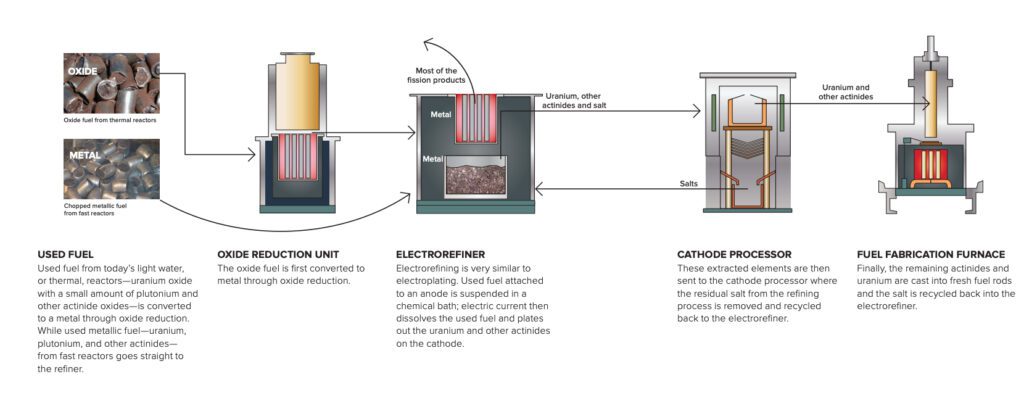

Pyroprocessing, a high-temperature, non-aqueous, batch electrochemical separation of UNF into different streams for re-use or disposal, could also be potentially attractive for production of fuel for some fast-spectrum advanced reactors fuel cycles from LWR UNF, because the TRU elements, including plutonium, are not well separated from each other, providing another layer of proliferation defense. Pyroprocessing, however, has only been demonstrated on a small scale in a research and development setting, the DOE notes.

Another high-temperature process, fluoride volatility, which exploits the volatility of high-oxidation state fluorides (for example, UF6) to achieve separation, was used to recover more than 100,000 MT of uranium from irradiated non-commercial fuel and to reprocess the Molten Salt Reactor Experiment fuel in the 1960s. While flowsheets have been designed that target actinides (uranium, plutonium, and neptunium) that can be useful as advanced reactor fuel feedstock, so far, fluoride volatility has not been demonstrated with UNF directly from a LWR. The DOE suggests it also expects interest from stakeholders (outside the advanced reactor community) to economically recover and repurpose fission products for industrial or medical radioisotope usage.

CURIE’s First Awards: A Dozen Noteworthy SNF Recycling Projects

For some in the advanced reactor community, the DOE’s efforts to explore SNF recycling marks a substantial step forward to address opportunities missed by the nation’s open-fuel cycle approach.

Oklo, a microreactor developer that is demonstrating the conversion of used oxide fuel into metal, enabling the recycling of waste from the current fleet into advanced reactor fuel, pointed to a potential for better fuel efficiency. “Today’s reactors only consume about 5% of the energy content contained in their fuel. Nearly 95% of the energy content remains unused,” the company told POWER on Oct 21.

Oklo has won four DOE awards to date with an array of partners, which include Idaho National Laboratory (INL), Argonne National Laboratory (ANL), nuclear waste management firm Deep Isolation, and Case Western Reserve University. In February, when the DOE granted Oklo a $5 million award under the ONWARDS program, Jacob DeWitte, Oklo co-founder and CEO, said the advanced nuclear technology firm plans to leverage its learnings from these projects to roll out a first-of-a-kind fuel recycling facility.

“The fuel recycling facility will enable Oklo to convert nuclear waste from existing used nuclear fuel into clean energy, as well as to recycle fuel from Oklo’s plants, allowing for a dramatic cost reduction and solving for a key supply chain need,” he said. “A commercial-scale fuel recycling facility will change the economic paradigm for advanced fission,” he added.

The DOE, notably, selected two projects spearheaded by Argonne as part of its CURIE awards on Friday. Under one project that garnered $4.9 million in federal funding, the Lemont, Illinois–based national laboratory will develop an electrochemical oxide reduction (OR) process that meets the CURIE program’s cost and waste metrics for a commercial pyroprocessing facility. “Electrochemical OR is a single-step process that converts used oxide fuels to metal, but current inefficiencies result in nonuniform and incomplete conversion to metal, long process times, and large waste volumes,” the DOE explained.

Argonne is set to demonstrate a highly efficient OR process with 97% conversion of the oxide fuel to metal by incorporating sensors to monitor oxide-to-metal conversion, using stable and efficient next-generation anode materials, and, finally, optimizing cell designs to achieve spatially uniform conversion to metal. Under the project, Oklo will pursue the acquisition of used fuel for recycling, and through the CURIE project, will develop its program for acquiring used oxide fuel feedstock, the advanced reactor developer told POWER. “This program will prioritize acquiring used fuel based on its physical and isotopic characteristics, and will include developing commercial relationships with entities that are actively seeking a solution for their used fuel inventory,” it said.

In parallel, under the second DOE-awarded project, Argonne will develop, produce, and test a suite of compact rotating packed bed contactors (RPBs) referred to as PAcked Centrifugal Equipment for Radiochemical separations (PACERs) for used nuclear fuel reprocessing.

Meanwhile, INL will get $2.7 million in federal funding to design, fabricate, and test robust anode materials for electrochemically reducing actinide and fission product oxides in SNF. “Electrochemical reduction of UNF is a key step in pyroprocessing flowsheets that enables subsequent recovery of actinides via electrorefining. Current anodes, which are typically fabricated from either platinum or graphite, suffer from high cost, rapid degradation of anode materials, contamination of the metallic product, and negative impact on carbon footprint,” the DOE explained. “To reduce anode costs and improve performance, INL will fabricate and evaluate the performance of coated and bimetallic anodes of iridium and ruthenium for commercial use. Developing robust anode materials supports a transformative solution to treating oxide UNF without generating greenhouse gases or isolating pure plutonium.”

However, the DOE’s biggest CURIE award under the October project selections—$6.5 million—will go to GE Research for the development of Monochromatic Assays Yielding Enhanced Reliability (MAYER) technology. MAYER is “a revolutionary safeguards solution for aqueous nuclear reprocessing facilities,” the firm explained. “MAYER uses a groundbreaking compact and tunable laser Compton scattering radiation source to provide a monochromatic, high-photon flux beam to enable high accuracy (<1% uncertainty), low latency (<2 minutes), in situ elemental and isotopic concentration measurements of fissile elements in a high radiation background.”

Leveraging the award, GE plans to also build a reprocessing facility safeguards management virtual pilot digital twin. The digital twin will use digital ledger technology to ensure data integrity and transparency. “The digital twin will enable continuous, on-demand artificial intelligence training to provide an active defense to lower standard errors in materials inventory and predict adverse events, to enable mitigation before a required facility shutdown,” it said.

Curio, a relatively new nuclear waste startup, will, meanwhile, get a $5 million award to develop and demonstrate its NuCycle SNF recycling process at the laboratory scale. Curio has been quietly developing the novel closed fuel cycle, which it says is “intentionally designed to avoid production of pure plutonium streams and dramatically reduces waste volumes over existing processes.” Curio expects “several” commercial products from the process, “including uranium/transuranic fuel and valuable radionuclides,” the company said. Designed for “facility footprint reductions with substantial economic efficiency, NuCycle uniquely leverages well-understood chemical processes and can accommodate a variety of UNF types (e.g., molten salts, nitride fuels, etc.). NuCycle shifts the current paradigm on ‘nuclear waste’ by recasting it as an asset and creates the commercial case for UNF recycling in the U.S.,” it added.

Another notable award—$4.7 million—will go to NuVision Engineering, a company that will design, build, commission, and operate an integrated material accountancy test platform. The platform will target the prediction of post-process nuclear material accountancy to within 1% uncertainty for an aqueous reprocessing plant. Engineering firm Mainstream Engineering will separately develop a vacuum swing separation technology to separate and capture volatile radionuclides. The project could “lower life cycle capital and operating costs, and minimize waste that must be stored,” the DOE said.

The DOE also awarded the Electric Power Research Institute (EPRI) $2.8 million to develop an “integrated fuel cycle enterprise” that will address “the coupled challenges of nuclear fuel life-cycle management and advanced reactor fuel supply.” The research organization will characterize and evaluate LWR fuel source options for economic viability, as well as options for a recycling facility that produces fuel for advanced reactors, such as a molten chloride fast reactor (MCFR). “EPRI will use this information to develop a recycling facility optimization tool to evaluate the many viable process options for their compatibility and efficiency. The output will inform the design of a recycling facility collocated with multiple fuel cycle facilities, potentially on an operating light-water reactor site,” the DOE said.

The DOE also selected several academic teams. The University of Alabama, Birmingham will develop a single-step process that recycles SNF by recovering the bulk of uranium and other transuranics from SNF after dissolution in nitric acid. The University of Colorado, Boulder will, meanwhile, advance technology capable of high-accuracy, substantially faster measurements of complex SNF mixtures. The University of North Texas will develop a self-powered, wireless sensor for long-term, real-time monitoring of high-temperature molten salt density and level to enable accurate safeguarding and monitoring of electrochemical processing of UNF. And the University of Utah will develop a pyrochemical process for efficiently converting SNF into a fuel feedstock suitable for sodium-cooled fast reactors or molten-salt-fueled reactors.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).

The post U.S. Spent Nuclear Fuel Reprocessing May Be Making a Comeback—Here’s Why appeared first on POWER Magazine.