NERC Warns of Mounting Reliability Risks, Urges Preparation for Challenging Summer

Credit to Author: Sonal Patel| Date: Thu, 19 May 2022 20:10:17 +0000

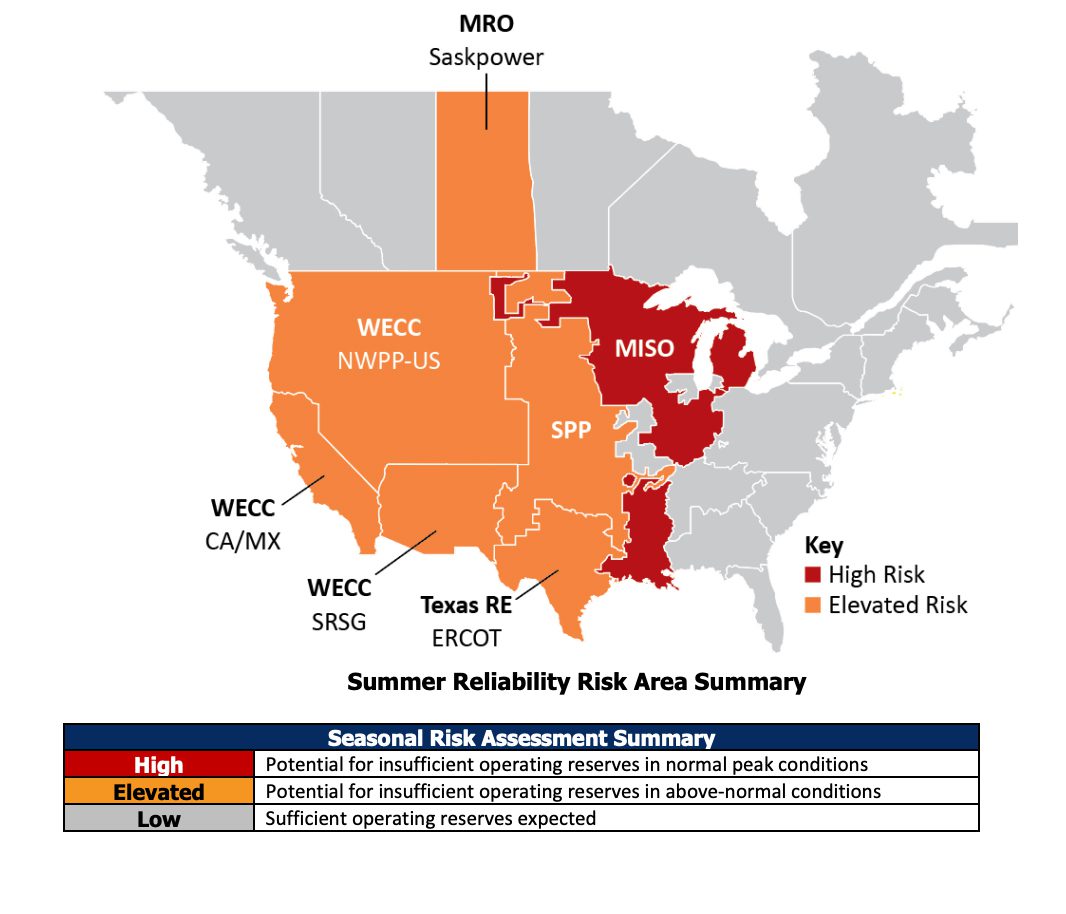

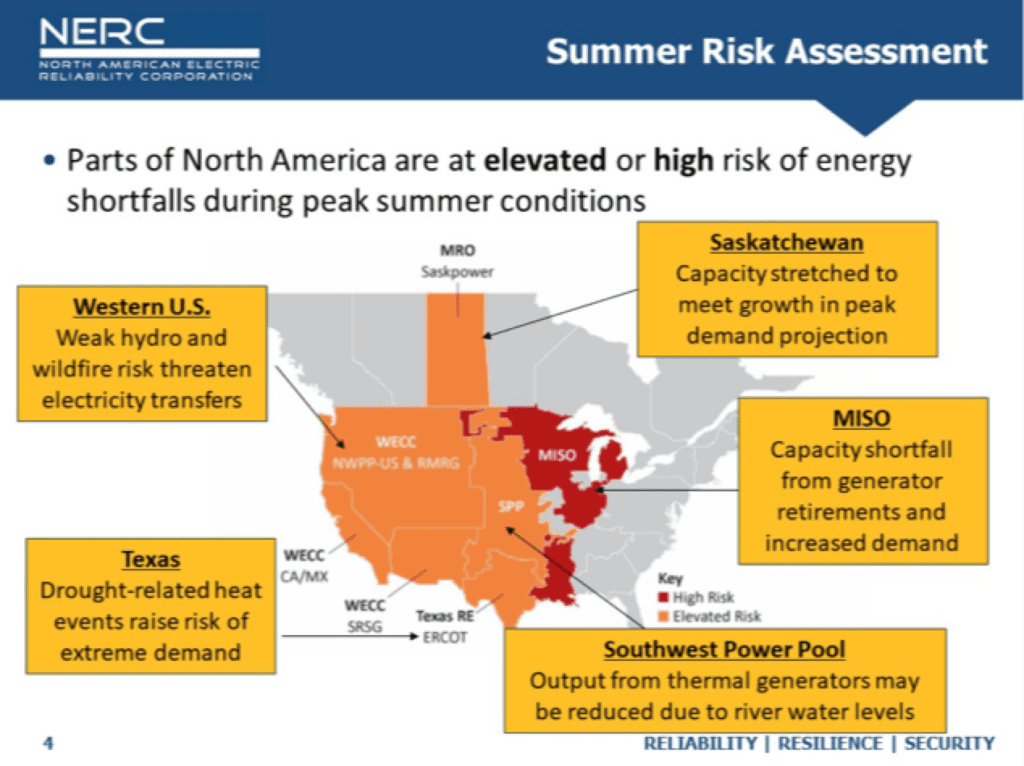

An unprecedented array of risks—ranging from capacity shortfalls, extreme weather, extended drought, supply chain issues, cybersecurity, solar PV tripping, fuel constraints, to wildfires—could imperil the reliability of nearly every North American bulk power system (BPS) region west of the Midcontinent Independent System Operator (MISO) this summer, the North American Electric Reliability Corp. (NERC) warns in a newly released summer assessment.

NERC’s May 18–issued 2022 Summer Reliability Assessment, which presents a forward-looking evaluation of generation resources, transmission system, and energy sufficiency across the North American BPS, estimates all its 20 regions will maintain anticipated reserve margins under typical outage conditions. However, seven regions could struggle if extreme events threaten generation output or demand spikes, NERC suggested.

MISO Faces Insufficient Firm Resources, Transmission Woes

Faring the worst, perhaps, is the Midcontinent independent system operator (MISO). NERC ranked MISO prominently in the “high risk” category, owing to forecasted capacity shortfalls in its north and central areas during both normal and extreme conditions. MISO’s predicament lies in elevated demand—up to 1.7% since last summer due to a post-lockdown surge—and, significantly, a 3,200 MW contraction in generation capacity from early generation retirements.

MISO raised an alarm on April 28 when it said it projects “insufficient firm resources” to cover the summer peak under typical demand and generation outages. It is now seeking increased non-firm imports as well as potential emergency resources to meet a 2022 summer peak demand of 124 GW. “More extreme temperatures, higher generation outages, or low wind conditions expose the MISO North and Central areas to higher risk of temporary operator-initiated load shedding to maintain system reliability,” NERC said.

System conditions in MISO may be especially precarious in early summer, when a tornado-damaged four-mile-long 500-KV transmission line connecting MISO’s northern and southern areas will be out of service for repairs. “The transmission outage affects 1,000 MW of firm transfers between the Midwestern and Southern MISO system that includes parts of Arkansas, Louisiana, and Mississippi,” NERC noted. The transmission line is expected to be restored at the end of June 2022.

However, the Canadian province of Saskatchewan this summer may also strain to meet peak demand projections, which have risen by more than 7.5% since 2021, NERC said. Regional reliability coordinator SaskPower’s capacity adequacy study suggests forced outages of 300 MW or greater that coincide with peak demand may result in demand response and potential load shed to maintain system balance, though that probability remains low.

Drought Is a Major Wildcard in Texas, SPP, the West

According to Mark Olson, NERC’s manager of Reliability Assessments, Texas and Western Interconnection will meanwhile grapple with multiple risks.

The Electric Reliability Council of Texas (ERCOT), which this week released its summer assessment of resource adequacy, expects it will have “more than sufficient” power for normal conditions this summer, though it warned extreme conditions and “dark and still conditions” could pose risks. The grid operator’s assessment has come under scrutiny, given that over the past week, it took a cautionary measure to urge conservation as unseasonably hot weather drove record demand during the “shoulder season,” when generators typically conduct maintenance ahead of the summer.

Olson on Wednesday, however, pointed to an elevated risk for ERCOT based on extreme weather and the current drought. “Extreme heat increases peak demand and the current drought in Texas can cause prolonged high temperatures to settle across the entire interconnection,” he said. “This raises risk of energy emergencies during a wide area heat event due to simultaneous high demand across the entire area, and also potential for increased forced generator outages or lower output for generation and the potential for reduced energy output from wind generation,” he added.

Yet another risk facing Texas relates to potential delays or cancellations of transmission projects that are underway in the state to alleviate transmission constraints, Olson noted.

Drought risks are also notably gripping the Missouri River Basin. Output from thermal generators that use the Missouri River for cooling in SPP “may be affected in summer months,” NERC said. “Low water levels in the river can impact generators that use once-through cooling and lead to reduced output capacity,” as well as output from hydropower plants, which could lead to energy shortfalls at peak demand, it explained. “Periods of above normal wind generator output may give some relief, however, this energy is not assured. System operators could require emergency procedures to meet peak demand during periods of high generator unavailability.”

However, SPP, the regional transmission organization that manages a grid across 17 central and western U.S. states, on May 12 has said it expects to have enough generating capacity from June through September to meet an expected record peak demand of 51.1 GW. SPP said its latest assessment factors drought conditions. “Drought conditions that will impact the SPP footprint and are likely to lead to increased irrigation loads: Electricity is needed to power the equipment used to water crops, and decreases in precipitation generally lead to increased electricity use,” it noted.

Drought, along with wildfire risks, are also persistent across the Western Interconnection. “An elevated risk of energy emergencies persists in these areas, as dry hydrological conditions threaten the availability of hydroelectric energy,” Olson said. “The risk is greatest in late summer as the water resource levels reached their lowest point as solar PV resources output falls off earlier in the day, but as we’ve seen in recent summers can still be extremely warm and demand can remain high.”

In California, that risk is especially pronounced late in the day—during a period Olson called “the hour of highest risk.” It “occurs in the evening and solar output is diminishing, but demand remains high. Under normal conditions, there’s sufficient energy and resource capacity with the normal amount of imports to meet demand during this evening risk period,” he explained.

Extreme temperatures however, can push demand up significantly and when combined with higher than normal generator outages or low hydroelectric output, or other energy limiting scenarios, operators in California will rely increasingly on transfers to make up for their demand, Olson noted. However, extreme regional heat events, like the one that occurred in August of 2020, “could reduce the availability of electricity for transfer as areas serve higher internal demand,” he warned.

A Complex Slate of Significant New Risks

During a call with reporters, John Moura, NERC director of Reliability Assessment and Performance Analysis, highlighted the summer assessment’s dire warnings with some acknowledgment that NERC has issued similar outlooks in past years. “What we’ve all learned from recent history is that ‘extreme’ doesn’t mean ‘rare,’” he said. “And I think that’s a really important concept when we think about planning going forward,” he said.

To better gauge how reliability risks are affecting the bulk power system in the face of more extreme events, NERC this year enhanced its assessment and analysis approach, he said. Rather than focusing on planning reserve margin and “normal” weather, “now, we’re really looking at extreme weather, and we’re asking, not ‘do you have enough supply?’ but ‘how resilient is your system in a particular extreme weather event? How much can it withstand? What are its greatest vulnerabilities?’” he said.

The new analysis ultimately reveals serious conclusions, Moura said. “It’s a pretty sobering report, and it’s clear the risks are spreading. And while we’ve initiated action on a number of fronts and sounded the alarm bells for quite a many years, there’s clear, objective, conclusive data indicating that the pace of our great transformation is a bit out of sync with the underlying realities and the physics of the system.”

Departing from past studies, NERC’s 2022 summer assessments, for example, provides a snapshot of peripheral reliability issues. These include enduring issues the power industry has been actively grappling with, such as cybersecurity.

Olson noted that in addition to “ongoing normal cyber risks,” the industry is facing elevated cybersecurity threats from Russian attackers amid heightened geopolitical tensions. NERC said its Electricity Infrastructure Sharing and Analysis Center (E-ISAC) is continuing to exchange information with its industry member and posted communications and guidance from government partners and other advisories on its portal.

Coal Generators Are Grappling With Fuel Constraints

Among newer, emerging risks are supply chain disruptions that are threatening the commissioning of new resource and transmission projects all over the country. “Assessment areas report that some generation and transmission projects are being impacted by product unavailability, shipping delays, and labor shortages,” NERC revealed. Regions most affected by the disruptions are in the Western Interconnect’s California and Southwest Reserve Sharing Group (SRSG) regions, where sizable capacity is under development, including resources projected for summer, it noted.

However, impacts are being felt in transmission projects in ERCOT, too. NERC urged stakeholders, including generators and transmission owners to communicate project delays to transmission operators and reliability coordinators “so that impacts are understood and steps are taken to reduce risks of capacity deficiencies or energy shortfalls.”

An especially significant risk, meanwhile, is affecting coal generators, who are suffering “relatively low” stockpiles compared to historical levels. In December, the U.S. Energy Information Administration (EIA) reported inventories of coal at the nation’s power plants were at their lowest level in more than 40 years. The agency’s latest assessment suggests total coal stockpiles showed a 4% decrease in February 2022 compared to January 2022, but this follows a normal seasonal pattern, the agency said, and most plants appear to have 90 days of fuel in stock.

NERC said it is monitoring factors that are prompting difficulties for coal generators in obtaining fuel and non-fuel consumables. However, while issues have been documented in the west and southeast, NERC said it doesn’t expect the risk will affect BPS reliability going into the summer, Olson told POWER. “But it is a concern,” he said. Some factors prompting the constraints are “issues with coal train shipments,” including difficulty by power plants in arranging coal shipments to their stores, which points to an issue with rail availability, he said.

In addition, “there’s some huge volumes of manpower shortages in the rail industry that are affecting the ability to supply coal,” he said. Several coal generators have raised those concerns and working to resolve them. “System operators are using some of the tools that they normally use in winter to make sure that the fuel supply coal fuel supply is there for peak periods,” Olson noted. “So they’re monitoring availability of coal at their plants and keeping an eye on their projections for generation to ensure that the fuel is there to meet the peak demands.”

Moura said natural gas supplies are meanwhile generally healthy nationwide for the summer. “The thing we’ll be monitoring in the summer is how much gas will be injected into storage wells for the upcoming winter,” he noted.

Generator Performance, Unexpected Solar PV Tripping a Concern

Recent reliability events, meanwhile, point to issues with generator performance. On May 13, ERCOT reported that six power generating facilities, a combined 2.9 GW, suddenly tripped offline, as the grid operator fielded a period of unseasonable hot weather that drove record demand across the state. However, according to Moura, the incident showed the merit of planning, and significantly, it called attention to vulnerabilities.

While Texas has improved its planning reserve margins, generators still face growing risks, especially in the face of changing market conditions and extreme weather, he noted. “The units are being run harder, they’re cycled more often than conventional use, there’s simply not enough conventional units that have secured onsite fuel, and they have to balance variable resources, solar and wind, which is really the only future generation that’s coming online in these areas,” he said.

Another risk the incident exposed is that grid operators are beginning to experience real challenges during the “shoulder period,” which typically marks the spring or fall, when temperatures are milder. “Shoulder periods aren’t traditionally where we’ve seen a lot of stress,” Moura noted. “And it’s a big signal of the tightness that they’re seeing really across the year, not just during peaks.”

Yet another substantial generator-attributed reliability risk NERC is closely monitoring relates to the unexpected tripping of solar PV resources during normal grid disturbances, like lightning strikes. NERC said the issue raised alarms last year when the Texas grid experienced widespread solar PV loss in May and June 2021, and similar events were logged in California between June and August 2021.

In a joint report NERC issued with Western Electricity Coordinating Council (WECC) this April, NERC and WECC concluded that the four disturbances involving the widespread reduction of power from BPS-connected solar PV resources in Southern California showed a need for more vigilance to ensure all BPS-connected inverter-based resources can operate reliably to support the BPS. “The persistent and systemic nature of these events indicate an ongoing and elevated level of risk to the BPS,” the report said.

“During these events, widespread loss of solar PV resources was also coupled with the loss of synchronous generation, unintended interactions with remedial action schemes, and some tripping of distributed energy resources,” NERC explained. “As industry urgently takes steps to address systemic reliability issues through modeling, planning, and interconnection processes, system operators in areas with significant amounts of solar PV resources should be aware of the potential for resource loss events during grid disturbances.”

Branden Sudduth, WECC’s vice president of Reliability Planning and Performance Analysis, in April underscored the emerging risks’s relevance. “There is no doubt that the penetration of inverter-based resources will increase, not just in California, but throughout the Western Interconnection,” owing to the energy transition, which is encouraging increasing amounts of renewable generation such as wind, solar PV, battery energy storage and hybrid power plants, he said. While these inverter-based resources present new opportunities in terms of grid control, they also introduce potential risks to the system, he said.

“We need to get to the point where we have confidence in the models and actual performance of these resources. We have a lot of work to do to get to this point, but we have efforts in place to ensure that the legacy equipment is performing as optimally as possible, while ensuring the performance of new plants exhibits the ride-through capabilities we know these resources are capable of,” Sudduth said.

Olson said NERC has already sprung into action to address the issue on a long-term basis, including ensuring that interconnection requirements will address PV performance before installation, and efforts to improve modeling. NERC is also initiating action to develop reliability standards for the industry to adopt that would improve solar PV resource performance.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).

The post NERC Warns of Mounting Reliability Risks, Urges Preparation for Challenging Summer appeared first on POWER Magazine.