Poland Secures NuScale SMR as Urgency for Nuclear Energy Ramps Up Across Central, Eastern Europe

Credit to Author: Sonal Patel| Date: Tue, 15 Feb 2022 17:16:04 +0000

NuScale Power has signed a definitive commercial agreement with mining and processing firm KGHM Polska Miedź S.A. to deploy a VOYGR power plant of up to 924 MWe as early as 2029 to support KGHM’s copper and silver production in Poland.

Under an “early works agreement” signed in a ceremony on Feb. 14 in the presence of U.S. and Polish government officials, Portland, Oregon—based NuScale and KGHM will kick off preparation of “the whole investment project,” including site selection, said Marcin Chludziński, president of the KGHM Polska Miedź S.A Management Board, during the ceremony. The agreement “is not just a declaration anymore, but an actual agreement,” Chludziński said.

The deal adds another major prospect to NuScale’s development pipeline of small modular reactors (SMRs) in Central and Eastern Europe, regions that have quickly emerged as a hotspot for advanced nuclear projects owing to a combination of factors. But it is also especially notable because it represents a deal with a large user of industrial energy, a key decentralized power market that could benefit from smaller installations of baseload, flexible power. KGHM is the second-largest industrial energy consumer in Poland, as Chludziński noted on Monday.

The Allure of SMRs for Large Industry

The commercial agreement follows a memorandum of understanding (MOU) the two companies and Poland-based business engineering consultant Piela Business Engineering signed in September 2021 to collaborate on the development, licensing, and construction of a NuScale VOYGR plant in Poland. Under that MOU, the companies have worked to examine deploying NuScale’s SMR technology as a coal repowering/repurposing solution for existing coal-fired power plants, as well as for “energy in support of industrial operations in Poland.” The companies in September said their examination would include “an analysis of technical, economic, legal, regulatory, financial, and organizational factors.”

NuScale’s VOYGR SMR technology, first introduced in 2000 as an Oregon State University concept, has evolved into a modular light water reactor (LWR) design that can supply energy for power generation, district heating, desalination, hydrogen production, and other process heat applications. With flexibility as a core attribute, NuScale currently offers VOYGR power plants in scalable sizes, including as twelve 77-MWe modules, and as four- and six-module facilities. The company in an October 2021 white paper argued that the modular plants are well-suited to coal repowering because of their design simplicity, modular construction, load-following capabilities, and competitive leveled cost of electricity (LCOE). A 12-module, 924-MWe plant design may have an LCOE of $64/MWh, the company has said.

For KGHM, a firm that owns the largest deposit of copper ore in Europe (which is located in southwestern Poland), the prospect offers a new avenue to decarbonize its mining operations. Chludziński on Monday also pointed to potential cost savings. “The SMR technology will increase the company’s cost efficiency and transform the Polish energy sector,” he said.

“We realize that SMRs can be used not just to generate power—we can use them for heat generation and also produce hydrogen for all the different operations,” Chludziński noted. “And we will definitely use any opportunity as a business that generates profits to operate in a better, streamlined way, and a more flexible one,” he said.

Minister: Poland Needs to Decarbonize Rapidly but Securely

How quickly a NuScale project could be developed and brought online in Poland, however, remains to be seen.

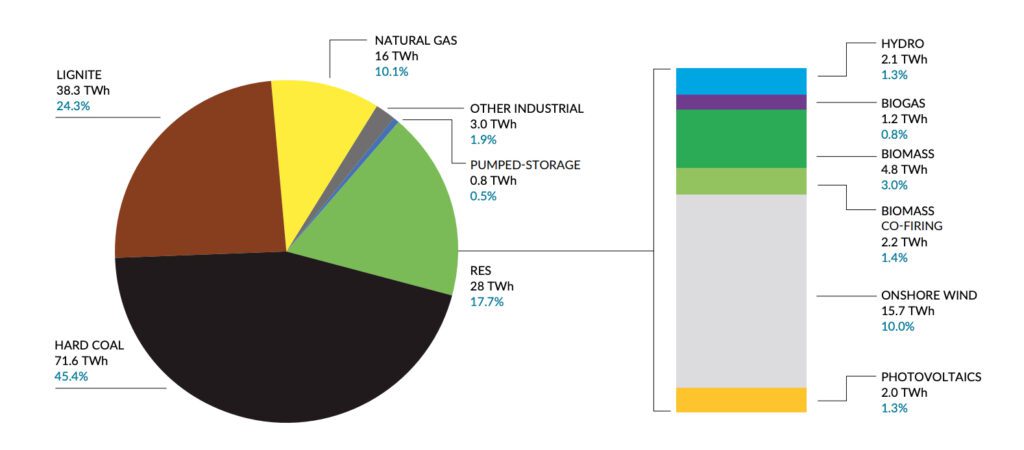

Poland’s Deputy Prime Minister and Minister of State Assets Jacek Sasin during the ceremony flagged the urgency to bring new nuclear online and accelerate the country’s energy transition. Poland holds the largest reserves of coal in Europe produced 70% of its power from coal in 2020, but it indicated a commitment last November to phase out its coal plants, targeting a 2040 timeframe—a decade earlier than the 2049 date it set earlier in 2021. The country has been steadily increasing its gas and renewable generation shares to meet stringent European Union (EU) climate goals to reach climate neutrality by 2050, Sasin noted.

However, the country has no nuclear plants. While this will require elaborate planning, including establishing an associated regulatory framework, Poland’s February 2021–adopted revised energy policy through 2040 calls for commissioning of its first nuclear power reactor in 2033, followed by subsequent units. The plan designates an investment of PLN 140 billion (about $40 billion) for the new builds.

“We’re in a race against time. We have to do this fast,” Sasin said on Monday. “So we’re looking at developments every year and every month.” Sasin noted the complexities Poland is facing as it sets out to meet its energy transition goals. “The process is difficult, and it requires a lot of investment—but it is absolutely necessary for is. But in the process, we want to preserve and assure that Poland keeps its energy independence without having a negative impact on this process on our society,” which currently depends heavily on its coal industry. “So, at the end of the day, we’d like to have our society have cheap and reliable power,” he said.

Poland, notably, has already signed an intergovernmental agreement with the U.S. to develop 6,000 MW to 9,000 MW of installed nuclear capacity based on proven, large-scale, pressurized water Gen III and III+ nuclear reactor designs. Construction of the first of six planned units is scheduled to begin in 2026, with commercial operation of the first unit to commence in 2032. Westinghouse and Bechtel, which have teamed to supply an AP1000 reactor, recently shared information on the Front-End Engineering and Design (FEED) project announced in June 2021. The Polish government is poised to review the FEED this year to help in its selection of the best partner for the nuclear power plant program.

Meanwhile, it is also exploring deployment of GE-Hitachi Nuclear Energy’s (GEH’s) BWRX-300 SMRs. Last December, Synthos Green Energy, a firm that is part of a large European private industrial group owned by Polish industrialist Michał Sołowow, partnered with GEH with the intention of deploying “at least 10 BWRX-300 SMRs in Poland by the early 2030s.” Synthos says it is targeting the first BWRX-300 in Poland to be operational in 2029. To support that goal, it has established partnerships with oil refiner PKN ORLEN. Separately, Polish energy group ZE Pak has an investment agreement with Synthos to build four to six BWRX-300s at the site of a lignite-fired power plant in Patnow.

NuScale Readying for Substantial Expansion

NuScale is meanwhile eyeing a 2027 delivery timetable for its first commercial VOYGR offering. If built as envisioned by 2029, the KGHM project could come online within months of the 462-MWe Carbon-Free Power Project, six-module NuScale Power VOYGR-6 power plant that Utah Associated Municipal Power Systems (UAMPS) is developing for a site at the Idaho National Laboratory (INL) in Idaho Falls. The CFFP project recently completed field investigation activities, and project developers are now readying to submit a combined license application (COLA) to the Nuclear Regulatory Commission (NRC) in early 2024.

“We maintain strong program momentum towards commercialization and rest of our technology. Our program is focusing now on readying that technology to equip and manufacture and construct,” said John Hopkins, chairman and CEO of NuScale Power, during the signing ceremony on Monday. Preparations include “finalizing agreements across our supply chain and completing plans for our power plant delivery activities, and startup and commercialization plans,” he noted.

Diane Hughes, vice president of Marketing & Communications at NuScale told POWER on Monday that while a “detailed project timeline” for the KGHM VOYGR plant will be developed under the commercial agreement signed Monday, NuScale expects the CFPP to remain its lead project.

Hughes acknowledged the timeframe will depend on Poland’s regulatory requirements. “We will be supporting our customers’ engagement with the Polish nuclear regulator regarding the requirements needed to obtain approval to construct and operate our VOYGR power plants in country,” she said. NuScale’s 50-MWe (160-MWth) module became the first SMR to receive a final safety evaluation report (FSER) from the U.S. Nuclear Regulatory Commission (NRC) as part of a Phase 6 review—the last and final phase—of NuScale’s Design Certification Application (DCA), she noted. (However, the NRC now needs to complete a review of the company’s power uprate from 60 MWe to 77 MWe as part of a Standard Design Approval (SDA) application, which NuScale has said it could submit this year.)

“The U.S. NRC is a world-class regulator who thoroughly reviewed and approved NuScale’s design, and the information developed for the U.S. NRC’s review will be highly relevant and instructive as we support this engagement,” Hughes said. “By working with the U.S. NRC and other regulators, NuScale is preparing to meet the regulatory requirements of global customers like Poland.”

Central and Eastern Europe Emerging Hotspots for Advanced Nuclear

NuScale notably is in parallel working on several other prospects in the Central and Eastern European regions. Outside of the KGHM VOYGR project, NuScale has separate agreements with Oklahoma-based integrated energy company Getka Group and Polish multi-energy group UNIMOT to explore the deployment NuScale SMR technology as a coal repurposing solution for existing coal-fired power plants in Poland.

Last December, NuScale signed an MOU with Kazakhstan Nuclear Power Plants to explore deployment of VOYGR plants in Kazakhstan to help that country meet its carbon neutrality goals by 2060. And in February, the company signed MOUs with Bulgaria’s Kozloduy Nuclear Power Plant—New Build, a public limited company established to commission new nuclear power capacity at the Kozloduy power plant location.

Meanwhile, following an MOU with Energoatom, Ukraine’s state-owned operator of the country’s four nuclear power stations, NuScale in November announced the U.S. Department of Energy will fund an independent review of NuScale’s Safety Analysis Review by Ukraine’s State Scientific and Technical Center for Nuclear and Radiation Safety. The review could allow Ukrainian entities to explore future VOYGR SMRs. NuScale is also providing technical assistance for a Ukrainian government study of SMR licensing gaps.

In November, notably, NuScale signed a teaming agreement with Romania’s Nuclearelectrica at the United Nations Conference on Climate Change (COP26) to help the state-owned power, heat, and nuclear fuel producer to take steps toward deploying a six-module, 462-MWe VOYGR-6 power plant in Romania as early as 2027/2028.

“Pursuant to MOUs with our customers in Ukraine and Kazakhstan, we are supporting these customers in their work to evaluate NuScale’s VOYGR technology for potential deployment,” Hughes explained on Monday. “For our customers in Poland and Romania, we are supporting their activities associated with a NuScale VOYGR plant deployment project. Each opportunity is progressing at an appropriate pace to meet the customers’ needs for delivery of clean energy,” she said.

U.S. Nuclear Companies Making Inroads

NuScale’s Eastern European developments are bolstered by U.S. government-led initiatives to expand nuclear power and advance nuclear power technology across the world. In November, the U.S. government committed $25 million to the Nuclear Futures Package, which includes funding for the Foundational Infrastructure for the Responsible Use of Small Modular Reactor Technology (FIRST) Initiative, and the U.S. SMR Public-Private Program and associated Small Modular and Advanced Reactor Standards and Regulations Workshop Series.

As the Nuclear Energy Institute (NEI), a Washington-based nuclear power industry group, recently noted, U.S. initiatives have helped spur many other developments worldwide, though the majority are in Central and Eastern Europe.

The Czech Republic’s government, for example, has “firm plans” to build another pressurized water reactor (PWR) at Dukavany, which currently hosts one reactor, as well as two additional units at the existing Temelin site. “The Dukavany 5 tender will be launched next year with construction planned to begin in 2029. Westinghouse will be a leading contender to supply the Dukavany plant,” NEI noted. Meanwhile, national electric utility ČEZ has also signed an MOU with GEH to examine the feasibility of constructing a BWRX-300.

In Ukraine, Westinghouse and Energoatom, the state-owned nuclear utility of Ukraine, are looking to build Westinghouse AP1000 reactors at multiple sites. In Slovenia, which is currently considering adding a second unit at the Krško nuclear power plant, Westinghouse, which supplied the first unit, is a leading contender to supply the second, NEI said. Westinghouse is also a leading contender for a large PWR at the existing Kozloduy site (Kozloduy 7).

Expert: Nuclear Promising for Central, Eastern Europe’s Crucial Energy Challenges

According to Josh Freed, senior vice president of Climate and Energy Program at U.S.-based public policy think tank Third Way, Central and Eastern Europe hold good prospects for advanced nuclear developers for several reasons. Mainly, “it’s a combination of three big forces coming together,” he told POWER on Monday. “One is, countries need to decarbonize and they need to do it with firm and clean power, especially in the heavily industrialized parts of Eastern Europe that want to replace their coal fleets, want to maintain manufacturing, and become leaders in innovation and clean energy,” he said.

Another factor is the regions’ quest for energy independence. While the looming threat of a large-scale Russian invasion of Ukraine has the U.S. and its European allies on alert, potential disruptions to the European energy market, which remains highly dependent on Russian oil and gas, has long been a concern.

“Even before the most recent crisis that we’re living through now with Ukraine, we heard and saw from a number of countries in Eastern Europe that we engage with a recognition that reliance on Russian natural gas, on Russia nuclear for firm power, was not safe,” Freed said. “And they were looking for opportunities to ensure their own energy autonomy, and to strengthen ties with countries that would enable them to maintain their autonomy, and so they look to the U.S. amongst others for that.”

A third factor is related to energy prices. Over 2021, a major energy crisis began brewing in Europe prompted by lagging natural gas supplies, including limited supplies from Russia, diminished North Sea production, and competition with Asia for liquefied natural gas. The resulting tripling of prices and threats of shortages across Europe has prompted some countries, like France, to make emphatic appeals for energy security and affordability.

Given the volatility in energy pricing, which is also related to decarbonization and energy independence challenges, “countries are looking at what is going to be the smartest, long-term investment for their future,” said Freed. “There’s a desire to move away from commodities, like natural gas, where prices fluctuate a lot. And nuclear is an option that gives a lot of predictability once it’s built,” he said.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).

The post Poland Secures NuScale SMR as Urgency for Nuclear Energy Ramps Up Across Central, Eastern Europe appeared first on POWER Magazine.