This Is Why California Will Keep Burning

Credit to Author: Susie Cagle| Date: Wed, 17 Apr 2019 17:00:15 +0000

California has always burned, but it hasn’t always burned like this. In 2017, the state saw its largest wildfire ever. Then in 2018, it happened again. Tens of thousands of homes burned, more than 100 people killed, whole neighbourhoods and one entire town all but destroyed, in the space of less than a hazy year and a half.

This is a place of extremes, where climate change has wreaked havoc across hundreds of thousands of square miles, pushing wildfires from the hills to the beaches, and where lawmakers have pledged to source 100 percent of the state’s energy from renewables by 2045. It’s a long time to wait for people worried about losing their homes or their lives in an instant.

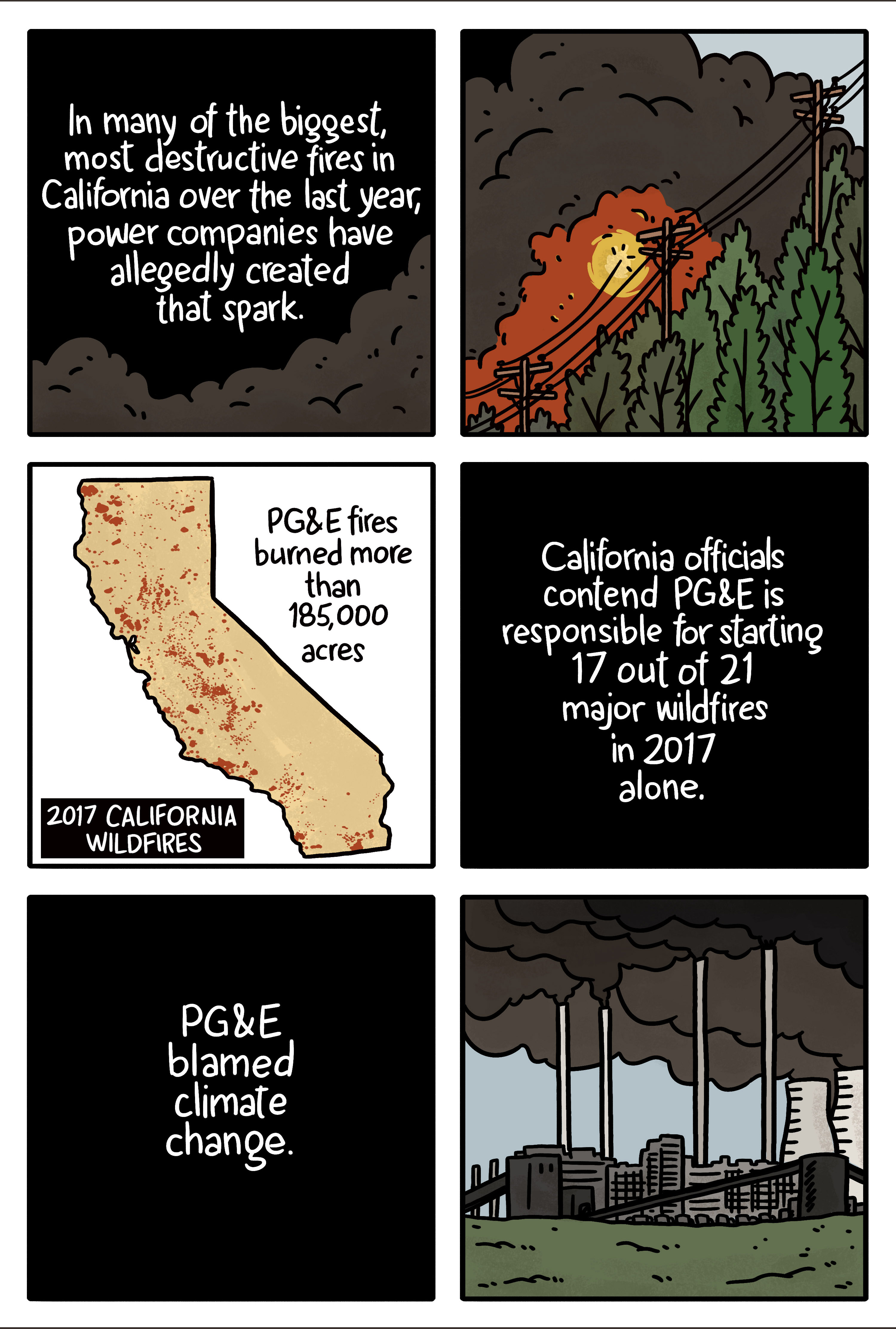

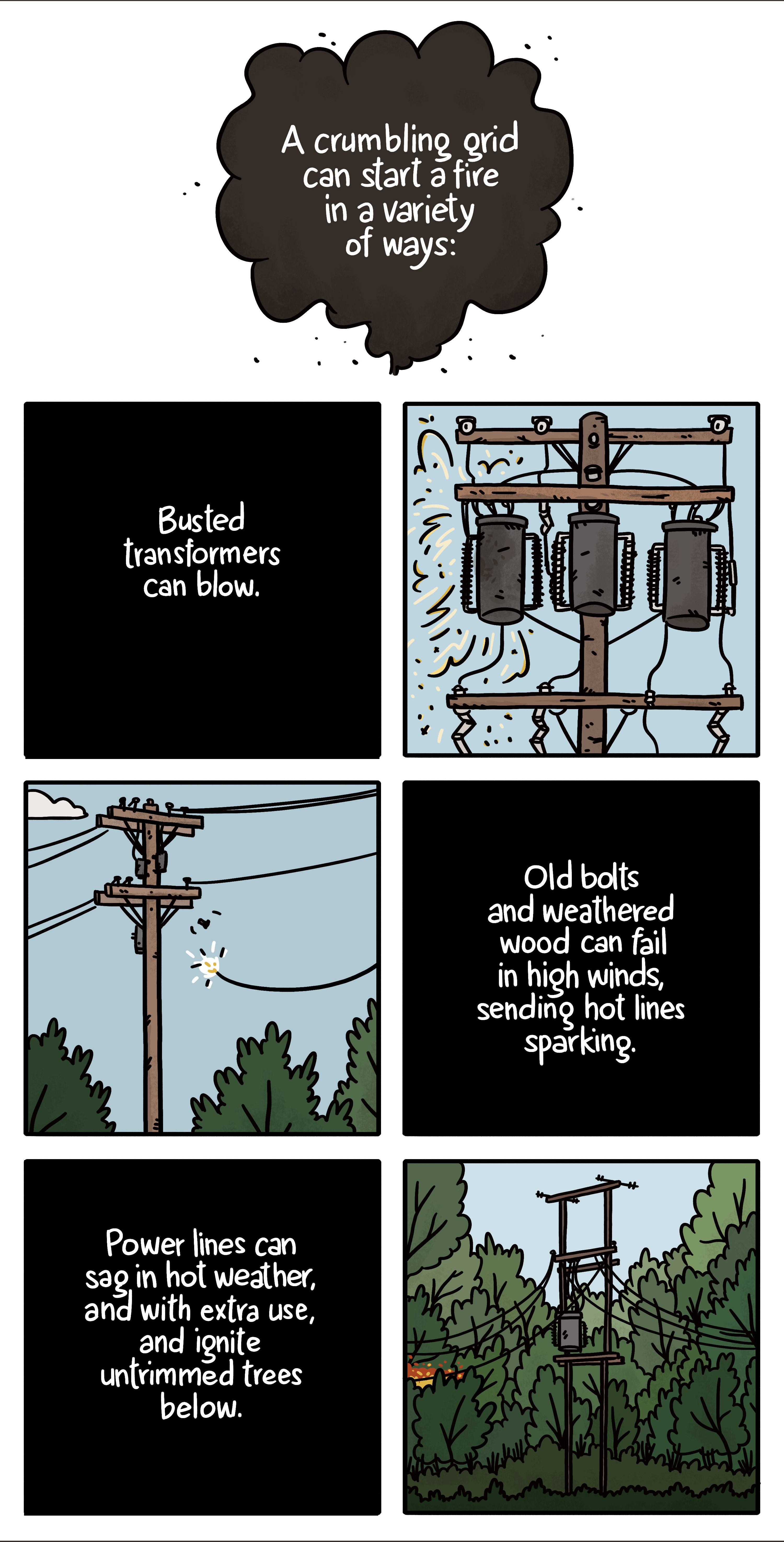

But fire is not purely a force of nature. People start fires—with a discarded cigarette butt, a poorly extinguished campfire, and also, though rarely, arson. And now, more frequently, fires are the result of an old, frail electric grid, failing under the pressure of a growing society and more extreme, climate-changed weather.

As the next fire season looms, Californians are wondering where the next fires will rage—and if there’s anything they can do to stop them. And retrofitting that crumbling electric grid is probably their best chance.

It’s not just Pacific Gas and Electric (PG&E), the largest utility in California, which has admitted its aging power lines likely caused the devastating Camp Fire that destroyed the town of Paradise. Infrastructure across the country is crumbling, and we haven’t made the investments and reforms necessary to keep things running smoothly—or, at times, running at all. The US is categorically quite bad at maintenance. The most progressive states may be looking toward some greener future, but there seems to be little interest in shoring up the crumbling present.

When the grid fails in other ways, in other places, we get multi-state mid-summer blackouts, or impressive city-wide light shows, with transformers arcing into the night sky. But in California, the stakes have risen sharply.

“I don’t think there’s ever been another utility implicated in as many deaths as PG&E has been,” says Mindy Spatt, spokesperson for consumer advocacy group The Utility Reform Network (TURN). “So where other customers may have experienced bad utility practices, this is on a whole other level.”

In 2016, PG&E was found guilty of violating safety regulations ahead of a gas pipeline explosion, in the northern California city of San Bruno, that killed eight people and turned a suburban neighbourhood into a crater. The utility has been on probation ever since. At the end of 2018, the California Public Utilities Commission, which regulates the state’s many power companies, announced that it would be investigating PG&E, and would consider breaking up the company, or taking it over completely, in the name of public safety. A few weeks later, PG&E announced it would be filing for bankruptcy protection.

If the largest utility with some of the highest energy prices in the country isn’t working, as a utility, a profitable business, or even just an entity that doesn’t kill people, it might mean utilities that sustain modern society shouldn’t be operating as for-profit companies. And that’s just in terms of doing the bare minimum, the maintenance we’ve long ignored. Building the green grid that would move us beyond a sketchy status quo is yet another problem.

The immediate strategy for dealing with an old grid under new pressures is simply to shut down the power on especially hot, windy days. So-called “de-energizing” is arguably the best infrastructure fix the state currently has for wildfire. But it’s controversial policy, affecting thousands of customers, and potentially even endangering those who require electrical power for equipment they need to live.

Yet it’s also an unusual opportunity to build something better—a more resilient, clean, distributed electrical grid, at least on a small scale, starting in wildfire country. California’s dire climate crisis could be the impetus for what some have called a kind of mini Green New Deal, something to address a crucial need for the state at the vanguard of some of the worst, most violent effects of climate change the country has seen yet.

But a broken, bankrupt utility monopoly is also a perfect illustration of the entrenched interests and systems that stand in the way of progress. PG&E’s strife might present an opportunity for systemic change that would ready a fragile state for the tumultuous fire seasons ahead, and prompt a massive new investment in green infrastructure—but it could also mean huge losses for existing renewables programs, and even higher utility bills for Californians who already grapple with rising costs of living.

Crisis is opportunity for much-needed change. It’s also just crisis.

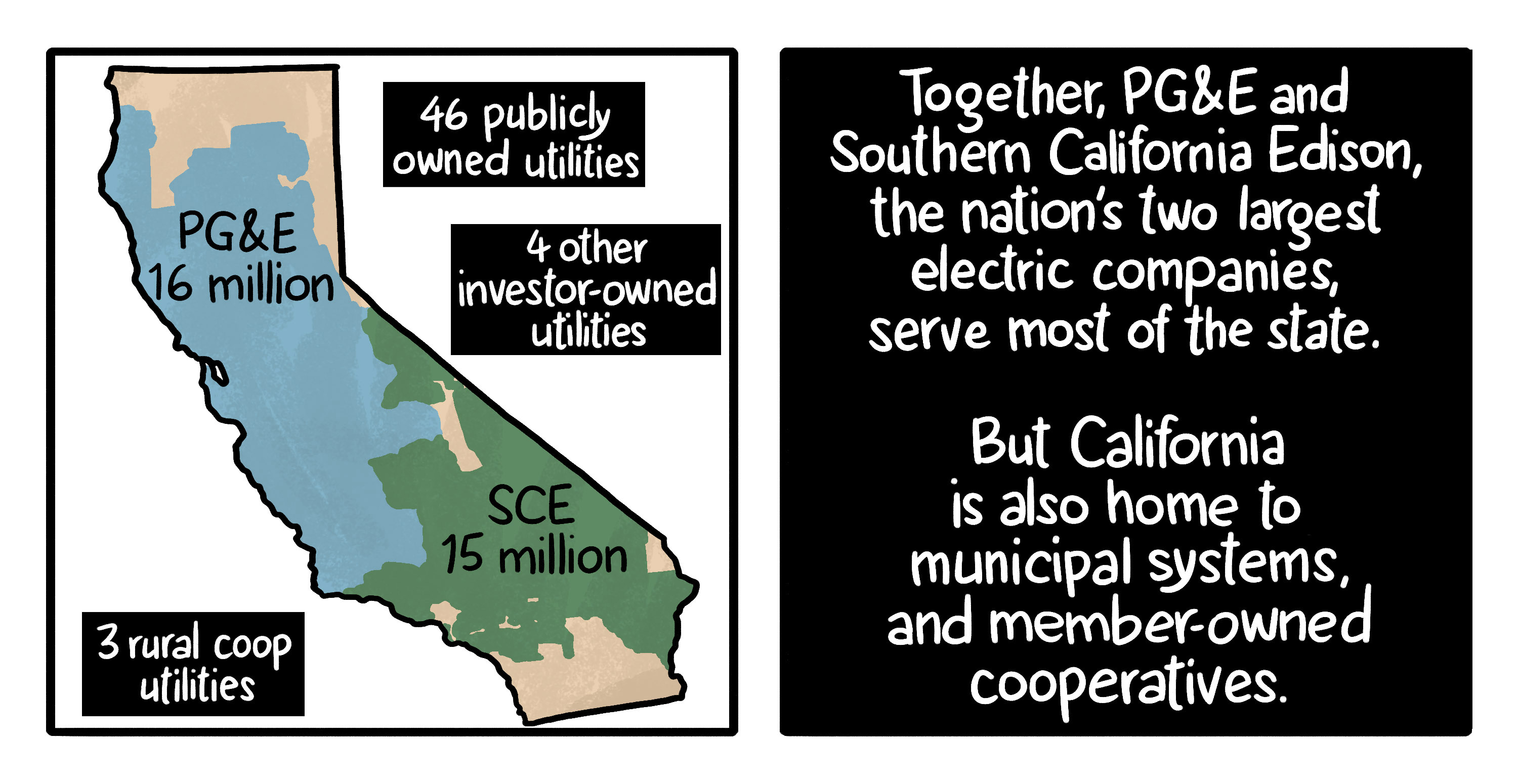

Most Californians—most Americans, really—don’t have a choice about where their electricity comes from. Our rickety national power grid is a cobbled-together mix of entities, for-profit and nonprofit alike, and much of it is owned by investors, not the general public. It’s hardly an open marketplace; in most places, you have just one power provider to choose from.

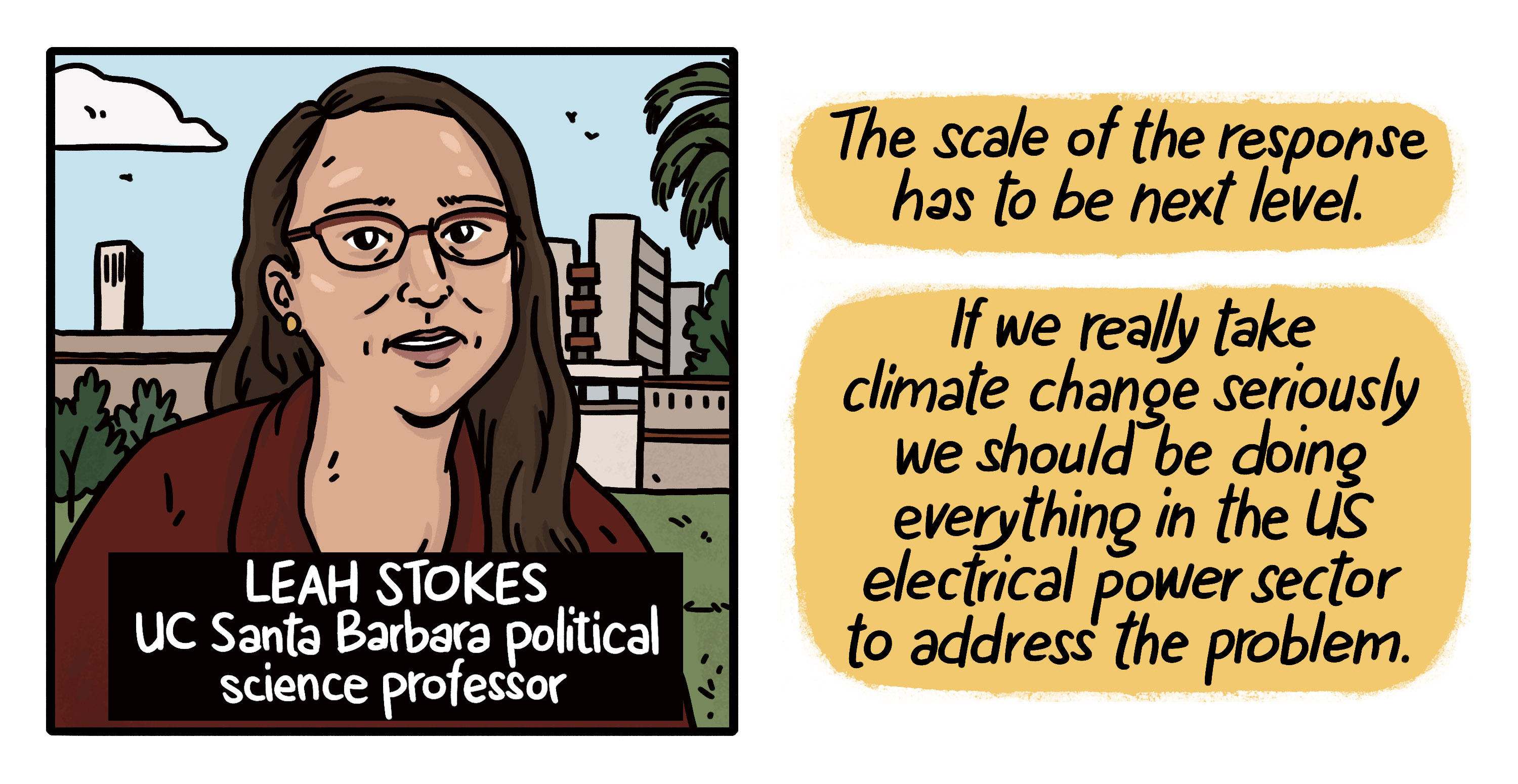

The construction of that private utility system was “a grand bargain,” says University of California, Santa Barbara, political science professor Leah Stokes. “They said, ‘we want to be private monopolies, we have to have a guaranteed market to make our product cheaper because we have all these fixed costs. So government said okay, if you’re a monopoly, we have to regulate you.”

Utilities in California are overseen by a state commission, staffed by appointees, and their powers over private companies are limited. There’s no direct accountability to the people relying on these providers, and their aging infrastructure. And in exchange for that regulation, investor-owned utilities enjoy a guaranteed rate of return.

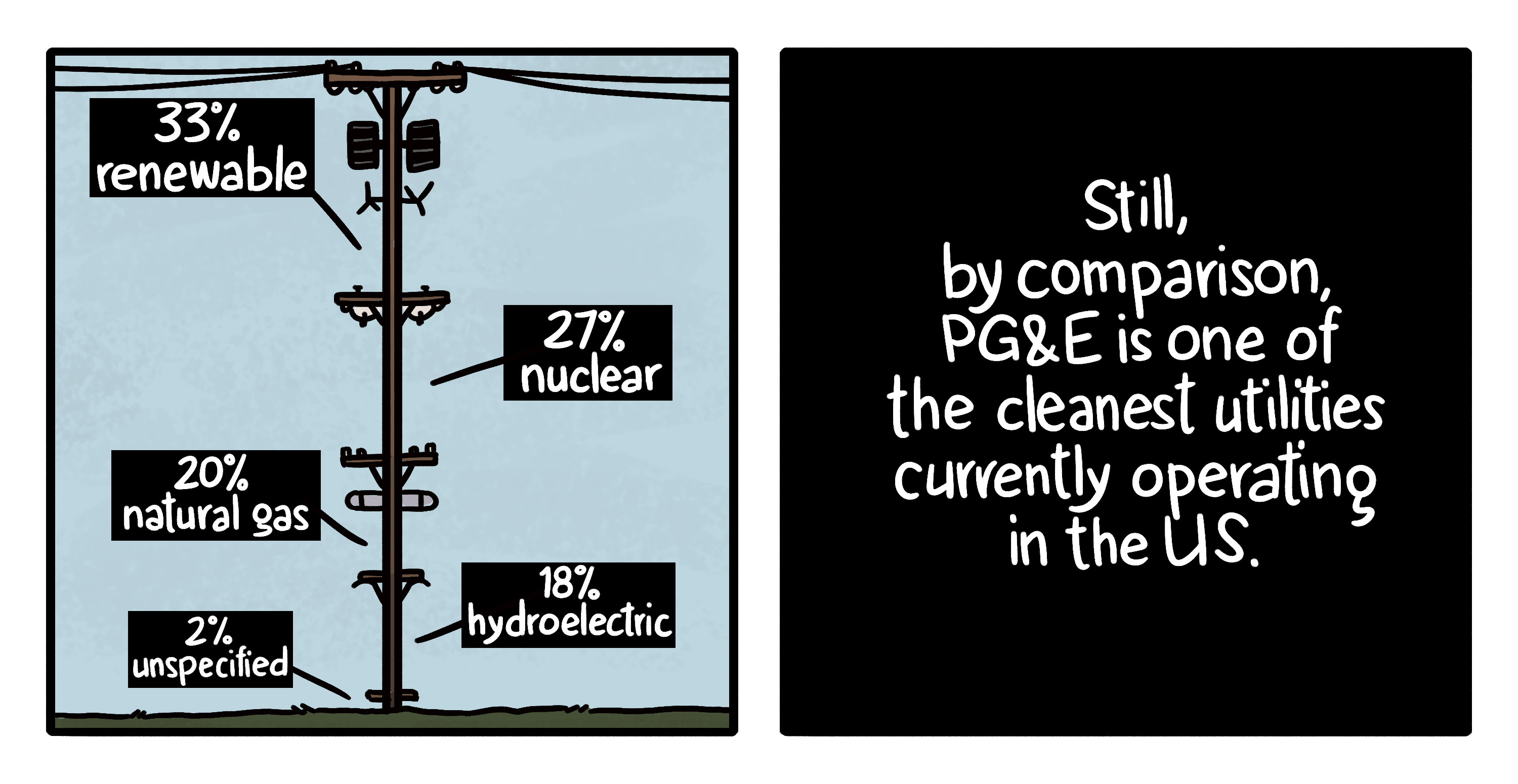

That grand bargain is now more than 100 years old. In some cases, including with PG&E, large service providers have been forward-thinking enough to invest heavily in renewable energy sources. But as for the infrastructure itself, it has not aged well.

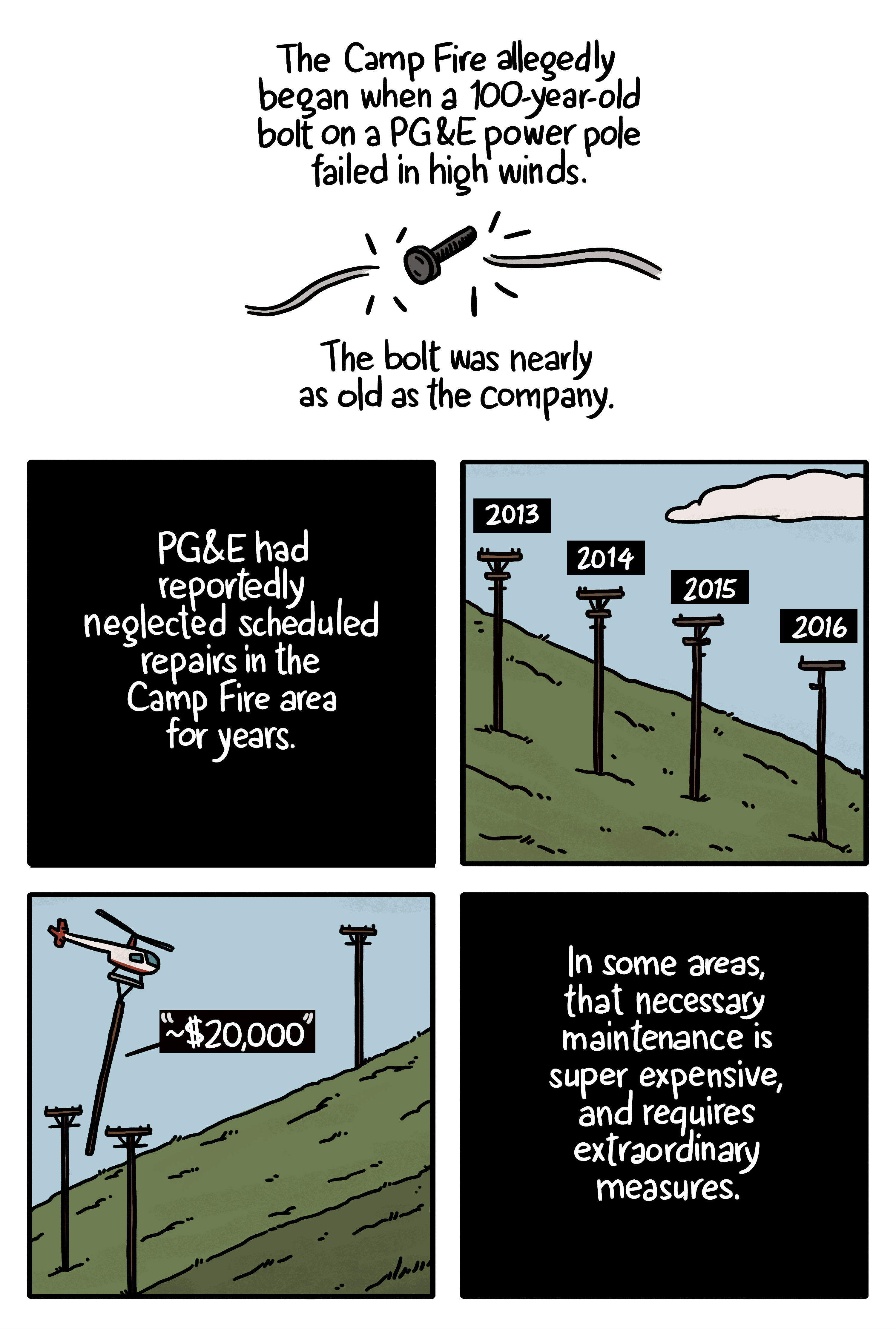

From replacing century-old bolts and wood to trimming the treeline where its lines sag and skim dry branches, PG&E defers necessary maintenance on its system year after year.

But the alternative is effectively untenable.

Utilities are motivated to keep their grid as safe as they can for the price they can afford, according to a risk model that’s been upended by climate change. New fire risks may present a new crisis to power utilities, but so long as they manage their liabilities within the “prudent” buffer, there’s little incentive to change course.

PG&E blames climate change for the uptick in California fires, and they aren’t wrong—but they’ve also been complicit, Stokes says. “These gas and electric utilities are not leaders at all in climate change,” though they may enjoy less notoriety as wild-scale polluters compared to oil producers.

Utilities may invest in renewables on their own grand, centralized scale, but it’s in service to maintaining the same grand bargain and the monopoly that makes such a massive operation profitable. Utility companies are heavily invested in maintaining the status quo, and new consumer-controlled technologies like home solar systems present an existential threat to their market power.

“They have a lot of fixed costs, so they have to spread those fixed costs across fewer customers, and then they have to raise the price—and that means it’s more profitable for the next person to go solar,” says Stokes. “More people go solar and [the utility] controls less of the grid.”

As renewable technology has advanced, large utility companies have had to compete with their own customers in order to maintain dominance, which is why they’ve lobbied states to impose higher and higher fees on solar users, making the savings less attractive, and the spiral less likely.

“Utilities are not really innovative companies. They innovated a sort of centralized electricity system and the distributed model really changes that,” says Stokes. “They haven’t figured out how to profit from it.”

But solar technology has come a long way since utilities first feared the death spiral. When consumers install just panels on their roofs, they’re relying on the existing grid to store the energy they produce. Home batteries that do that storage work as well as manage voltage are what can make a new kind of distributed power grid really work. It’s a different spiral: The more demand for the batteries, the cheaper they get.

Whether utility companies like it or not, the microgrids are coming.

In 2018, California passed a law intended to boost the development of more solar microgrids: the connection of many small household systems that each capture, store, and manage power. But those microgrids are still connected to the big grid.

“In the vision of this there’s still one regulated monopoly that gets a regulated rate of return,” says Brad Heavner, policy director for the California Solar and Storage Association. “We need them to be there.”

Most advocates of resilient microgrids aren’t suggesting the state tear out all the existing transformers and power lines, but make them redundant over time with the installation of these networked little grids. The prospect of a distributed grid is less infrastructure anarchy than making the old monopoly system more environmentally responsible, more efficient, and more resilient.

In the near-ish term, autonomy from corporate utilities is possible on an individual scale; very tricky for a community; and all but impossible for a state of 40 million.

Undertaking such a massive overhaul of utility infrastructure is basically unworkable. Even if new solar-powered microgrids would be safer and more resilient, the system would be prohibitively expensive, and take many years to implement. It’s a dream so unrealistic, it’s essentially off the table.

But the sorry state of PG&E’s grid has created an unlikely opportunity to retrofit the grid, at least in part. The most obvious place to begin building this resilient distributed system is in high fire-risk wildlands areas—not as a primary source of power, but as backup.

After such a devastating stretch of fires, the idea of temporarily shutting down or “de-energizing” the grid is gaining traction. It’s the backbone of PG&E’s 2019 Wildfire Safety Plan, which calls for shutting off the power to parts of more than 30,000 miles of distribution and transmission lines during high fire-risk weather. In a statement, PG&E Electric Operations senior vice president Michael Lewis said, “We know how much our customers rely on electric service. Proactively turning off power is a highly complex issue with significant public safety risks on both sides—all of which need to be carefully considered and addressed.”

PG&E’s plan calls for “Resilience Zones” that could be isolated from the big grid, and provided with mobile generators. In 2019, the company will pilot the first isolated mini grid in the little Napa County town of Angwin. The report continues: “Microgrids also continue to be a point of interest and optionality for both our customers and our internal operations in multiple contexts.” There’s no mention of solar power.

But where PG&E is still hedging, Heavner sees an immediate distributed green grid opportunity: to start, a solar-powered battery for every breathing machine, and in every VFW hall—an independent microgrid that could be grown and linked in fire-risky communities.

It’s what Stanford’s Michael Wara calls “a Green New Deal for California,” but one centered on immediate climate disaster relief as much as future sustainability.

By its nature, the distributed grid would not rely on direct financial investment from existing corporate utilities. It would require enough interested people with the start-up costs and free time, willing and able to set up their own energy systems—because of wanting to avoid inconvenient de-energizing episodes, or just because they want to lower their bills. The bigger problem is for utilities: as investor-owned companies, they’re beholden to shareholders who want to maximize profit, not give business away to microgrids.

“If you can manage the grid using software and customer-owned assets, it creates a much better grid, but it takes away the utility profit motive,” Heavner says.

Conventional economics wisdom says the only way to incentivize utilities to support microgrids that go against their own business interests would be to pay them to do it.

“If you make them neutral whether they build a big clunky centralized thing or rely on distributed resources, then the theory is they won’t resist the distributed resources,” Heavner says. Paying a negligent utility company even more money to make up for their lost profits might help establish microgrids initially, but it may not do much to actually wrench control away from that monopoly.

“I think paying them not to build stuff is not a good long term solution—and even if they’re neutral, they’re going to like a centralized system in general,” says Heavner. “The utility business model and profit motive is all centered around building big infrastructure.”

If the grid is broken, it’s less to do with individual 100-year-old bolts, woodpeckered, weathered power poles, and wire-skimming trees, and more to do with the presupposition of the grid’s monopoly model.

“To become a smaller company—that’s against shareholder interests,” Heavner says. “In my mind it’s fine if the utility of the future is a fraction of the size of the utility today, but to the shareholders that’s bad news.”

Still, functional microgrids presume a functional macrogrid. One that is, presumably, not bankrupt.

A PG&E bankruptcy has worried some green energy advocates, who fear the impact on the company’s existing large renewables contracts, and the solar and wind markets at large. PG&E is a big enough buyer to tip them. When the utility’s credit rating was downgraded, so was Topaz Solar Farm’s, a Berkshire Hathaway solar electricity supplier to PG&E.

“It’s a little more unknown what the impacts would be” to microgrids, Heavner says.

Investors and analysts have said PG&E is worth around $20 billion, and the company still has the cash on hand to keep the state’s lights on—just not enough to cover presumed tens of billions in eventual wildfire liabilities. Or, apparently, to maintain the equipment that allegedly caused those fires. The federal judge overseeing PG&E’s ongoing probation presented a safety proposal for the utility that would see 650,000 workers remove 100 million trees and inspect and repair thousands of miles of line. PG&E claimed the plan would cost $150 billion.

Retrofitting every mile of PG&E’s lines, every rotting pole, every rusting bolt is hardly impossible, but it is decidedly not profitable. And PG&E has already openly acknowledged that it’s not in compliance with existing state safety regulations.

“We’ve been paying these high rates, and they’re again and again found negligent—and they’re not even saying they’re in compliance,” says the Utility Reform Network’s Mindy Spatt. “So what have we paid for?”

Some system failure appears to be the cost of doing business, if that business is to profit.

After the 2017 Tubbs fire in Northern California, which destroyed more than 5,000 structures and killed 22 people, was attributed to a dilapidated power pole not owned by PG&E, the utility’s shares jumped 75 percent in a single day. But it didn’t do anything to deter PG&E from filing for bankruptcy.

In its SEC filing, PG&E claims that the bankruptcy will have no impact on its commitment to “supporting the orderly, fair and expeditious resolution of its liabilities resulting from the 2017 and 2018 wildfires.”

Even without being held responsible for the Tubbs fire, PG&E anticipates paying out upwards of $30 billion for other lawsuits stemming from other fires. Under California law passed in 2018, utilities were able to cover liabilities from 2017 fire lawsuits with state bonds. PG&E is also planning to raise electricity rates sharply in order to make up the extra cash, pending approval by state regulators. Essentially, so long as a company isn’t found to have been outright negligent, it can pass some of the costs of tens of thousands of burnt homes and dozens of people killed on to the rest of the state and ratepayers.

Yet it’s not totally clear what necessarily counts as negligence when it comes to operating a pre- World War I electric utility, and a ruling on that old bolt is still likely years away.

“That’s supposed to be a bottom-line consumer protection, that we shouldn’t pay for the cost of criminally negligent behavior, which is what PG&E has been found guilty of again and again,” Spatt says.

Bankruptcy aside, were PG&E actually held liable for the costs of all those major fires in 2017 and 2018, unable to push costs on to customers with huge bonds or steep rate hikes, its risk model could change. If fixing 100-year old infrastructure ends up being cheaper than paying for the wrongful deaths of dozens of people, PG&E will probably fix its infrastructure.

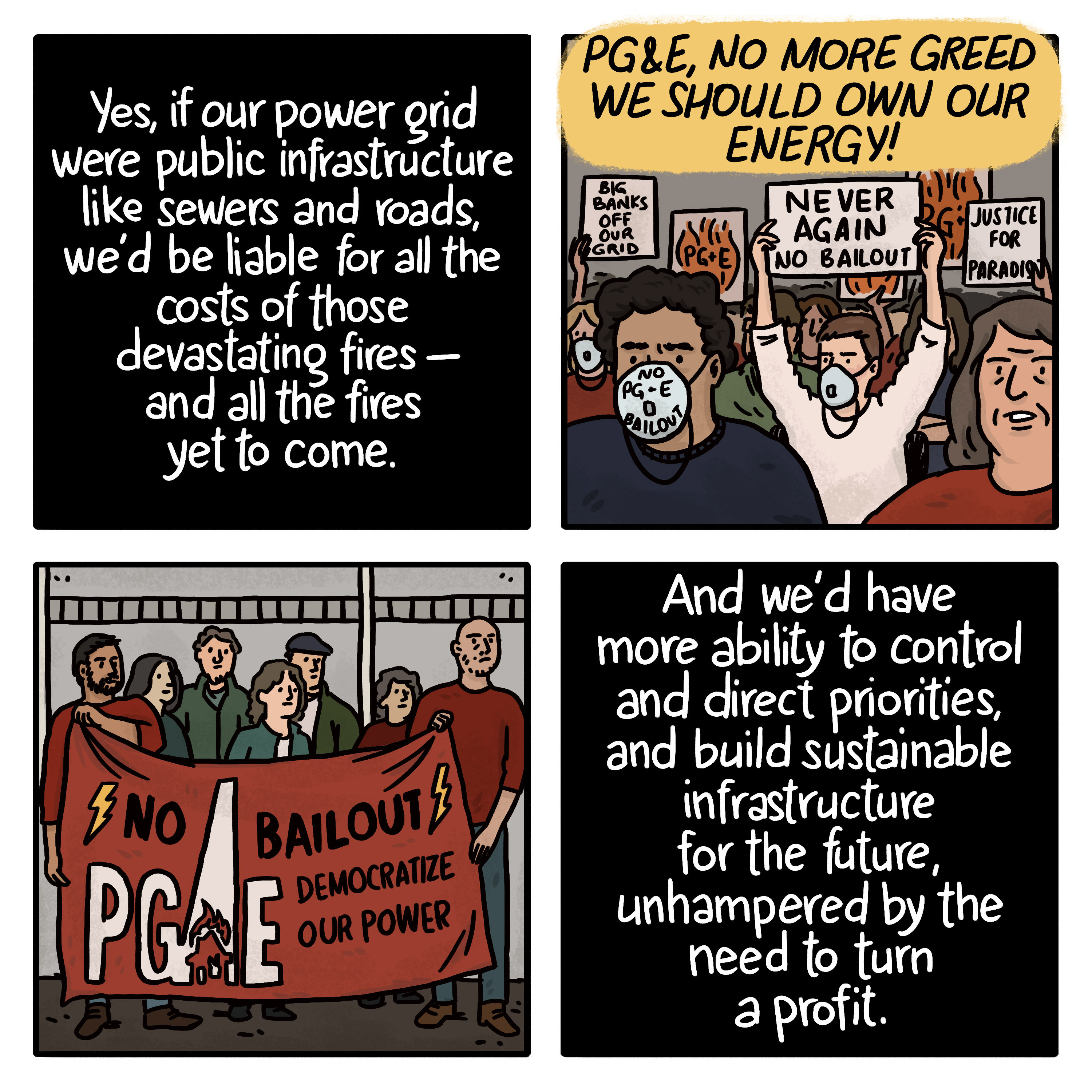

But if bankruptcy is a ploy for a bailout, PG&E is unlikely to have much support from the general public, which is increasingly lobbying for more control over their own power.

While the Democratic Socialists of America are pushing for a total takeover, TURN adopts a comparably more conservative approach. “In theory certainly we absolutely want to see more public control and more accountability,” Spatt says. “But we want to be careful, and we have to be realistic about how fast anything can change.”

A state takeover of PG&E in part or in total would be very expensive—tens of billions of dollars expensive, if the public were to directly pay for all the maintenance the utility has shirked for years, or future liabilities for future horrific fires.

But compared to the other options, all of which are expensive, it would be an investment in the state’s tenuous future. And with that investment, the public could also have the ability to more directly control, regulate, and investigate the utility, as well as invest in cleaner, safer technology.

A new grand bargain.

These fates are interwoven: The more renewable energy, the less pressure on a creaky, aged power grid—and, incrementally, hopefully, the less fuel for climate change, and the mitigated risk of deadly dry and windy weather conditions that push those inevitable wildfires faster and further than ever before.

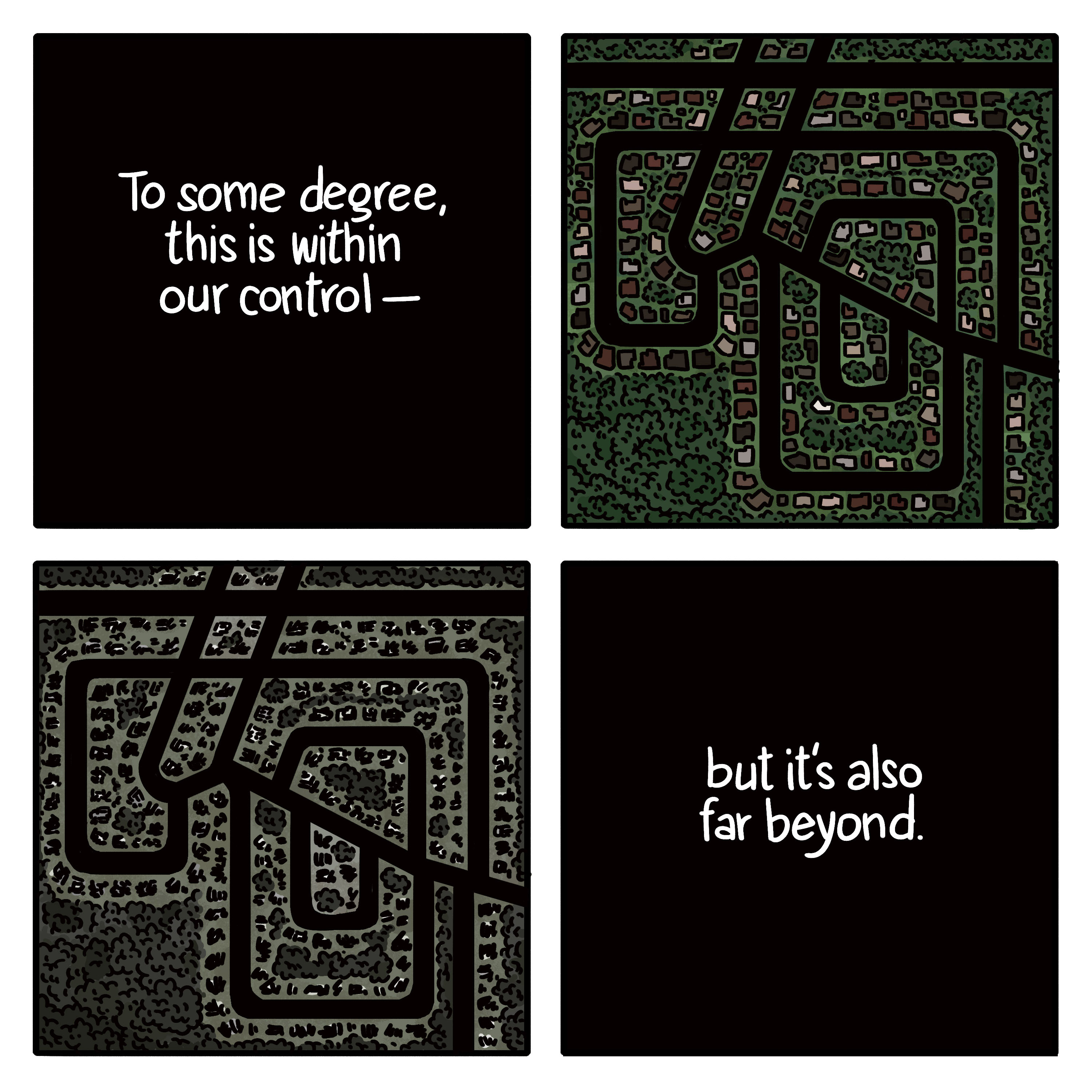

Investing in resilient green energy is a matter of long-term survival for the planet, but one of short-term survival for many Californians. California is at the vanguard of the existential and practical questions posed by climate change, and the modern industrial paradigm that’s helped create it.

With solar panels on every roof and a storage system in every garage, California would still be built in a state prone to long cyclical droughts, with power lines connecting its many dispersed and sprawling communities, strung across parched hilly landscapes that have burned at least since people have lived here. The grid only exists because the people wanted to live here, and the grid was built to serve them across those hills and through those dry valleys. There are limits to retrofitting this—especially as the state continues to grow, building further into the wildlands, where more and more people demand more and more power.

For fire in California, the power grid is just one piece of a terrible puzzle. And no amount of batteries will save a place that keeps rebuilding when it burns down.

This article originally appeared on VICE US.