Challenges with Optimizing Generation Assets in New World with Large Renewable Mix

Credit to Author: Contributed Content| Date: Fri, 21 Apr 2023 17:24:24 +0000

New rules, regulations, and legislation are changing the way U.S. utilities generate electricity. First, there was the Clean Power Plan (CPP), which was passed by the Environmental Protection Agency (EPA) in 2015. This was replaced in 2019 by the EPA’s Affordable Clean Energy (ACE) rule. Both policies aim to reduce and limit carbon dioxide emissions at coal-fired generating units.

Many states have adopted renewable portfolio standards that establish the minimum percentage of a utility’s electricity generation that must come from renewable resources. Plus, to reduce the cost and encourage investment in renewable energy generation, the federal government has included production tax credits for wind resources and investment tax credits for solar resources in recent legislation.

As a result of these policies and incentives, coal units are being retired at an accelerated pace and being replaced by new natural gas units and renewable resources, such as wind, solar, and batteries.

Three Challenges

As more renewable energy power sources are integrated into a utility’s energy mix, there are three challenges that must be overcome. The good news is that there are software solutions available to meet the needs of utilities in this rapidly changing environment.

Capacity Challenges. The first of the three challenges that utilities must address is capacity or resource adequacy requirements. There are significant differences in capacity credits for coal-fired units as compared to renewable resources.

Coal plants have historically been very reliable in terms of providing capacity to serve peak loads. For example, when you own a 100-MW coal unit, you know that the unit will fairly consistently generate about 80–100 MW when it’s needed to serve the annual peak load. Even factoring in maintenance and forced outages, it’s very possible to receive a capacity credit of 80–90%. Gas power plants have performed even better, with capacity credits averaging greater than 90% over the last decade.

Meanwhile, the typical capacity credit for wind resources is only about 15–20%, while the capacity credit for utility-scale solar resources is not much better—averaging about 20–50%. This means that from a reliability viewpoint, you can’t just replace a 100-MW coal-fired plant with a 100-MW solar or wind plant and expect the same reliability level. Keep in mind the difference between power capacity and energy generation. A plant’s capacity credit (in MW) is how much power it’s capable of producing when operating during the peak load of the year.

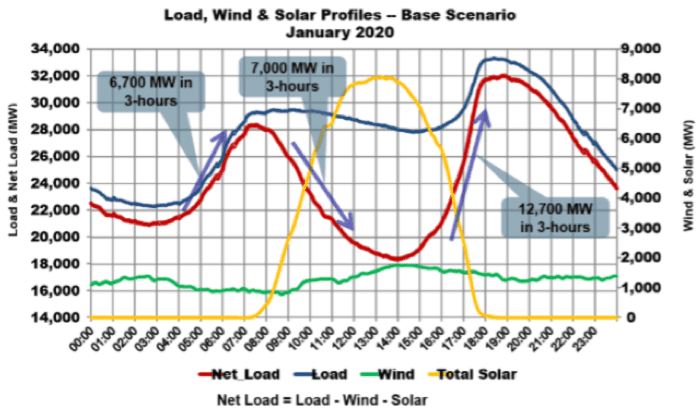

Also, as more wind and solar are installed, the net load curve becomes duck shaped. As you can see in the chart below, there are high net load increases in the early morning, but once solar plants begin to generate electricity, that net load decreases. The net load increases again in the evening when the solar production drops off as the sun sets.

Addressing Capacity Challenges. To address the capacity challenges presented by renewables, utilities must have flexible resources that can help meet demand at peak times. Thermal resources or energy-storage resources with fast ramping capabilities can be utilized to provide these flexible reserves.

It’s also critical that traders employ advanced unit-commitment software tools to manage market operations. Unit-commitment software can help operators optimize the use of their flexible resources to meet net load fluctuations.

Forecasting Challenges. The second challenge presented by the increased penetration of renewable energy resources stems from the inherent intermittency of wind and solar. It’s easily understood that a solar farm won’t generate electricity overnight, nor will a wind turbine be an effective power source on a calm day when the wind does not blow.

But renewables aren’t just on or off. For example, during the day, cloud cover can cut your solar generation significantly. This intermittency makes renewable generation very difficult to forecast.

Addressing Forecasting Challenges. There have been significant advances in machine learning (ML) in recent years. These ML tools can be used to better forecast a utility’s wind and solar schedule for the day-ahead and real-time markets. ML-driven software can evaluate historic weather data, current and predicted wind speed or insolation, and other factors such as planned maintenance outages. The result is more accurate wind and solar forecasts that allow system operators to make data-informed decisions.

ML-powered tools will be critical in the not-so-distant future because there will be more generation assets online than ever before. Remember, more renewable assets will be needed to replace the existing coal capacity. Plus, demand for electricity is likely to increase as the transportation sector and other aspects of life continue down the path to electrification.

The bottom line is that as a greater number of generation assets come online, the amount of data a utility will manage on a day-to-day basis will grow exponentially. Simply put, it will be more data than any human, or humans, could possibly manage. ML software tools, on the other hand, can quickly and efficiently analyze mountains of data, providing decision-makers with the information they need.

Optimization Challenges. The third challenge utilities must address as they integrate new renewable units is also related to intermittency. We know that wind energy is typically generated at night, because that’s when the wind is blowing. But the overnight hours also have less demand for electricity. Likewise, a solar resource may actually generate more energy than is needed during its peak hours. Clearly, curtailing those resources is inefficient and not cost-effective. That’s why utilities are turning to energy storage resources (ESRs), such as batteries.

ESRs store excess energy so it can be discharged when needed to support consumer demand. They allow the utility to supply ancillary services (Regulation, Spin, Ramp) and use the energy when it’s needed, not when it’s generated. In this way, the storage system becomes yet another distributed energy asset to be managed and optimized along with the utility’s generation assets, renewable or otherwise.

Addressing Optimization Challenges. Here again, ML tools can be employed to ensure the optimization of all energy resources, including storage. In addition to looking at weather data, ML can be used to forecast important variables, such as day-ahead and real-time market prices, providing decision-makers with the information they need to optimize the operation of ESRs to maximize market benefits.

A Note on Settlements & Reporting

Our discussion of optimizing generation assets would be incomplete if we didn’t take a moment to talk about settlements. Validating settlements is critical in the new world of market operations.

There are three types of invoices to validate: market-settlement invoices, transmission-settlement invoices, and contract-settlement invoices. Each invoice may have 50–100 charge codes with 500–1,000 billing determinants. Validating these invoices is essential before closing the book at the end of each month and sending key financial data to the general ledger.

Due to the large volume of data, market participants like to store their data—both front-office as well as back-office data—in datamarts and use business-intelligence tools, such as PowerBI, Tableau, and other programs, to build custom reports. Contact PCI Energy Solutions to learn more about how their AI-powered software tools can help utilities manage forecasting, optimization, and settlements tasks.

—Khai Le, PE is senior vice president of PCI Energy Solutions. He specializes in market-based operations, portfolio optimization, bidding strategies, transaction evaluation, and shadow settlement. For more than 40 years, Khai has worked closely with major utilities throughout North and South America, Europe, and Asia to implement software tools for automated bid management, bid evaluation, shadow settlement, unit commitment, post analysis, transaction management, and risk evaluation.

The post Challenges with Optimizing Generation Assets in New World with Large Renewable Mix appeared first on POWER Magazine.