Western Energy Imbalance Market Gains Three Participants, Including First Generation-Only Entity

Credit to Author: Sonal Patel| Date: Thu, 06 Apr 2023 17:05:59 +0000

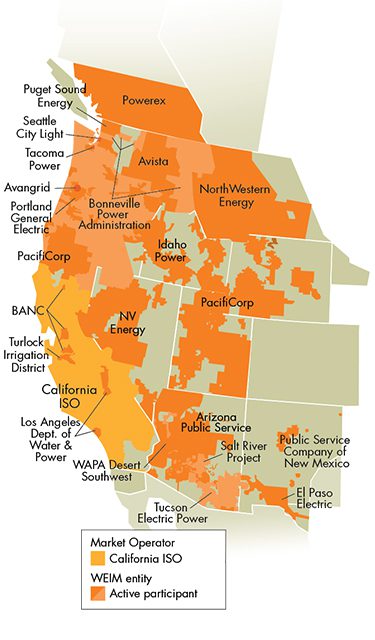

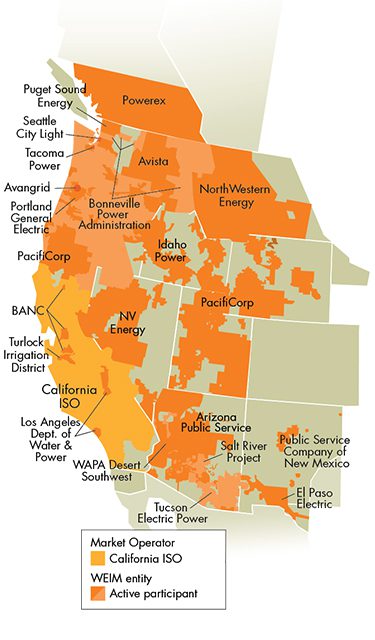

The Western Energy Imbalance Market (WEIM), a real-time energy market operated by the California Independent System Operator (CAISO), has gained three new participants, including its first generation-only entity.

CAISO on April 5 announced the Western Area Power Administration (WAPA) Desert Southwest region, El Paso Electric (EPE), and AVANGRID have formally begun participation in the WEIM. WEIM’s 22 active participants, which now span 11 Western states, represent “nearly 80% of the demand for electricity in the Western interconnection,” CAISO said.

The WEIM, an energy-only market established in 2014 by CAISO and PacifiCorp, allows participants that are not transmission owners in the CAISO grid to sell energy in real-time—on a 15-minute and 5-minute basis—to balance their supply and demand.

The market’s platform is designed to resolve grid stress within the Western Interconnection by enabling energy transfers, essentially giving participants—which span across multiple Western states—access to a larger pool of diverse resources. Participants, however, determine how transmission and generation resources engage in the market, allowing them to control their assets and maintain their own compliance responsibilities.

“The WEIM is designed to enable participants to buy and sell power close to the time electricity is consumed. With state-of-the-art technology, the market finds and delivers lowest-cost resources to meet immediate power needs and manages congestion on transmission lines to maintain grid reliability,” CAISO explains.

Expanded Resource Diversity

The market’s newest participants add more crucial resource diversity, CAISO suggested. “WAPA Desert Southwest provides federal hydroelectric power and transmission services to 70 municipalities, cooperatives, Native American tribes, federal and state agencies, and irrigation districts,” while EPE is a “regional energy provider engaged in generation, transmission, and distribution that serves more than 460,000 customers in west Texas and southern New Mexico,” it noted.

AVANGRID, an Iberdrola company that has a 2-GW portfolio of renewable generating resources in 11 Western states, is WEIM’s first generation-only entity. The company lauded the milestone in a statement on Wednesday, highlighting benefits for regional energy costs. “Regional coordination in generating and delivering the lowest-cost energy to participants enhances reliability while providing environmental benefits by integrating renewable energy into the grid more efficiently,” it said.

According to CAISO, the WEIM has already shown tangible benefits for participants through its growing volume of economical transfers. “In 2022, the WEIM accumulated $1 billion in benefits, increasing the cumulative amount to more than $3.4 billion, in part due to more participants in the real-time market,” the grid operator said.

CAISO Readying to Launch Extended Day-Ahead Market for WEIM

CAISO, which manages a grid that serves about 80% of California and a small part of Nevada, is meanwhile working toward the launch of an extended day-ahead market (EDAM), an initiative that was jointly approved in February by CAISO’s Board of Governors and the WEIM Governing Body.

CAISO already operates a day-ahead market, a wholesale market for energy and ancillary services that, similar to a commodity market, enables transactions a day in advance to ensure the system operator has adequate resources available in real time. The EDAM will essentially extend CAISO’s day-ahead market to WEIM entities.

The EDAM design “allows for the optimized commitment of resources and use of transmission capability across a larger footprint to effectively and efficiently position resources to meet next-day demand,” noted Anna McKenna, CAISO vice president of Market Policy and Performance in a January memorandum. It will provide “the opportunity for existing WEIM entities to voluntarily extend their participation to the EDAM, building upon the established relationship with the ISO, while continuing to retain their resource planning, transmission service and planning, and reliability functions through their respective processes and Open Access Transmission Tariffs (OATTs).”

A big benefit of the approach is that “it will provide access to a diverse pool of resources and increase visibility into the supply conditions across the market footprint in the day-ahead timeframe,” McKenna added. “The design further maximizes the optimal utilization of transmission capability within and between participating balancing areas to derive benefits of energy transfers across the footprint, while providing assurance that the transfer of energy may be relied on to serve load. This enables the market to optimize available supply and transmission through economic solutions to anticipated system conditions in the day ahead of the operating day, reducing the frequency of real-time emergency declarations under stressed system conditions.”

The design will also support greenhouse gas emissions accounting and reporting obligations associated with the transfer of energy across the region, “thereby facilitating participants’ compliance with regulations that may be implemented in different states across the region,” she wrote.

CAISO is now working to “develop tariff language” through stakeholder engagement. The grid operator said it will spend this year and “part of 2024 focusing on implementation activities.” So far, one utility, PacifiCorp, has announced its intent to join EDAM when it launches. “The ISO will continue to engage other utilities with potential interest in participating in the market and incorporate valuable input from stakeholders across the West,” CAISO said.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).

The post Western Energy Imbalance Market Gains Three Participants, Including First Generation-Only Entity appeared first on POWER Magazine.