Startups Are Shaking Up Geothermal Power’s Prospects

Credit to Author: Sonal Patel| Date: Mon, 03 Apr 2023 04:13:00 +0000

Driven by ripe market conditions, technology startups are injecting investment and innovation into geothermal power to unlock novel applications that could substantially scale up the niche renewable power subsector.

While this year’s CERAWeek by S&P Global—an annual energy conference hosted in Houston, Texas—once again heavily focused on energy innovation solutions that span the entire energy ecosystem, U.S. Energy Secretary Jennifer Granholm in a standout moment enthusiastically extolled one: geothermal energy.

“Geothermal is hot!” she declared at a fireside chat that followed her keynote speech. Queried about her optimism, the energy secretary touted the multiple benefits of harvesting the energy source stored in the Earth’s crust. “The heat beneath our feet is 24/7/365,” she said. “Depending on how far down you go … you can power the entire world over with being able to pull up heat from beneath our feet.”

Making the prospect a reality presents a lucrative opportunity to leverage oil and gas (O&G) expertise, providing an avenue for that sector to participate in sustainable development and climate action, she said. And if successful, it could expand a much-needed portfolio of carbon-free power and heat, and foster cross-industry synergies, she suggested.

|

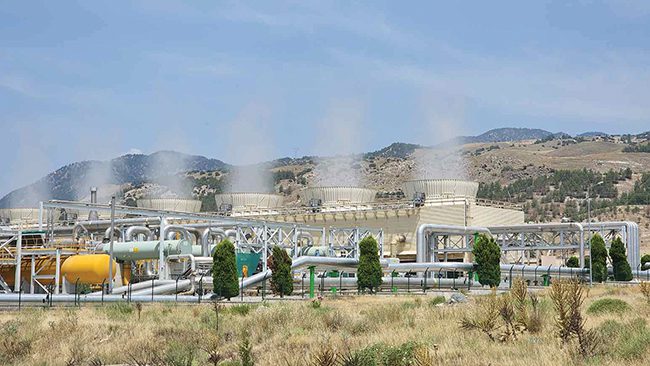

1. The International Renewable Energy Agency (IRENA) estimated that 15.96 GW of geothermal power capacity was installed worldwide at the end of 2021. The red zones on this map indicate high-temperature geothermal zones, while the black symbols indicate geothermal power plants. Courtesy: IRENA |

Granholm’s declaration is notable given geothermal’s relatively undeveloped potential. Today, worldwide, the technical potential of hydrothermal geothermal resources is estimated to be about 200 GWe and more than 5,000 GWth. But according to the International Renewable Energy Agency (IRENA), the global installed capacity for geothermal power generation worldwide was 15.96 GW at the end of 2021 (Figure 1). The number represented 0.5% of the global renewable power market in 2022, epitomizing what many experts consider a “niche” status in the power generation space.

And while many countries have set geothermal targets, growth in the market has been historically hindered by a long list of hurdles. These include challenges associated with siting, higher-risk early exploration phases, public resistance, financing, regulations, market competition, and technological limitations.

Ripe Conditions for Geothermal

However, owing to a significant shift in drivers, that may be poised to change. The biggest driver, perhaps, is decarbonization. Climate change politics and policies—charged by developing and implementing nationally determined contributions—have long facilitated the development of renewable energy projects. While geothermal has historically thrived owing to its unique renewable baseload capabilities, its value proposition has since expanded to include flexible operation and sustainable heating and cooling.

That’s essential, given that heating and cooling represent almost half of the total energy use globally, and most are derived from fossil fuel combustion, noted Ann Robertson-Tait, president of GeothermEx, a consultancy that has worked exclusively in the geothermal sector for the past 50 years. “We have to think differently now. We have to think more universally,” she told POWER. “The decarbonization options for heat are immense in geothermal,” she said.

Energy security is also a growing consideration. While geothermal energy has been in commercial use for more than a century, geothermal’s first boom was spurred in the 1970s and 1980s, partly due to the era’s oil crises. Installed geothermal power capacity has increased at an average annual rate of about 3%, driven chiefly by countries looking to diversify their energy resources, like Indonesia, Kenya, Türkiye, and the U.S., IRENA noted.

The agency predicted that uncertainty of energy supply in 2022, exacerbated by the Russia-Ukraine conflict, has “resulted in increased interest in accelerating development of geothermal resources as a strategic energy source.” It noted the global energy market context is similar to what it was during earlier energy crises. In addition, it said that countries are exploring “an array of fiscal and economic incentives” that could facilitate project financing and reduce project risks. These include tax incentives, feed-in tariffs, and direct subsidies.

Technology Innovation Ramping Up Geothermal’s Game

Finally, technology advancements are opening up new prospects and applications, potentially boring new pathways for the niche sector within changing energy markets.

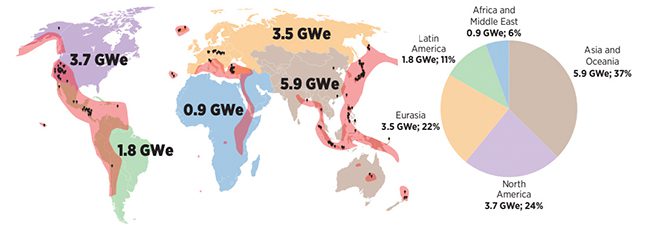

At existing geothermal power plants, innovation is boosting efficiency improvements (Figure 2) and furnishing plants with viable dispatchability, such as at the Organic Rankine Cycle Puna Geothermal Venture plant in Hawaii. And while many operational geothermal power plants today are dry-steam plants or flash plants, harnessing temperatures higher than 180C, medium-temperature fields utilizing binary cycle technology are increasingly used for power generation or combined heat and power.

|

2. Pilot installation of an SLB REDA Thermal power-efficient geothermal electric submersible pump (ESP) at Zorlu Enerji’s high-enthalpy well field resulted in a net increase of 1.7 MW in geothermal power supplied to the Turkish grid. Zorlu Enerji has requested 14 additional ESP units for wells at its Kizildere Field, along with digital services for ESP monitoring and surveillance. Courtesy: SLB |

Meanwhile, more novel technologies on the horizon could allow for geothermal energy production from deeper geothermal resources include enhanced geothermal systems (EGS), advanced geothermal systems (AGS), and supercritical geothermal systems. Geothermal startup Fervo Energy, a company participating in the U.S. government’s EGS laboratory in Utah, plans to build, own, and operate power plants that will source energy from hot rock reservoirs using existing innovations, such as horizontal drilling and distributed fiberoptic sensing.

Canadian firm Eavor Technologies, meanwhile, is demonstrating a 2019-built full-scale prototype of its innovative Eavor-Loop technology in Alberta, Canada. The Derek Riddell Eavor-Lite Demonstration Facility connects two vertical wells with many horizontal multilateral wellbores creating a closed-sealed radiator-like system. Eavor, notably, is also building its first 8.2-MWe commercial implementation of an Eavor-Loop in Bavaria south of Munich near Geretsried, Germany.

In March, another startup, California-based GreenFire Energy, announced it would provide its AGS closed-loop technology to run a geothermal test using a test well at Baker Hughes’ Energy Innovation Center in Oklahoma City, Oklahoma. “The project will create the first of its kind closed-loop geothermal laboratory in the world. GreenFire Energy and strategic partner, Vallourec, will provide in-kind materials and labor for construction, testing, and piloting,” the company noted.

Leveraging Oil and Gas Expertise

Another significant emerging driver for geothermal, meanwhile, is its backing by the oil and gas sector. Many startups entering the geothermal space are notably bolstered by O&G investments or have leadership teams comprising lifelong O&G industry veterans. That’s because geothermal relies on some of the same technologies used in the O&G industry, including drilling and well completion technologies, and underground resource assessment technologies, experts suggest. EGS, for example, was developed using technologies that expanded U.S. shale oil and natural gas production, including directional drilling, hydraulic fracturing (fracking), and reservoir stimulation and management tools.

Among startups leveraging O&G expertise to advance geothermal is Quaise. The Boston-headquartered firm is developing “millimeter wave” drilling systems that have the potential to drill down to temperatures of 500C and depths of 20 kilometers (km) “to greatly increase the performance and geographical reach of geothermal energy,” it said. The company plans to develop a first-of-its-kind “100 MW+ geothermal field by 2026 and to repower a full coal-fired thermal power plant by 2028,” it said.

Another company, Houston-based Sage, is working to optimize power generated from geothermal systems using GeoTwin, a tool based on “decades of experience modeling subsurface fluids and processes in the drilling of oil and gas wells.” The company targets lower temperatures of 100C to 250C at depths of 3 km to 6 km worldwide. Sage is notably also exploring a supercritical carbon dioxide turbine to double the efficiency of converting heat to power. And along with its proprietary single-well ESG design, the company is working on two forms of geothermal energy storage—pressure storage and geothermal storage—deep in the earth.

New Applications on the Horizon

Meanwhile, several startups are exploring new geothermal energy applications, such as recovering minerals from geothermal brines, increasing synergies with hydrogen production, improving the efficiency of electricity production from medium-temperature geothermal resources, hybrid configurations, and carbon capture.

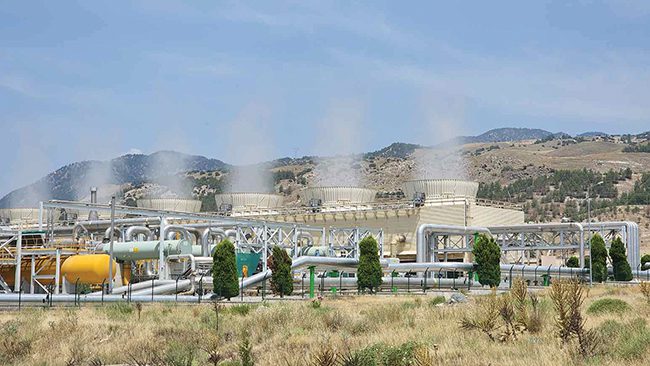

These prospects extend geothermal’s usability and could potentially give it more market clout (Figure 3), noted Amanda Kolker, geothermal laboratory program manager at the National Renewable Energy Laboratory (NREL). “Geothermal is a triple resource: an energy source for heating, cooling, and power; a storage resource; and a mineral resource,” she said. “The Earth itself has the potential to address a variety of hurdles in the transition to a clean energy future.”

Geothermal hydrogen production has so far been pioneered in Taupo, New Zealand, by Halcyon Power, a 50/50 joint venture between New Zealand’s Tuaropaki Trust and the Japanese firm Obayashi Corp. Halcyon’s project began production in December 2021 and uses geothermal power to produce about 180 tonnes of hydrogen annually.

Meanwhile, in 2021, startup Geo40 commissioned the world’s first sustainable large-scale commercial silica recovery plant from geothermal brine at the 110-MWe Ohaaki electric power station also located in the Taupo Volcanic Zone of New Zealand. That project can produce 5,000 tons per year of colloidal silica. The achievement is notable because “Colloidal silica has traditionally been manufactured in a very carbon-intensive fashion, which required quartz-rich sand to be melted in a blast furnace at very high temperatures,” the company said. “Geo40 extracts its silica directly from solution downstream of the power station, without the need to disturb the surface with mining. The depleted solution is then re-injected back into the hydrothermal aquifer, helping to maintain its water balance.”

Meanwhile, several companies are also developing lithium extraction facilities. Vulcan Energy Resources, developer of the Zero Carbon Lithium project, says it intends to produce a “battery-quality” lithium hydroxide chemical product from its combined geothermal energy and lithium resource in Germany—Europe’s largest lithium resource. In January, Vulcan signed a binding term sheet for a multiphase project with Dutch automaker Stellantis to develop new geothermal projects aimed at decarbonizing the energy mix of Stellantis’ Rüsselsheim industrial site in Germany.

Finally, geothermal developers venturing into carbon capture include Fervo Energy. In February, the company announced that it would design and engineer a fully integrated geothermal and direct air capture (DAC) facility with support from the Chan Zuckerberg Initiative (CZI). “Geothermal can deliver the carbon-free power and heat needed to make DAC a viable means for removing carbon dioxide from the atmosphere,” noted Tim Latimer, CEO of Fervo.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).

The post Startups Are Shaking Up Geothermal Power’s Prospects appeared first on POWER Magazine.