Entergy, RWE Partner to Assess Offshore Wind Prospects in Gulf of Mexico

Credit to Author: Sonal Patel| Date: Thu, 30 Mar 2023 19:09:11 +0000

U.S. utility Entergy and global power giant RWE are partnering to jointly assess the best means to develop an offshore wind market in the Gulf of Mexico.

The two companies on March 30 unveiled a memorandum of understanding (MoU) under which they will analyze the Gulf of Mexico offshore wind market and define an optimal route-to-market. RWE and Entergy said the analyses will include “resource economics, transmission analysis to ensure reliability; economic impacts extending to direct and indirect job creation; and curricula to prepare the workforce of the future.”

The MoU comes on the heels of the U.S. Department of Interior’s (DOI’s) first-ever proposed offshore wind lease sale in the Gulf of Mexico. The proposed sale notice, issued on Feb. 22, identifies a 102,480-acre area offshore Lake Charles, Louisiana, and two areas offshore Galveston, Texas, one comprising 102,480 acres and the other comprising 96,786 acres.

The announcement comes the same day that Hitachi Energy was chosen to provide infrastructure to support offshore wind in Europe as part of a $14 billion deal with transmission system operator TenneT.

An ‘Important Early Step’

According to Entergy and RWE, the Gulf of Mexico effort serves as “an important early step” to potentially bring wind power to industrial customers in Texas and Louisiana. For Entergy, which serves a four-state territory that comprises a sizable industrial hub, the prospect opens up new pathways to expand its existing renewable resources.

The company noted it has plans for as much as 17 GW of renewable capacity by the end of 2031. “Entergy Texas is perfectly positioned to explore offshore wind development as Texas already leads the nation in electricity generated by wind energy,” noted Eliecer Viamontes, Entergy Texas president and CEO, on Thursday.

“The state and our service area are growing at a rapid rate and this partnership with RWE will play a key role in evaluating a broader slate of clean resources that will sustain our robust pace of industrial growth and economic development in the decades to come,” he said.

RWE, meanwhile, has already developed 8 GW of renewable capacity within the U.S., and it has substantial investments in offshore wind activities in Europe. The company is now eyeing the U.S. offshore wind market, which it suggested is “rapidly growing.” RWE, notably, has already secured sites in federal offshore wind lease auctions for sites in the New York Bight and California. “RWE has secured sites with the potential to host a total of about 3.9 GW (pro rata RWE) installed capacity in offshore wind,” the company noted on Thursday.

“The Gulf of Mexico is next on the Bureau of Ocean Energy Management’s offshore wind lease auction schedule with three lease areas proposed under the Pre-Sale Notice,” it added. “The region has gained momentum following Louisiana Governor John Bel Edwards’ Climate Action Plan, which includes a goal of 5 GW of offshore wind power by 2035.”

RWE said it is already active in a program to accelerate the engagement of Louisiana’s supply chain to identify companies with transferable capabilities for offshore wind. Results from the supply chain collaboration are expected to be released industrywide later this year, the company said.

DOE Takes a Closer Look at Offshore Wind Challenges in New Strategy

The MoU also notably follows the Department of Energy’s (DOE’s) March 29 launch of a comprehensive offshore wind strategy to accelerate the deployment of offshore wind in the U.S. The effort largely caters to the Biden administration’s goal to deploy 30 GW of offshore wind energy by 2030 (and more than 110 GW by 2050), as well as goals to deploy 15 GW of floating offshore wind by 2035.

The DOE’s newly unveiled strategy seeks to reduce the cost of fixed-bottom offshore wind from $73/MWh in 2021 to $51/MWh by 2030. It also seeks to achieve the Biden administration’s Floating Offshore Wind Shot goal of reducing the cost of floating offshore wind energy in deep waters to $45/MWh by 2035.

Finally, it encourages industrywide connection to coordinate planning for a transmission system that will integrate offshore wind, and it promotes new revenue opportunities for offshore wind power, such as energy storage, wind-to-x technologies, and offshore wind energy hubs.

Compared to the Biden administration’s nationwide strategy for offshore wind rolled out in January 2022, this strategy is more focused, the DOE said. “This strategy document outlines DOE’s contributions to meeting the challenges indicated in the nationwide strategy, including the need to reduce the levelized cost of energy; expand predictable leasing and permitting processes; develop the domestic supply chain; and expand transmission,” the agency added. “DOE’s efforts form a part of a broader all-of-government approach to advancing offshore wind energy and strengthening the U.S. transmission grid as part of our nation’s clean energy future.”

The agency said a comprehensive, nationwide strategy will be imperative as more states include offshore wind in their policies. So far, states have established nearly 74 GW of offshore wind procurement targets, suggests industry trade group American Clean Power (ACP). “Developers plan to bring over 11,000 MW of offshore wind online by 2026 by developing 13 offshore wind projects,” it noted.

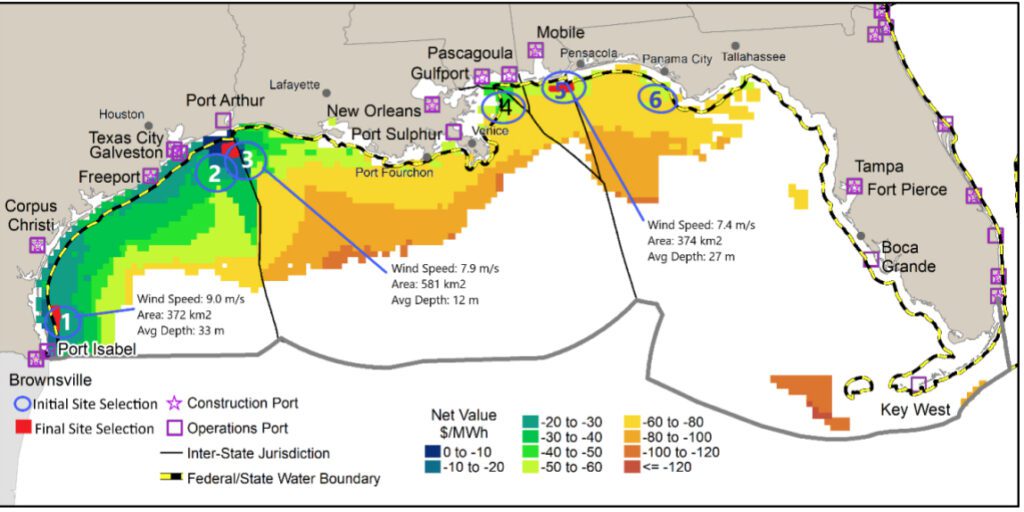

NREL: Gulf of Mexico Offers Unique Challenges, Benefits for Offshore Wind

The strategy notes that offshore wind has a technical resource potential of more than 4,200 GW. In a March 2021 paper, the National Renewable Energy Laboratory (NREL) noted that most offshore wind power will likely be sited in five main regions: the North Atlantic, the South Atlantic, the Gulf Coast, the Great Lakes, and the Pacific Coast. The Gulf of Mexico may have a technical offshore wind resource capacity of 508 GW and an energy-generating potential of 1,556 TWh per year, the paper suggests.

All regions, however, will face unique challenges, NREL predicted. “The commercial offshore wind industry has emerged over the past few years in the North Sea and Baltic Sea where predictable high winds, strong soils, and shallow waters prevail. In the U.S. North Atlantic, where the industry is now establishing itself, there are similar conditions,” it said. However, “In [the Gulf of Mexico], offshore wind will encounter unique conditions that present technology challenges such as hurricane exposure, lower winds, and softer soils,” it said.

“Although some of these challenges are significant, they will generally require an adaptation of the existing technology to survive the load conditions and demonstrate cost competitiveness in the regional electric market,” NREL said.

For example, turbines designed for the Gulf of Mexico will need to address risks caused by hurricanes, and, at the same time, address the lower wind speed regime. “Turbines that minimize project cost by balancing higher energy production and increased hurricane load resistance may have unique design features not found in the current fleet of turbines,” it said.

Solutions may include adding features that include lower rotor solidity by increasing blade tip speed, low-solidity two-bladed rotors, highly ruggedized wind speed and yaw sensors to allow for continued operability under extreme conditions, active advanced load mitigation control systems, uninterruptible yaw power positioning, and downwind rotors, the paper suggests.

But if accomplished and the Gulf of Mexico offshore wind market thrives, technology advancements could accelerate the development of hurricane-resilient turbines. That would be fruitful for “hurricane-prone markets such as the U.S. South Atlantic, southeast Asia, India, and Hawaii,” NREL noted.

The Gulf of Mexico, however, also poses several technical advantages that could help offshore wind compete, the paper notes. These include “better turbine accessibility, shallow water, lower labor cost, and direct access to the existing industrial supply chains of the oil and gas industry.”

Lower average wave heights could allow “construction and service vessels greater access and longer windows to perform installation and maintenance activities, resulting in lower capital cost as well as operation and maintenance costs for the project,” it adds. Finally, the region may offer an expanded seasonal operations profile compared to the northeastern U.S., where many marine operations shut down during winter months.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine).

The post Entergy, RWE Partner to Assess Offshore Wind Prospects in Gulf of Mexico appeared first on POWER Magazine.