A Complex Landscape for the Future of Combined Heat and Power

Credit to Author: Sonal Patel| Date: Wed, 01 Mar 2023 05:18:00 +0000

Few power-generating resources present the combination of workhouse abilities that combined heat and power (CHP) does. But, powered predominantly by fossil fuels, will CHP find its unique footing within the energy transition?

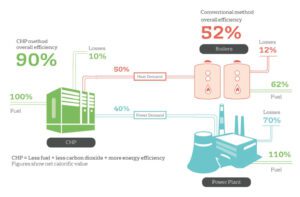

Considering all its hefty attributes, combined heat and power (CHP) should thrive as the world races to transition to an energy system characterized by more efficiency and lower emissions. The energy resource, sometimes referred to as “cogeneration,” is a long-proven multitasker, generating on-site power and useful thermal energy using different technologies and various fuels. Its production of two forms of energy is highly efficient—at least when evaluated against comparable separate heat and power sources. Some systems can achieve total system efficiencies of more than 80%.

CHP can vary in size, satisfying distributed or captive energy requirements for a variety of end-users, providing heat and power to hospitals, schools, university campuses, hotels, nursing homes, office buildings, and apartment complexes, as well as for larger district energy systems, microgrids, factories and other industry, and even utilities. And perhaps uniquely for a distributed resource, CHP is resilient and can provide crucial reliability: Capable of producing heat and power 24 hours a day, it can be designed to operate independently from the grid or implemented with black-start capability to provide a reliable, cost-effective alternative to installing backup generators.

Owing to these attributes, the technology has enjoyed an expansion worldwide, surging 30% between 2009 and 2019. According to global industry group COGEN World Coalition (CWC), the annual output of CHP systems in 2019 amounted to 11,200 TWh of heat and 4,159 TWh of electricity, representing just over 15% of total electricity generation. But that share “has wobbled around,” varying by region (see sidebar, “How CHP Is Evolving Around the World”), and overall, it has diminished amid increasing demand, noted Simon Minett, managing director for Challoch Energy and a CHP expert.

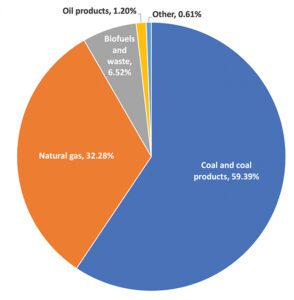

How CHP Is Evolving Around the WorldAccording to the COGEN World Coalition (CWC), which represents major players in combined heat and power (CHP), the world’s most developed markets for CHP technologies are centered in Asia-Pacific, Europe, and the Americas, and to a smaller extent, in Africa and Australia. Each region has its own characteristics in terms of CHP capacity, market sector focus, and fuel use (Figure 1), Simon Minett, managing director of research and analysis consultancy firm Challoch Energy, said in November.

While Europe currently produces 700 TWh of CHP power—mostly from steam turbines and combined cycles gas turbines—its share of CHP within the total electricity mix of 20% has fallen, owing in part to the energy price crisis. “There’s not much growth in that market. It’s a mature market, and Europe is focusing on a lot of renewables and electrification, so we can see some pressure on cogeneration there. It has a decent role to play, but it’s an active policy debate,” Minett said. Europe’s CHP plants, led by Germany, are mostly powered by natural gas, followed by renewable sources like biofuels and biomass. However, coal still makes up a large share of Eastern Europe’s CHP production. North America’s CHP market produces about 330 TWh, representing about 6.8% of the total electricity mix. This share has also fallen, even though the market has mostly “remained flat over the last decade,” Minett said. Natural gas is CHP’s dominant fuel in both the U.S. and especially Canada, though fuel mixes vary by region. Central and South American CHP markets, which are much smaller, producing 87 TWh, rely 70% on biofuels, including biomass, biogas, and waste. Brazil makes up to 90% of the region’s total CHP capacity, he noted. The world’s largest CHP market by far is in the Asia-Pacific region, producing nearly 3,000 TWh—a substantial portion of CHP’s global total of 4,000 TWh. “It’s seen steady growth in terms of heat output,” but 68% of that market is dominated by China, which produces “almost all” its CHP energy from coal, mainly for district heating, said Minett. In total, the regional market relies on coal for 75% of its CHP production and 25% from natural gas. |

Future growth of CHP at the same rate over the next decade, meanwhile, appears less certain, owing mainly to CHP’s heavy use of fossil fuel. “The big thing we’re seeing in the market is decarbonization,” noted David Jones, manager of Energy Markets for Virginia-based global consulting and technology services company ICF. “Everybody’s talking about what role CHP will play.” The pervading concern is that while CHP currently reduces emissions compared to separate heat and power, as regional power grids go green, “CHP may not be able to reduce emissions anymore at some point,” he said. “At that point, they [will need to] incorporate renewable natural gas [RNG] or hydrogen to continue reducing carbon emissions.”

Trends: Smaller Installations That Cater to Resiliency, Reliability

Jones, who is part of ICF’s efforts to maintain a 2002-initiated Department of Energy (DOE) database that logs CHP installations in the U.S., noted these concerns overarch several recent trends in the CHP market. The most significant shift, he said, is that CHP is moving away from traditional installations, which were custom-engineered site-specific systems at industrial or institutional facilities. Following a CHP boom in the late 1990s, manufacturers and developers began offering standardized, factory-built and ready-to-install packaged CHP systems, prompting a market shift that integrated smaller commercial and residential markets.

In the U.S., the shift has been bolstered by the DOE’s publicly available CHP catalog, which enabled interested parties to compare “different systems that have been installed—standard systems, with standard inputs and outputs,” Jones noted. Bolstered with inclusive contracts, the packages shorten CHP system procurement, simplify installation, and alleviate maintenance concerns—attributes attractive to smaller, non-traditional end-users like multi-family buildings and smaller commercial, institutional facilities, and manufacturing outfits, he said.

|

2. Public power generator Korea East-West Power’s (EWP’s) 4.2-MW CHP plant featuring Bloom Energy solid oxide fuel cells (SOFCs) opened in June 2022 in Donghae City, South Korea. The utility uses heat from the plant to supply hot water to a swimming pool at the adjacent Bukpyeong Leisure Sports Center. SK Ecoplant developed a custom heat recovery system for the project. Courtesy: SK Ecoplant. |

Meanwhile, CHP’s economics have improved substantially over the past two decades, driven partly by improvements in gas engine and turbine technologies concerning power, efficiency, durability, emissions, and time or cost to market. However, all equipment manufacturers are striving to improve the efficiency, reliability, and emission profiles of prime mover technologies, including reciprocating engines, gas turbines, microturbines, and fuel cells (Figure 2). Initiatives underway are exploring, for example, options for new cycles or working fluids, controls, and control schemes that will generally enable a new generation of CHP plants to integrate with a dynamic smart grid and distributed microgrids.

What is Combined Heat and Power (CHP)?Combined heat and power (CHP), a form of distributed generation typically located at or near an energy consumer, is one of a few technologies that can provide both demand-side energy efficiency and supply-side efficiency (Figure 2). “Every CHP application involves the recovery of otherwise wasted thermal energy to produce useful thermal energy or electricity,” said the U.S. Environmental Protection (EPA) Agency’s Combined Heat and Power Partnership. CHP can be configured either as a topping or bottoming cycle. The main difference is that topping cycles prioritize power generation while bottoming cycles focus mainly on heat generation. “In a typical topping cycle system, fuel is combusted in a prime mover such as a gas turbine or reciprocating engine to generate electricity. Energy normally lost in the prime mover’s hot exhaust and cooling systems is instead recovered to provide heat for industrial processes (e.g., food processing, paint drying), hot water (e.g., laundry, dishwashing), or for space heating, cooling, and dehumidification,” the EPA explained. “In a bottoming cycle system, also referred to as ‘waste heat to power,’ fuel is combusted to provide thermal input to a furnace or other industrial process and heat rejected from the process is then used for electricity production.” Topping cycles plants are much more common than bottoming cycle plants, owing to their economics, though there are CHP systems that make effective use of both cycles. Industrial steam turbines, for example, can be used to produce steam that drives a turbine. “[T]hat steam can be highly pressured and removed from the input stage. Instead, it can be used to provide the process heat needed for industrial tasks,” noted engineering consulting firm Vista Projects. Topping cycles are typically characterized by five predominant “prime mover” technologies: reciprocating engines, gas turbines, microturbines, fuel cells, and boiler/steam turbines (Figure 3). “The heat source at the heart of the system is used to generate high-enthalpy steam, along with additional electricity. However, low-enthalpy steam is also used, sometimes from an intermediate turbine stage, but also from the process requirements that involve a general turbine exhaust,” engineering consulting firm Vista Projects said. Most of the world’s CHP systems are driven by coal and natural gas. However, “clean energy” markets for cogeneration, including from biomass and other biofuels, geothermal, and nuclear power are also beginning to flourish, the firm noted.

|

Bright Prospects for Hydrogen

As Jones pointed out, one of CHP’s biggest selling points has been its ability to boost energy efficiency through reduced fuel consumption. But to secure CHP system relevance as the transition unfolds, the sector will also need to demonstrate renewable and lower-carbon fuels, such as RNG and hydrogen, can serve as primary fuel sources for CHP systems. The U.S.-based Combined Heat and Power Alliance, a trade group that works to expand CHP markets, appears confident industry can achieve this so long as critical barriers related to the production, transportation, and storage of “clean” hydrogen are addressed.

The group pointed to sectoral-wide benefits for hydrogen utilization in CHP—or “CHP 2.0.” Along with allowing CHP systems to “reduce emissions even further across the industrial, commercial, and municipal sectors,” CHP systems could use these fuels efficiently, “requiring [fewer] lower-carbon fuel inputs for the same energy outputs compared to other generation units,” it said. “Efficient use of hydrogen fuel should be central to any hydrogen and climate strategy, and CHP helps meet this goal.” Moreover, as a distributed resource, CHP hydrogen utilization would bolster renewables integration, microgrid deployment, and energy storage, as well as adapt to hydrogen blending in gas infrastructure, it said.

The CHP Alliance noted that existing and newly installed CHP systems already use hydrogen fuel blend volumes that range from 20% to 100%. “Within the decade, and in many cases much sooner, new CHP systems will be capable of burning 100% clean hydrogen,” it added. “Existing CHP systems, including ones installed today, can convert to 100% hydrogen at a reasonable cost and with minimal downtime because these conversions can occur during scheduled overhauls [which typically occur every 8 to 10 years for baseload units]. These conversions are possible despite the fact that CHP systems in the U.S. vary widely in application, design, and size.”

|

3. Enbridge Gas is building North America’s first CHP system that will eventually run on 100% hydrogen to energize its Technology Operations Centre (TOC) in Markham, Ontario. The project’s 115-kW 2G Agenitor engine will initially operate with a minimum blend of 25% hydrogen and 75% natural gas. Enbridge estimates the CHP system could consume approximately 78,000 kilograms of hydrogen annually. Courtesy: 2G |

So far, the overall impact and cost-efficiency of hydrogen utilization at larger installations are still under study. Siemens Energy, for example, is evaluating the economics of hydrogen CHP at Duke Energy’s 14.3-MWe/33-MWth SGT-400 Clemson CHP system at Clemson University in South Carolina. A market for smaller-scale hydrogen-ready systems, however, is already thriving. In 2012, a pilot 160-kW Agenitor 306 CHP system manufactured by German CHP technology firm 2G Energy at the Berlin Brandenburg Airport showcased 100% hydrogen (wind gas) combustion, and 2G has since commissioned 100% hydrogen–ready reciprocating engine models at three other locations in Germany, one in Scotland, and another in Japan. In mid-2023, 2G will kick off operation of its first North American hydrogen CHP project at an Enbridge Gas facility in Markham, Ontario (Figure 3).

Emily Robertson, a 2G business development team manager, told POWER that a fundamental tenet of developing its fleet of hydrogen-ready Agenitor engines was to “future-proof” 2G’s CHP systems and provide 2G’s customers with crucial fuel flexibility. “Fuel flexibility is hugely important to many end-users. The ability to fuel blend for biogas and natural gas is key to many biogas installations. In addition, the ability to blend hydrogen is absolutely boosting CHP’s efficiencies and flexibilities,” she said. “2G’s natural gas CHP systems can blend up to 40% hydrogen. Those same systems can be retrofitted later in the field to 100% hydrogen. If this is done at the time of the engine’s major overhaul, it can be cost-effective,” she said.

The CHP Alliance is hopeful hydrogen barriers will soon be resolved. For more near-term prospects, the group points to biogas and RNG (also known as biomethane), commercial fuels that it says “can be implemented immediately.” While CHP systems have long used digester and biogas as fuel sources, farm waste and food waste facilities represent significant emerging sources for biogas production. RNG, meanwhile, can be generated from the direct gasification or pyrolysis of biomass. “The high methane content of RNG allows for full compatibility within natural gas appliances and pipeline systems. CHP fleets that run on natural gas require minimal upgrades to be fueled by RNG and would produce immediate emission reductions by transitioning,” the CHP Alliance noted. However, the group acknowledges feedstocks for the low-carbon fuel alternative are “relatively lacking.”

Emerging Potential: CHP Hybrids

To thrive in decarbonized markets, the CHP sector will also need to address myriad other challenges, experts told POWER. These include securing high utilization rates, and ensuring reliability, efficiency, and flexibility—all while minimizing capital, infrastructure, and integration needs associated with carbon-intensive processes.

One emerging solution entails exploring hybrid system design and operation. The optimized combination of solar, storage, and CHP could provide “long-duration, on-site energy for sites with high-resilience needs with the least possible carbon emissions,” Jones noted. A few projects are already pairing high-temperature renewable sources with CHP solutions. An example is Danish utility Brønderslev Forsyning’s district heating plant in northern Denmark.

Meanwhile, as CHP’s inherent reliability and resilience attributes have bolstered its uptake in microgrids, a new category of microgrid installations—hybrid CHP systems—also appears to be emerging. According to the DOE, these systems incorporate a combination of CHP and other distributed energy resources (DERs) in a single installation. As opposed to the piecemeal installation of DERs, the defining characteristic of hybrid CHP systems is coordination between developers of different DER technologies (such as CHP, PV, and/or energy storage) to engineer and optimize combined systems.

“A hybrid CHP system can provide maximum resilience with minimal fossil fuel emissions when configured as a microgrid. In a typical hybrid configuration with CHP, solar PV, and energy storage, CHP would be used for baseload power and heat, while PV and storage are used opportunistically to maximize renewable output and participate in utility markets for grid services,” the DOE said.

|

4. Danish utility Brønderslev Forsyning in 2018 replaced seven gas-fired CHP units and began operating a district heating plant that utilizes two wood chip boilers, heat pumps, and solar heating from a 27,000-square-meter parabolic trough concentrated solar power plant supplied by Denmark’s Aalborg CSP. The boilers and solar heat supply energy to a Turboden Organic Rankine Cycle (ORC) turbine. During the summer months, the wood chip boilers can be shut down and the solar collectors take over heat production. The ORC system converts 20 MWth into 4 MWe and 15 MWth. Courtesy: Brønderslev Forsyning |

However, a key challenge associated with microgrid CHP and hybrid CHP involves establishing teams of DER developers and financiers that can deliver multi-technology solutions. The product is complex, and simplified power purchase agreements (PPAs) with no capital investment will likely be needed to attract end-users. The agency noted that more experience gained with these systems could ultimately lead to standardized packages.

Incentives and Future Profitability

Still, experts suggested that tackling CHP’s capital-intensive investment requirements, as well as market and regulatory barriers, could ultimately require broader efforts. The U.S.-based CHP Alliance is hopeful that the August 2022–enacted Inflation Reduction Act (IRA) will spur new development. Under the IRA, investment tax credits will be available to qualifying CHP systems that begin construction before January 2025. CHP projects that start construction after that date may be eligible for production tax credits only “if the project yields zero-greenhouse gas emissions,” the alliance stressed. The IRA, however, also provides tax credits for clean hydrogen production, the group noted.

On the market front, evolving opportunities include the outgrowth of PPA-style contracts (which can be designed for heat and power purchases). These contracts allow developers to own, operate, and maintain systems, allowing commercial or smaller facility owners to benefit from CHP’s myriad benefits without committing to maintaining the energy source. Along with these opportunities, state-driven efforts to boost distributed generation are cleaving new pathways for non-traditional CHP entrants. Utilities, for example, are integrating CHP into energy efficiency portfolios or becoming owners and operators of CHP systems at customer sites.

—Sonal Patel is a POWER senior associate editor (@sonalcpatel, @POWERmagazine)

The post A Complex Landscape for the Future of Combined Heat and Power appeared first on POWER Magazine.