Updates on Five Big Nuclear Energy Developments POWER Was Watching in 2022

Credit to Author: Aaron Larson| Date: Fri, 30 Dec 2022 19:16:48 +0000

In January 2022, the U.S. Department of Energy’s (DOE’s) Office of Nuclear Energy (NE) published a list of five nuclear energy stories to watch in 2022. Here’s an update on the items the NE felt were important for industry insiders to keep an eye on.

The Bipartisan Infrastructure Law

The DOE noted in the January write-up that the Bipartisan Infrastructure Law included more than $62 billion for the department to help transition the country to a “clean energy economy” and that included $6 billion to start a Civil Nuclear Credit (CNC) Program. The intention of the program is for owners or operators of commercial U.S. reactors to apply for certification and competitively bid on credits to help support their continued operations and avoid premature retirements due to “financial hardship.” Back in January, the DOE suggested it would start awarding its first credits to U.S. nuclear power plants as early as the fall. In the end, it achieved that objective.

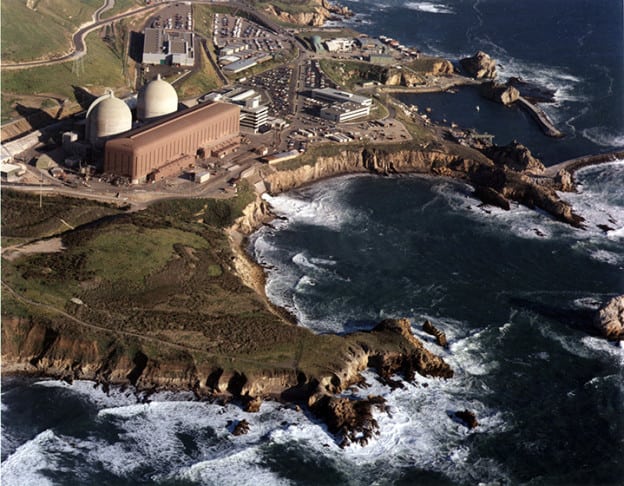

On Nov. 21, the DOE announced the conditional selection of the Diablo Canyon Power Plant (Figure 1), located near Avila Beach, California, to receive the first round of funding from the CNC Program. Units 1 and 2 at the Diablo Canyon Power Plant were scheduled to be decommissioned in 2024 and 2025, respectively, but with the conditional award of credits valued at up to $1.1 billion, Diablo Canyon has a path forward to remain open.

“This is a critical step toward ensuring that our domestic nuclear fleet will continue providing reliable and affordable power to Americans as the nation’s largest source of clean electricity,” U.S. Secretary of Energy Jennifer M. Granholm said in a statement in November. “Nuclear energy will help us meet President Biden’s climate goals, and with these historic investments in clean energy, we can protect these facilities and the communities they serve.”

The DOE said the first CNC award cycle prioritized reactors facing the most imminent threat of closure, limiting applications to reactors that had already announced intentions to cease operations due to economic factors. The Diablo Canyon plant, owned and operated by Pacific Gas and Electric Co. (PG&E), met the requirement. Final terms of the funding remain subject to negotiation and finalization by the DOE.

The second CNC award cycle will prioritize reactors that are projected to shut down due to economic factors within the next four years. The DOE is expected to begin accepting applications for the second cycle of CNC funding in January 2023.

Another piece of the Bipartisan Infrastructure Law allocates $8 billion to demonstrate regional clean hydrogen hubs, including at least one hub dedicated to the production of hydrogen with nuclear energy. But the DOE is doing much more than that. It is currently supporting at least four clean hydrogen demonstration projects at commercial nuclear power plants. Those projects originated as part of the department’s “Hydrogen Shot” goal to reduce the cost of hydrogen to $1 per 1 kilogram in one decade. The four projects are at: Nine Mile Point Nuclear Power Station in Oswego, New York; Davis–Besse Nuclear Power Station in Oak Harbor, Ohio; Prairie Island Nuclear Generating Plant in Red Wing, Minnesota; and Palo Verde Generating Station in Tonopah, Arizona.

At Nine Mile Point, the DOE is supporting the construction and installation of a low-temperature electrolysis system. The project will be the first nuclear-powered clean hydrogen production facility in the U.S. and will use the hydrogen to help cool the plant. While no official announcement has yet been made, Constellation appears to be very close to producing hydrogen at the facility. The utility is also partnering with the New York State Energy Research and Development Authority (NYSERDA) on a separate project to power a fuel cell at the facility, which it expects to start providing additional power to the grid in 2025.

Energy Harbor is working to demonstrate a low-temperature electrolysis system at the Davis–Besse Nuclear Power Station. The goal of that project is to prove the technical feasibility and economic benefits of clean hydrogen production, which could facilitate future opportunities for large-scale commercialization. The single-unit reactor is expected to produce clean hydrogen sometime in 2023, and could sell production from the project to local manufacturing and transportation services companies, which may use the fuel in a local bus fleet, among other things.

At Prairie Island, Bloom Energy and Xcel Energy are working on a first-of-a-kind project to demonstrate high-temperature electrolysis. The data collected from this demonstration will be used to scale up the process. Hydrogen production is expected to begin at the Minnesota site in early 2024.

Finally, at Palo Verde, the DOE anticipates Arizona Public Service (APS) and PNW Hydrogen will demonstrate another low-temperature electrolysis system. The hydrogen will be used to produce electricity during times of high demand or to make chemicals and other fuels. That project could also start producing hydrogen in 2024.

The Bipartisan Infrastructure Law includes about $2.5 billion to support the demonstration of two advanced U.S. reactors by 2028. The two projects feature technology developed by X-energy and TerraPower. X-energy is planning to site its four-unit Xe-100 reactor power plant at the Hanford site near Richland, Washington, and TerraPower is utilizing existing infrastructure and the workforce at a retiring PacifiCorp coal facility to build its Natrium reactor in Kemmerer, Wyoming. Both projects will be carried out under the DOE’s Office of Clean Energy Demonstrations.

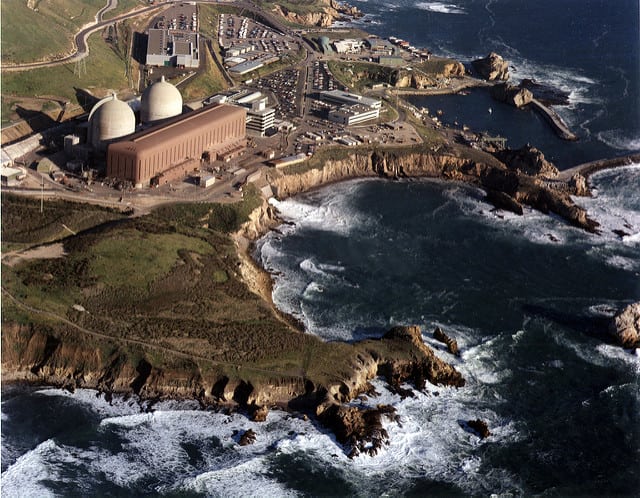

TerraPower reported in May that the Natrium demonstration plant was underway. It said the project is the “only coal-to-nuclear project in the world currently in development.” In December, the company reported that crews had conducted geotechnical investigations onsite during the year (Figure 2). It said there were more than 800 engineers working on the final plant design and engineering. It expects onsite work to begin again in spring 2023 with construction of a large sodium test facility—a non-nuclear building that will allow for the testing of critical components for the Natrium plant. The TerraPower team also plans to submit the construction permit application to the Nuclear Regulatory Commission (NRC) in 2023.

In December, X-energy, in partnership with Paragon Energy Solutions, announced the completion of a Reactor Protection System (RPS) prototype, a key safety feature of X-energy’s Xe-100 advanced nuclear reactors. The four-division RPS prototype utilizes Paragon’s highly integrated protection system (HIPS) and marks the first time that Paragon has deployed HIPS to a Generation IV high-temperature gas reactor (HTGR).

X-energy said it worked with Paragon for two years to develop, deliver, install, and test the RPS prototype in the company’s control room simulator at its Rockville, Maryland, headquarters. The prototype delivery is a milestone in X-energy’s progress toward completing the DOE’s demonstration project. X-energy expects to demonstrate its Xe-100 HTGRs under the program by 2028.

Deploying New Reactors

In its January list, the DOE noted that Unit 3 of Southern Company’s Plant Vogtle nuclear expansion was scheduled to come online in November 2022. However, that didn’t happen. Still, much progress was made at the site during the year.

In October, Georgia Power finished loading fuel into Unit 3. It said, “The fuel load process marks a historic and pivotal milestone toward startup and commercial operation of the first new nuclear units to be built in the U.S. in more than three decades.” Teams at the site have continued to advance through various phases of start-up testing since then. Vogtle Unit 3 is projected to enter service in the first quarter of 2023.

Georgia Power also reported that Vogtle Unit 4 had completed cold hydro testing in December. The last major test remaining for Unit 4 is hot functional testing, which is expected to begin by the end of the first quarter of 2023.

The DOE also suggested monitoring progress on NuScale Power’s small modular reactor (SMR) plant slated for construction at the Idaho National Laboratory, and there were developments throughout the year. In February, for example, NuScale completed field investigation activities at the site in Idaho Falls. The achievement, announced on Feb. 3, marked a major milestone for the company and Utah Associated Municipal Power Systems (UAMPS), a full-service interlocal agency that provides comprehensive wholesale electric energy services on a non-profit basis to community-owned power systems throughout the Intermountain West, which is working with NuScale on the first-of-a-kind project. About a month later, UAMPS signed a deal with Xcel Energy Nuclear Services Holdings, Xcel Energy’s nuclear operations arm, committing both parties to work toward a potential long-term maintenance and operating contract.

In April, NuScale reached an agreement with a South Korean industrial giant to forge materials for its SMRs. Under the deal signed with Doosan Enerbility Co.—a Doosan subsidiary known until March 2022 as Doosan Heavy Industries and Construction—the company will begin full-scale equipment manufacturing of forging dies for NuScale’s upper reactor pressure vessel by the latter half of 2023. NuScale separately also teamed with unnamed American large component forging firms to boost its U.S. supply chain planning as it approaches near-term commercialization of NuScale Power Modules.

Meanwhile, on Dec. 22, NuScale Power announced it had completed its Standard Plant Design (SPD) project ahead of schedule. The company said the project demonstrated “NuScale’s preparedness for facility construction and equipment procurement and manufacturing of long-lead major engineered equipment, while underscoring the company’s unmatched level of progress toward delivering VOYGR SMR power plants to customers around the world.”

The SPD provides customers with a generic VOYGR power plant design that will serve as a starting point for deploying site-specific designs. The SPD encompasses 12,000 deliverables to support client-licensing and deployment activities.

Fueling Future Reactors

Third on the DOE’s list of items to watch in 2022 were pathways to domestic high-assay low-enriched uranium (HALEU) fuel production. The DOE was seeking public input on establishing a HALEU availability program to help spur demand for additional HALEU production and private investment in nuclear fuel supply infrastructure.

And there was progress made on the HALEU front in 2022. On April 6, X-energy announced its subsidiary, TRISO-X, had submitted to the NRC the first-ever HALEU fuel fabrication facility license application. It said “the TRISO-X Fuel Fabrication Facility (TF3) will be the nation’s first 10 CFR 70 Category II fuel facility dedicated exclusively to fueling HALEU based reactors.”

Initially, the TF3 is expected to produce 8 metric tons of fuel per year (MTU/year), supporting about 16 advanced reactors, including X-energy’s Xe-100 design. The TRISO-X team aims to expand the facility’s capacity to 16 MTU/year by the early 2030s, filling a crucial gap in the advanced reactor fuel supply chain.

Also, in April, TRISO-X said it had acquired a 110-acre lot at the Horizon Center Industrial Park in Oak Ridge, Tennessee, as the site for the facility (Figure 3). The company said the TF3 will be built in parallel with the license application review, following all requirements associated with the construction and operation of a nuclear fuel facility. The review of the application is expected to take 24 to 36 months, with issuance of the special nuclear material license and operation of the TF3 in “the 2025 timeframe.”

A fuel fabrication facility to supply TerraPower’s Natrium plant was also revealed in 2022. On Oct. 21, Global Nuclear Fuel–Americas (GNF-A), a GE-led joint venture, and TerraPower announced an agreement to build the Natrium Fuel Facility at the site of GNF-A’s existing plant site near Wilmington, North Carolina. The Natrium Fuel Facility will be jointly funded by TerraPower and the DOE through the Advanced Reactor Demonstration Program, and represents an investment of more than $200 million.

Meanwhile, on Dec. 7, NE announced the establishment of a HALEU consortium “to help inform DOE activities to secure a domestic supply of HALEU.” It said membership is free and open to any U.S. entity involved in the nuclear fuel cycle. At its discretion, the DOE may also accept requests for membership in the consortium from entities whose facilities are located in ally or partner nations.

The HALEU consortium is part of the HALEU Availability Program, established under the Energy Act of 2020, to support the availability of HALEU for civilian domestic research, development, demonstration, and commercial use. The DOE said that because HALEU is not currently available at commercial scale from domestic suppliers, the deployment of advanced reactors could be affected, if the situation isn’t addressed.

The DOE is also supporting a small-scale HALEU enrichment project. Centrus Energy Corp. announced on Dec. 1 that its wholly-owned subsidiary, American Centrifuge Operating LLC (ACO), had signed a definitized contract with the DOE to “pioneer production” of HALEU at its facility in Piketon, Ohio, which is leased from the DOE. ACO was selected on Nov. 10 for the competitively awarded contract.

As part of a previous, cost-shared contract awarded in 2019, Centrus has been deploying its AC100M advanced uranium enrichment centrifuges in Piketon and has secured a license amendment from the NRC, making it the only NRC-licensed HALEU production site. The site could produce about 900 kilograms of HALEU per year using 16 advanced centrifuge machines as a step toward establishing a long-term, diverse, competitive, and market-driven commercial supply of HALEU.

Consent-Based Siting

On Dec. 1, 2021, the DOE issued a request for information (RFI) in the Federal Register on using consent-based siting to identify sites for interim storage of spent nuclear fuel. It asked the public for feedback on several items, including the consent-based siting process itself, and it received 225 responses to the RFI.

In a 57-page report summarizing the findings and analyzing the extensive feedback, one key takeaway from respondents was that they distrusted the DOE, and the federal government’s nuclear waste management efforts more broadly. Furthermore, there were significant differences of opinion about whether the federal government should pursue consolidated interim storage for commercial spent nuclear fuel, including related concerns about progress toward a deep geologic repository and transportation requirements and risks. There were also strong differences of opinion about the need for and merits of nuclear energy technology in general.

Nonetheless, on Sept. 20, the DOE issued a $16 million funding opportunity announcement (FOA) to provide resources for communities interested in learning more about consent-based siting, management of spent nuclear fuel, and interim storage facility siting considerations. It said: “Nuclear power plants that produce carbon-free, reliable power will be needed to meet President Biden’s emissions reduction and climate change goals. The production of nuclear energy requires proper management of spent nuclear fuel and DOE continues to advance research and development related to the long-term disposition of spent nuclear fuel and high-level radioactive waste. To maximize transparency and support for facilities needed to manage spent nuclear fuel, DOE is committed to a consent-based approach that is driven by communities and reflective of needs specific to each surrounding area.”

The DOE plans to fund as many as eight awardees over a period of 18 to 24 months. Award recipients will “advance mutual learning within a community, provide ease of access to information, and foster open discussions.” On Dec. 7, the DOE extended the deadline to apply to its Community Engagement on Consent-Based Siting Funding Opportunity Announcement. Applications are now due Jan. 31, 2023. The DOE also extended the deadline to submit optional FOA-specific questions to Jan. 16, 2023.

Retirements and Subsequent License Renewals

In the DOE’s list of items to keep an eye on in 2022, it specifically mentioned the planned closure of the Palisades Nuclear Power Plant (Figure 4). The plant was ultimately taken offline after more than 50 years of operation on May 20. The station’s permanent shut down had been scheduled on May 31, but Entergy’s plant operators “made the conservative decision to shut down the plant early due to the performance of a control rod drive seal,” the company, which owned and operated the plant, said.

However, that was not the end of the story. When the CNC Program was rolled out, Holtec International, which had acquired the site from Entergy in June, decided to pursue funding to reopen the single-unit 800-MW plant. The company even had Michigan Gov. Gretchen Whitmer on its side. In a Sept. 9 letter, Whitmer asked Secretary Granholm to support Holtec’s plans to reopen Palisades. “We are ready to do our part should they receive funding through the CNC program, including identifying state funding and facilitating a power purchase agreement,” she wrote.

In the end, however, Palisades was not saved. On Nov. 18, Holtec spokesperson Pat O’Brien confirmed that the DOE had denied its request for funds.

Also, worth keeping an eye on during the past year were subsequent license renewal (SLR) applications that North Anna Units 1 and 2, and Point Beach Units 1 and 2 had pending with the NRC. The DOE was expecting a decision to possibly be made in 2022, but the NRC had other plans.

On Feb. 24, the commission threw out a key environmental review that staff had applied to SLR approvals for units at Turkey Point and Peach Bottom nuclear plants in 2019 and 2020, deeming their applications incomplete. As POWER reported in early March, the federal regulatory agency’s three commissioners also halted all SLR license issuances, through a series of orders, until deficiencies could be addressed and adequate environmental reviews could be completed. The decisions posed substantial new hurdles and delays for at least 20 U.S. reactors that had set out to seek lifetime extensions of up to 80 years.

In November, the NRC sought public comment “on the scope of its supplemental environmental impact statement [EIS] concerning an application for a second renewal of operating licenses for the North Anna nuclear power plant in Virginia.” The staff’s additional analysis was prompted by a supplemental environmental report received from Dominion Generation. The NRC was seeking comment until Dec. 15. It is unclear when a decision on the matter should be expected.

—Aaron Larson is executive editor of POWER.

The post Updates on Five Big Nuclear Energy Developments POWER Was Watching in 2022 appeared first on POWER Magazine.