Why the Solar Market Is Down and Why It’s Poised for a Comeback

Credit to Author: Aaron Larson| Date: Thu, 08 Sep 2022 13:55:06 +0000

The forecast for U.S. solar energy installations in 2022 have been revised downward in a report published by Wood Mackenzie and the Solar Energy Industries Association (SEIA) on Sept. 8, due in large part to supply chain constraints and an industry-wide slowdown caused by the initiation of an anticircumvention investigation earlier this year.

The U.S. solar market installed 4.6 GWdc of solar capacity in the second quarter (Q2) this year. That was a 12% decrease from the same period in 2021. The result follows a 24% decrease year-over-year in Q1, which was the weakest quarter for U.S. solar installations in two years. As a result, Wood Mackenzie and SEIA have lower their forecasts for U.S. solar installation in 2022 to 15.7 GW, the market’s lowest total since 2019.

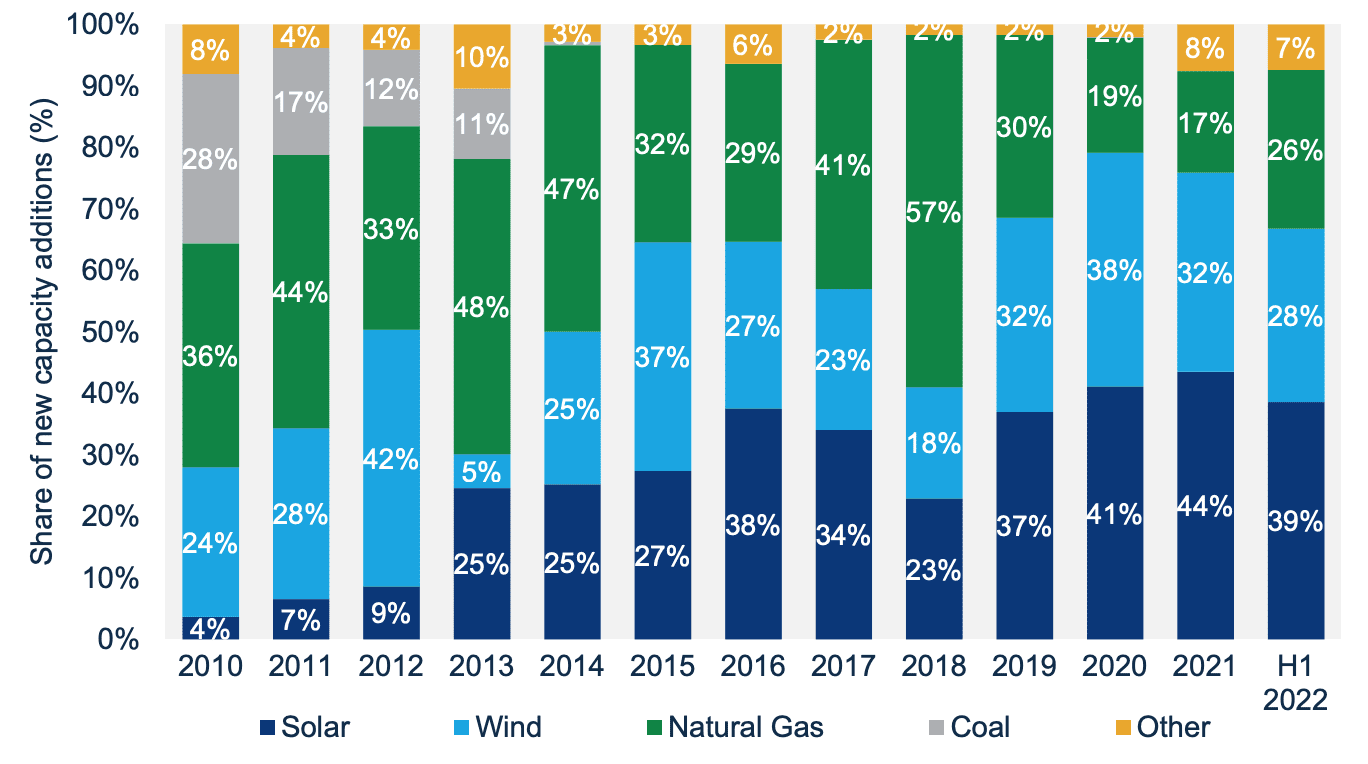

Still, solar accounted for 39% of all new electricity-generating capacity added to the U.S. grid in the first half of 2022 (Figure 1), which was the most of any generating technology. Wind power additions placed second (28%), and natural gas came in third (26%) through the first six months of the year.

Demand for rooftop solar (Figure 2) continues to be strong in the U.S. The residential solar segment set a record for the fifth consecutive quarter with 1.36 GWdc installed in Q2, which means nearly 180,000 customers added solar panels to their homes. Commercial and community solar installations were “relatively stable,” according to the report. Utility-scale installations, however, are expected to decrease this year to only 8.1 GWdc, the lowest annual total for the sector since 2018.

Factors Hindering Solar Installations

One of the main causes of the slowdown is a U.S. Department of Commerce (DOC) tariff investigation. In response to a request from Auxin Solar Inc., the DOC on April 1, 2022, published a notice in the Federal Register announcing that it was “initiating country-wide circumvention inquiries to determine whether imports of crystalline silicon photovoltaic cells, whether or not assembled into modules (solar cells and modules), which are completed in Cambodia, Malaysia, Thailand, or Vietnam using parts and components from the People’s Republic of China (China), are circumventing the antidumping duty (AD) and countervailing duty (CVD) orders on solar cells and modules from China.”

Commenting on the investigation, McGuireWoods, a legal firm that serves clients in the energy industry, among others, said on April 15: “The announcement of an investigation is already impacting current and future solar developments using crystalline silicon photovoltaic cells (CSPV). Although it initially stated that no additional duties will be imposed at this time, the DOC will consider supplementary tariffs on the solar industry based on the results of its investigation. Additional tariffs (which could apply retroactively, to as early as Nov. 4, 2021) could significantly disrupt the supply and manufacture of solar modules, as roughly 80% of U.S. CSPV modules are imported from Vietnam, Malaysia, and Thailand.”

However, on June 6, President Biden declared an emergency and authorized “temporary extensions of time and duty-free importation of solar cells and modules from Southeast Asia” to avoid disruptions to the electric power system. Following the decision, Assistant Secretary of Commerce for Enforcement and Compliance Lisa Wang released a statement saying, “Pursuant to the President’s Proclamation, the Department of Commerce will issue regulations to temporarily permit for up to 24 months duty-free access to solar cells and modules from Cambodia, Malaysia, Thailand, and Vietnam.”

She added: “The Commerce Department’s anti-circumvention proceeding continues uninterrupted, and whatever conclusion Commerce reaches when the investigation concludes will apply once this short-term emergency period is over. In accordance with the President’s declaration, no solar cells or modules imported from Cambodia, Malaysia, Thailand, and Vietnam will be subject to new antidumping or countervailing duties during the period of the emergency. Existing duties on Chinese and Taiwanese imports of solar cells and modules remain in effect.”

Meanwhile, the Uyghur Forced Labor Prevention Act (UFLPA) went into effect on June 21 and has resulted in detentions of solar modules, according to SEIA, exacerbating ongoing supply chain challenges. The U.S. Solar Market Insight report issued on Thursday finds that the UFLPA could limit solar deployment through 2023 due to module availability constraints.

The Inflation Reduction Act

On August 16, President Biden signed the Inflation Reduction Act (IRA) into law. The package includes significant policy initiatives that will benefit clean energy, including the solar power sector. It provides long-term tax credits and incentives for a myriad of renewable energy and electrification technologies. Some organizations have suggested the IRA could help the U.S. achieve about two-thirds of President Biden’s 2030 carbon reduction goals.

The U.S. Solar Market Insight report says the passage of the IRA “gives the industry the most long-term certainty for federal tax credits it has ever had.” The industry will have 10 years between the extensions of the current investment tax credit (ITC) and production tax credit (PTC), in addition to a new technology-neutral tax credit that begins after 2024. “This stands in stark contrast to the one-, two-, or five-year extensions of the last decade that have typically been passed in the final days of the year,” the authors wrote.

Equally as important, the report says, are key provisions of the Solar Energy Manufacturing for America Act (SEMA), which were included in the IRA. “For the first time, the U.S. solar industry will have access to production tax credits and an investment tax credit for domestic manufacturing across the solar value chain. Multiple companies have already announced commitments to build new domestic facilities, which will diversify and bolster the U.S. solar supply chain over the long term,” it says.

Among other provisions in the IRA that could benefit the solar industry is a standalone energy storage ITC, which provides more options for financing and deploying storage (Figure 3). Many solar installations today are being paired with storage projects, so the storage ITC could help facilitate those projects, indirectly benefiting the solar portion of the development.

“This report provides an early look at how the Inflation Reduction Act is going to transform America’s energy economy, and the forecasts show a wave of clean energy and manufacturing investments that will uplift communities nationwide,” Abigail Ross Hopper, president and CEO of SEIA, said in a statement. “With this incredible opportunity comes a responsibility to clearly address concerns over forced labor and ensure that we have ethical supply chains throughout the world.”

Wood Mackenzie believes the utility-scale sector will lead the solar industry’s growth over the next five years with 162 GW of new capacity. Cumulative solar installations across all market segments will nearly triple in size, growing from 129 GW today to 336 GW by 2027, according to the company’s projections. Yet, Wood Mackenzie expects the solar industry to remain supply constrained through year-end 2023. As a result, it says, the full benefits of the IRA won’t be felt until at least 2024.

—Aaron Larson is POWER’s executive editor (@AaronL_Power, @POWERmagazine).

The post Why the Solar Market Is Down and Why It’s Poised for a Comeback appeared first on POWER Magazine.