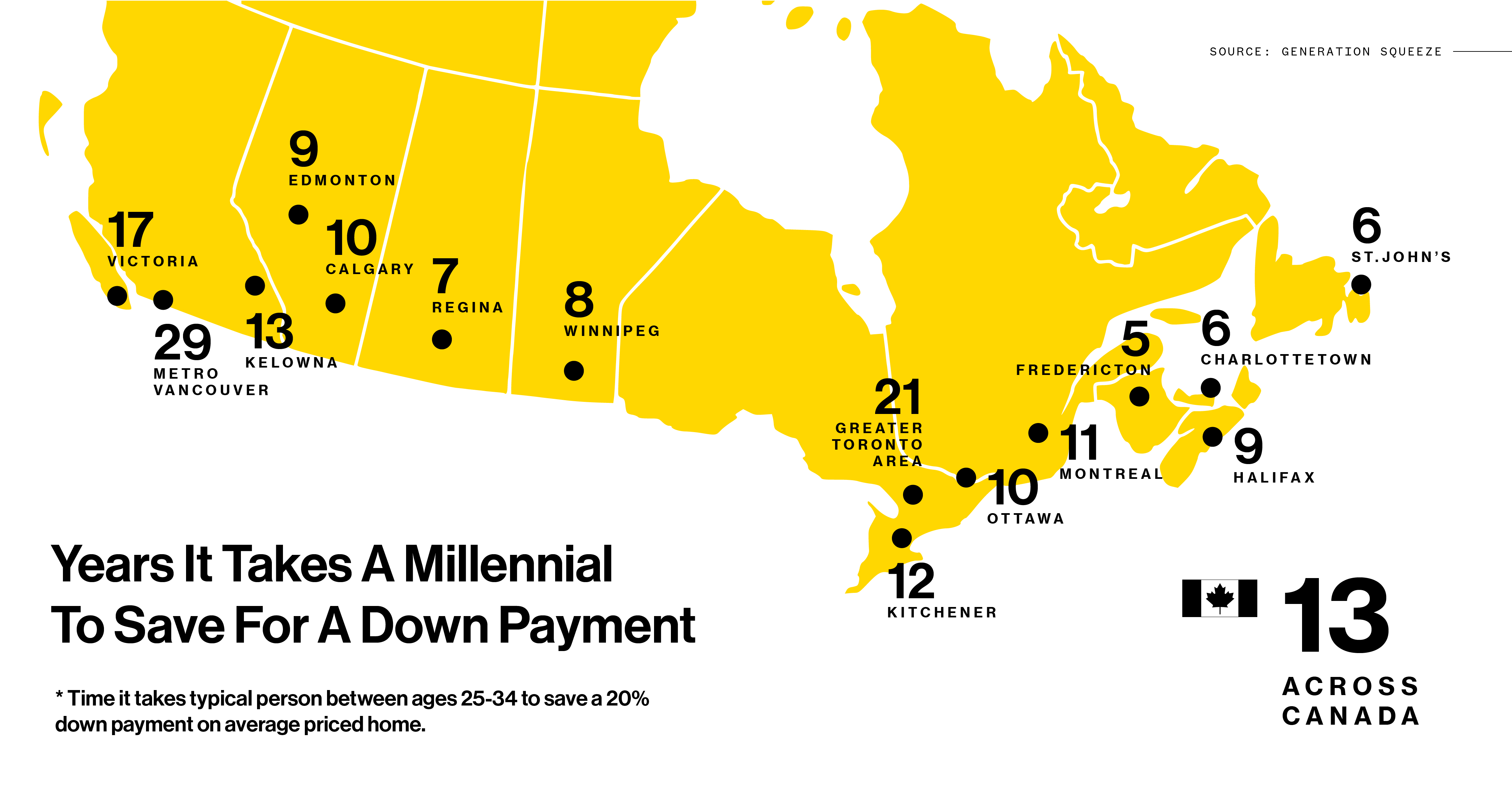

How Long It Takes to Save for a Home, Depending on Where You Live

Credit to Author: Anne Gaviola| Date: Thu, 27 Jun 2019 17:11:32 +0000

If you’re a millennial and you’re wondering how long it will likely take you to save up a down payment to buy an average place in Vancouver, you don’t need to do much math. The time it takes is close to the number of years you’ve been alive: 29 years.

That’s the harsh reality in Canada’s major urban centres, according to a recent report by Generation Squeeze, a non-profit that advocates on behalf of young Canadians. The average time it takes to save up for a home in Toronto is 21 years. And it’s not just Toronto and Vancouver’s housing markets that are increasingly tough to get into—unaffordability extends to places such as Victoria (17 years), Kelowna, B.C. (13), and Kitchener, ON (12).

According to lead author Paul Kershaw, the data shows an urgent need for action from politicians, and a need to fight collective complacency. “We’ve normalized the idea that it’s OK that our housing market is so much worse for younger Canadians today, whether it’s owners or renters facing higher rents.”

It wasn’t always like this though. Back in 1976, it took the average person aged 25 to 34, working full-time, five years to save up 20 percent of the average home price for a down payment. Today, across Canada, it takes 13 years.

That’s because the sticker price on a home in many Canadian cities remains near or at historic highs, but the amount of money that millennials are making hasn’t marched high enough to keep up with the rising cost of owning a place.

Annual earnings for this cohort would have to double to $93,400 in order for the average millennial to be able to afford an average home. Either that, or home prices would need to drop by 44 percent to $223,000 from the current $508,000. That’s how big the affordability gap has become. The Canada Mortgage and Housing Corporation (CMHC) defines “affordable” as not taking up more than 30 percent of your pre-tax earnings.

The affordability gap is widening is the U.S. too, and not just for millennials. Someone with a median income needs 40 years to save for a median down payment in San Francisco. That number is 43 in Los Angeles whereas New York and Miami will take 36 years.

Kershaw, who is also the founder of Generation Squeeze, said he hopes the report can be an antidote to the dangerous narrative that exists. “One of the dominant messages in the media is that home prices aren’t rising like they were before—problem solved. Let’s move on. It’s probably time to reignite the housing market so the economy continues to grow in a way that helps make the real estate industry even more profitable,” he said.

With the federal election coming in October, Generation Squeeze has several policy recommendations to address the housing affordability gap for young workers. Kershaw is calling on all parties to incorporate them into their platforms. These include reducing other major expenses that millennials are saddled with, such as student debt, tuition, child care and transit, which take a big bite out of what they can allocate to housing.

Kershaw advocates plans to level the playing field between renters and owners, to deal with the reality that a larger number of millennials will be renting for longer periods of time. In fact, based on current trends, many will be renting indefinitely. It also suggests the need for a cultural shift, to embrace the notion that a rental can be a “forever home.” A key part of making that a reality is policy to support the construction and maintenance of purpose-built rental housing in urban centres.

Personal finance expert Rubina Ahmed-Haq is a proponent of a paradigm shift, away from the cult of home ownership. “So many young Canadians dream of owning a home but they’ll never be able to afford real estate because they’ll be in their 50s and 60s by the time they get the down payment. We need to make peace with that, the way I would feel if I moved to New York. I wouldn’t expect to ever be able to buy property there because it’s out of my reach.”

She worries that by focusing on home ownership over long-term savings, many millennials are creating a ticking financial bomb that could go off when they can least afford it. This is especially important for this cohort, because they’re saddled with a record amount of student debt and many are precariously employed or making ends meet by combining a side hustle or three—meaning they don’t have access to retirement savings plans that come with salaried, full-time jobs.

Things are very different than they were decades ago, when the path to financial security meant graduating, getting a steady job and buying a home, in that order.

“It was miraculous, wasn’t it? When you were a full-time worker in the 70s, you had a workplace pension and it just came off your salary. But we are no longer in a situation where we can expect work to take care of us,” she said.

According to Ahmed-Haq, young workers need to have a financial cushion for things that come up, like health issues or unexpected events that could force them to stop earning money, but won’t stop the bills from coming in.

“Let’s stop calling it retirement savings—it’s long-term savings,” she said. According to Ahmed-Haq, young people need to set aside between 10 and 20 percent of their pre-tax income for whatever the future holds.

Kershaw, who is also a policy professor at UBC, said this delayed ability to hit personal and financial milestones has a snowball effect. “Younger Canadians are doing everything later in large part because home prices have left behind our earnings, which means we need to work and study so much more to achieve the same things for which our parents’ generation could achieve.”

Follow Anne Gaviola on Twitter.