The Eight Most Important Things in the Federal Budget For Young People

Credit to Author: Anne Gaviola| Date: Tue, 19 Mar 2019 22:23:57 +0000

The stars have aligned to create a federal budget that could be the biggest deal ever for young voters in Canada. For the first time in modern history, millennials and Gen Z have the chance to be the most important demographic in a federal election. Canadians between the ages of 18 and 38 could make up nearly 40 percent of the electorate––should they decide to vote in October. Back in 2015, the youth vote was crucial in getting Justin Trudeau into office (18 to 24 year olds turned out in record numbers).

The federal budget is both a policy and a political tool. And you know what helps people forget about that pesky SNC-Lavalin debacle that keeps rearing its ugly head? Mad money! Not to mention the fact that the Liberals could benefit from an image makeover, away from the perception that they’re too chummy with big corporations. That means a win for the “little guy,” aka low and middle-income earners.

For all these reasons, Trudeau’s Liberals are highly motivated to target young voters with budget goodies—and they have more in their revenue coffers than expected this time around to do so. According to RBC’s latest estimate, the feds have a $324 million surplus for this fiscal year.

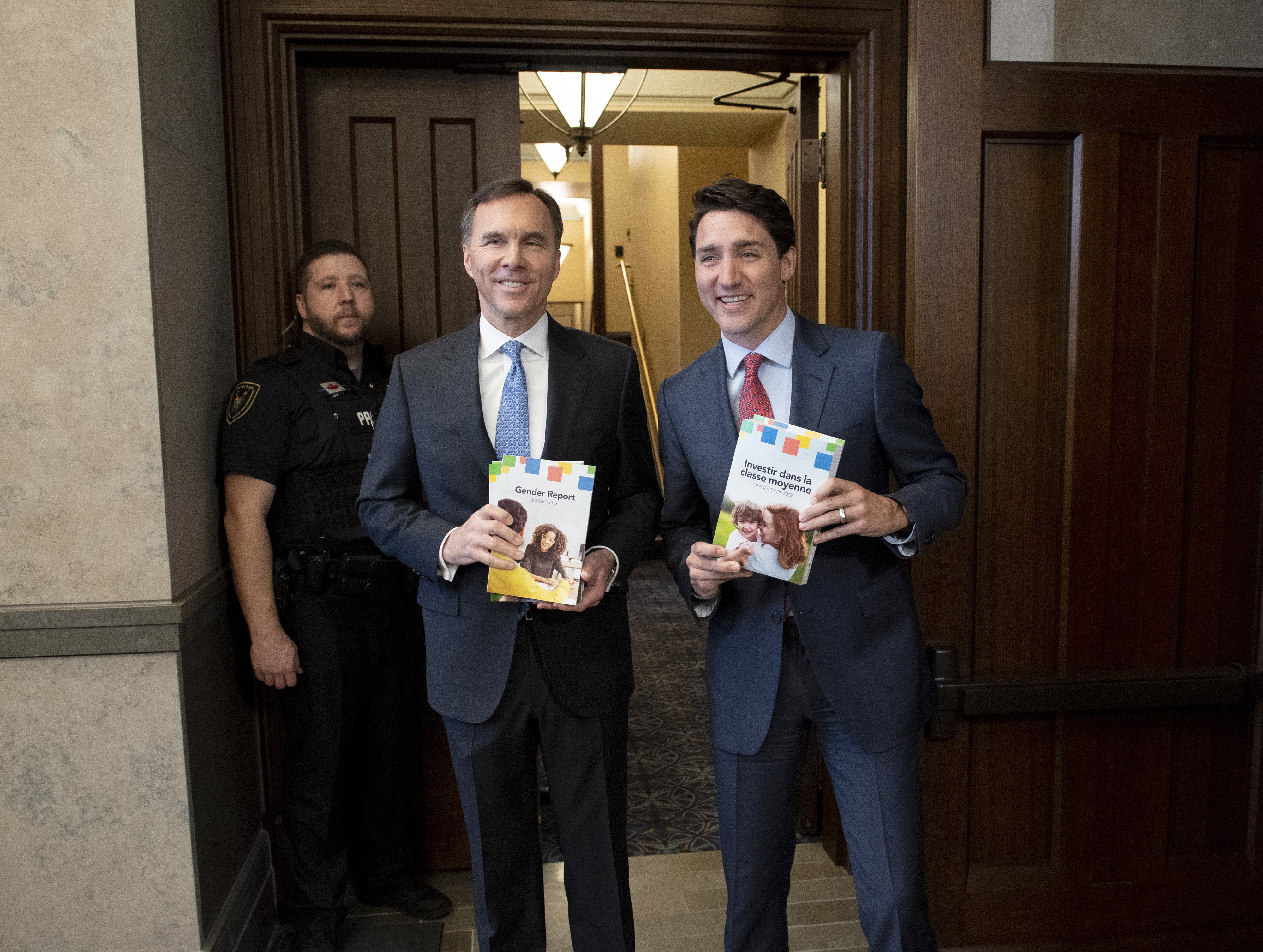

Today the government unveiled $23 billion in new spending, with no firm timeline to balance the books (which Trudeau pledged to do by 2019, back when he was campaigning in 2015). Here’s a look at the most important things for young people in the federal budget:

First-time Home Buyers

One of the biggest ‘gifts’ in the budget is aimed at first-time homebuyers with a special incentive––a shared-equity mortgage. Essentially, the federal government will buy up to five percent of an older home with you. If it’s a new build (which Ottawa wants to incentivize), the government will cover up to ten percent of the price of the home. You can choose to pay back the government over time, or when you sell your place.

Finance Minister Bill Morneau says he expects 100,000 first-time home buyers to benefit from this measure over the next three years.

In addition to this, there’s extra help towards the down payment and costs associated with the purchase of a first home through a change to the Home Buyers’ Plan (HBP). The maximum non-taxable withdrawal from RRSPs is going up to $35,000 from $25,000.

More Rental Housing

Designed to boost the amount of affordable rental options across the country, this budget pledges an additional $10 billion in financing, over nine years, through the Rental Construction Financing Initiative. The program is supposed to support the creation of 42,500 new rental units, especially in areas that need it the most.

Student Loans

If you are one of the approximately one million people in Canada currently trying to pay off your student loan (or about to join the club), this one’s for you. The big changes are that the grace period of six months is now interest-free and the floating interest rate (which is what 99 percent of borrowers choose) is being lowered to prime from its current rate of prime plus 2.5 percentage points.

If you’re one of the less than one percent that have chosen the fixed interest rate option, that will drop to prime plus 2.0 percentage points (down from prime plus 5.0 percentage points).

Skills Training

The budget promises $1.7 over five years for under the Canada Training Benefit to help workers upgrade their skills and learn new ones while they keep their jobs. This comes as a $250 annual tax credit to help pay for training, plus you get EI to cover living expenses for up to four weeks away from work. This will be available to people who are 25 years of age and older.

Apprenticeships and Skilled Trades

The government has earmarked $40 million over four years, starting in 2020, to encourage more young people to train and work in the skilled trades. That includes a PR campaign that’s supposed to change attitudes around skilled trades and remind people that these can be lucrative, in-demand careers. Projects that roll out under this initiative will try to help attract and retain women, Indigenous Peoples and people with disabilities in particular.

Scholarships

In order to help more students get a higher education, $114 million is proposed over five years to create 500 more master’s level scholarships awards every year as well as 167 more three-year doctoral scholarship awards. This will be done through the Canada Graduate Scholarship program.

Indigenous Education

Indigenous Peoples are in the unique position of being one of the youngest and fastest-growing segments of Canada’s population. Ottawa is pledging $9 million over three years for additional bursaries and scholarships for First Nations, Metis and Inuit students.

International Students/Studying Abroad

This initiative was publicized in last year’s Fall Economic Statement, but it’s back in the budget with some detail. The feds pledge to invest $147.9 million over five years to publicize the merit of coming to Canada to get a higher education as an international student, as well as help post-secondary students who want to pursue opportunities to study or work abroad.

Although the budget was one of the most youth-focused ever, critics say there was a lot missing in the 127 spending initiatives. “Budget 2019 identifies the right targets, but holds off on making necessary investments: climate change, unaffordable housing and the lack of wage raises are issues that can’t afford to wait,” said Senior Economist David Macdonald who is with the Canadian Centre For Policy Alternatives think tank, in a statement.

All this new spending is essentially borrowing from the future, meaning millennials, Gen Z and younger cohorts. The fact that the government has chosen not to balance the books while the economy is in relatively good shape is going to delay the inevitable, according to Rosalie Wyonch who is a policy analyst at the C.D. Howe Institute, a non-profit policy research organization. She told VICE “Younger Canadians should pay attention to deficits and government debt, because ultimately they will be the ones to shoulder most of the burden of paying for that debt.”

Follow Anne on Twitter.